By: Simona M Mocuta, Chief Economist, Elliot Hentov, Ph.D., Head of Macro Policy Research, Vladimir Gorshkov, CFA, Macro Policy Strategist, Amy Le, CFA, Investment Strategist, and Venkata Vamsea Krishna Bhimavarapu, Economist

The inflation story is progressing roughly as anticipated, with the caveat that the disinflation process had paused in the US earlier this year. We, however, see this as a temporary phenomenon.

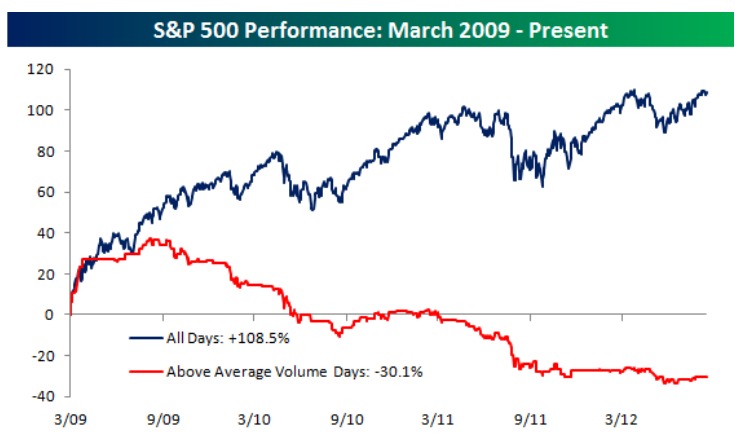

Considerable Market Volatility

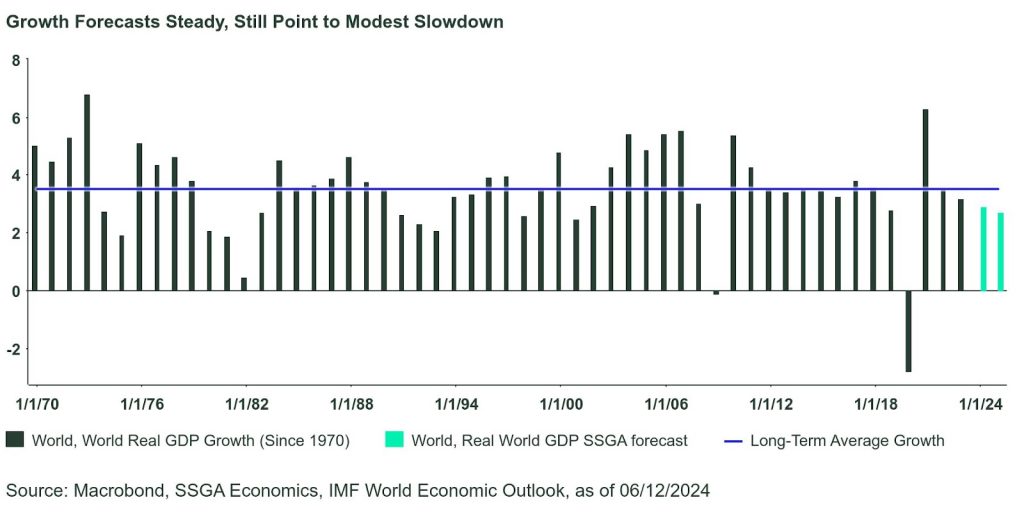

Since our last update in March, the global economy has progressed largely as anticipated. Global growth remains moderate but steady, with broadening signs of a bottoming out in manufacturing, improvement in Europe and a visible deceleration in the US. Chinese economic growth has stabilized but remains constrained, with weak consumer sentiment and ongoing challenges in the property sector. Consequently, there has been no change to the global growth forecast this quarter, and only modest adjustments to individual countries.

The inflation story is also progressing roughly as anticipated, with the caveat that the disinflation process had paused in the US earlier this year, while continuing to unfold elsewhere. We see this as a temporary phenomenon driven largely by peculiarities around shelter inflation calculations in the US and a delayed catch-up cycle in insurance (home and auto). US inflationary pressures are increasingly narrow and, given normalizing labor markets and anchored inflation expectations, the disinflation process is set to resume. The much-improved May inflation report supports this interpretation. For now, the Fed has remained on the sidelines even as other developed market central banks (most recently, the ECB and Bank of Canada) have started lowering interest rates. Nevertheless, the Fed might join the easing cycle later in the year and quicken it in 2025. The “different speeds, same direction” mantra we applied to global disinflation in 2023 applies to global policy easing in 2024-25.

Political and geopolitical risks loom large. Elections in Mexico, India, and the European Union all brought surprising outcomes, highlighting the limitations of forecasting exercises. As we gear up for US elections in November, investors are bound to grapple with rising volatility. Risks to all forecasts are elevated and two-sided.

This post first appeared on June 17th 2024, SSGA Blog

PHOTO CREDIT: https://www.shutterstock.com/g/HTWE

Via SHUTTERSTOCK

Disclosure

Marketing Communication

State Street Global Advisors Worldwide Entities

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the applicable regional regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This communication is directed at professional clients (this includes eligible counterparties as defined by the “appropriate EU regulator”) who are deemed both knowledgeable and experienced in matters relating to investments. The products and services to which this communication relates are only available to such persons and persons of any other description (including retail clients) should not rely on this communication.

The views expressed in this material are the views of SSGA Economics Team through the period ended June 14, 2024 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.