by Michael Tarsala

It could be potentially better news for the S&P 500 if investment manager Ben Dickey is correct with his 2012 oil projection.

Dickey runs the Global Plus Income model at Covestor, and here’ s what he had to say about crude this week:

Our forecast for oil prices, without geopolitical risk, is to end the year at between $100 to $110 a barrel for West Texas Intermediate (WTI) crude.

The International Energy Agency is projecting an increase of a million barrels a day in world oil consumption by the end of the year.

As more pipe lines began moving oil from Cushing to the gulf coast refineries, I believe WTI will narrow the gap with Brent crude. The emerging markets are increasing oil consumption faster than the U. S. and Europe are decreasing.

Plus, central banks are adding liquidity to markets which will show up in oil prices. As Iranian crude slows to markets, Saudi Arabia is the only country that can increase production. They do not like oil prices to fall below $100 a barrel, Brent.

Here’s why Dickey’s projection may be also be saying something about stocks:

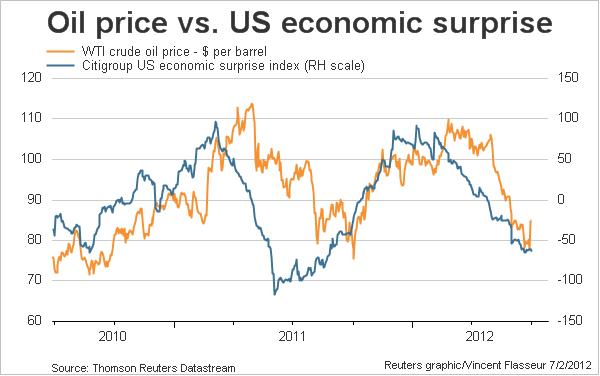

Source: Reuters

The chart above from Vincent Flasseur over at Reuters shows that WTI oil prices and the Citigroup Economic Surprise Index (CESI) have moved roughly in tandem this year.

And while the correlation is not super-strong between the CESI and the S&P 500 — and the correlation between oil and the S&P 500 is not strong either — a decline below the 50 level on the CESI tends to signal near-term stocks weakness.

So higher oil could at help to bring the CESI out of the stock-drop danger zone, which it entered earlier this year.