By: Brie Williams, Head of Practice Management

- Every market shift or headline has the potential to tempt investors to abandon their financial plans or investment strategies.

- Both new investors and those nearing retirement are particularly vulnerable to overreacting.

- Financial advisors can help investors avoid counterproductive behaviors and pursue their financial goals with confidence, especially in uncertain markets.

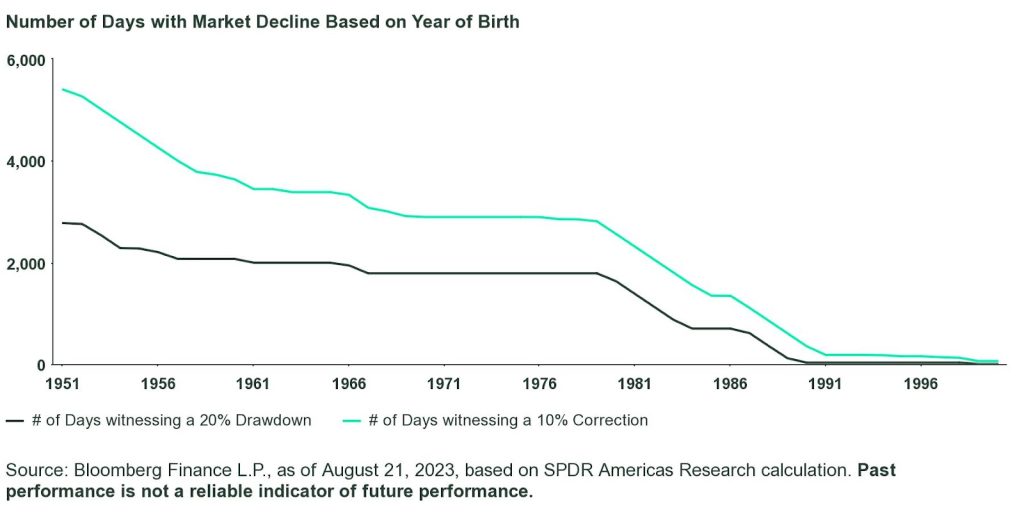

In the world of investing, market uncertainty — which is shaped by various economic, geopolitical, and societal factors — is an inevitable reality. And it isn’t likely to go away any time soon. In fact, the majority of individual investors believe that market uncertainty (80%) and inflation (64%) will persist for at least the next 12 months, according to our 2023 Gold ETF Impact Study.1

During periods of heightened uncertainty, financial advisors (FAs) can provide advice to their clients that extends beyond asset allocation and retirement projections.

Risk of Trying to Time the Market

In times of uncertainty or volatility, the role of the FA evolves into actively managing client behavior and emotions, especially as investors feel a heightened impulse to deviate from the plan or to time the market.

But history has shown that market timing usually comes at a cost — it’s simply impossible to know exactly when the market will take a sharp downturn or reaccelerate.

Financial professionals are uniquely positioned to guide investors through periods of uncertainty by emphasizing the importance of a steady, long-term perspective. Advisors who emphasize a disciplined approach, and who focus on maintaining well-diversified portfolios and suitable asset allocations, can empower investors to feel less anxious and to stay aligned with their overarching financial goals.

Managing Investor Expectations In Uncertain Markets

Two investor types in particular may be vulnerable to making poor investment decisions in uncertain or volatile markets: new investors and those nearing retirement.

Younger Investors Have Never Seen a Bear Market

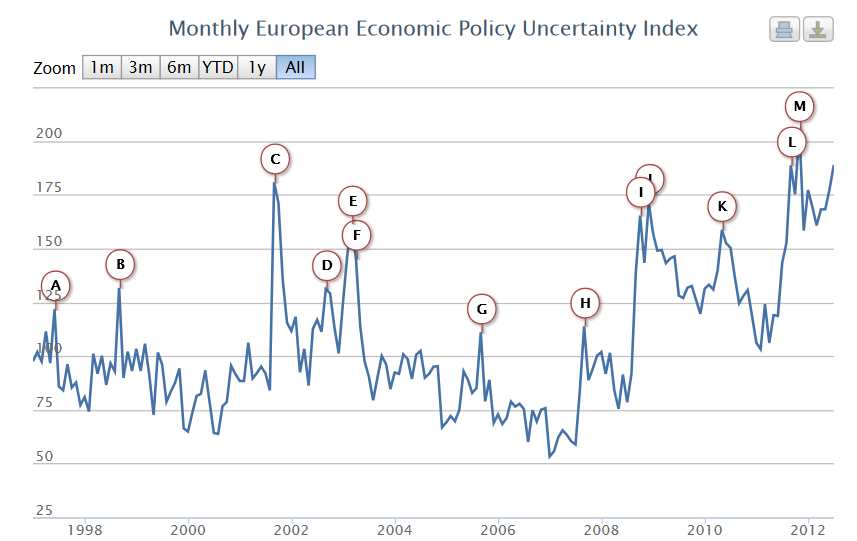

Younger investors or those who started investing after the 2008 Global Financial Crisis have far less experience navigating bear markets.

Number of Days with Market Decline Based on Year of Birth

Talk of a bear market or recession may cause them significant distress, even panic. How can advisors help?

- Discuss the concepts of risk aversion and loss aversion, and how these can bias decisions. This can help strengthen their investment decision-making framework.

- Review risk budgeting concepts, like opportunity cost and risk-adjusted return, to support more intentional decision making.

Whether investors see market downturns as opportunities to buy and hold or fall victim to chasing returns will likely depend on their advisor’s ability to steer them away from benchmark performance-focused discussions, and toward decision-making that supports their long-term goals.

Mature Investors May Be Worried About Retirement

More mature investors, on the other hand, may be concerned about the timing of a potential downturn, or their sequence of returns risk.

After all, investors nearing retirement or already retired have few or no income-earning years left to make up for large drawdowns. So when markets are volatile or losses are mounting, how can advisors help mature investors avoid panic selling? Or help calm their fears?

It goes back to helping investors mindfully link risk to their goals, time horizon, and life stage, to take advantage of the value that portfolio construction delivers. Instead of trying to time the markets, consider creating an equity glide path that gradually reduces market risk as investors approach retirement or during their retirement years.

Having a plan in place that is designed to achieve one’s financial goals — regardless of the market environment — can help investors feel more confident they’ll have the money they need to enjoy their retirement.

The truth is, irrational behavior is an all-too-human trait, even among the smartest investors. As a result, it can be especially difficult to stay the course during a crisis or times of market uncertainty. That’s why an advisor’s role in emotional governance is critical to clients’ long-term success. And it’s why market uncertainty presents an opportunity to strengthen relationships between advisors and their clients.

Value of Financial Advice When Uncertainty Strikes

For all types of investors, the key is to balance investment risk with opportunity risk in a way that reflects an investor’s unique risk tolerance.

Investors may have had more than their fair share of market volatility or crises in recent years. It can be helpful for advisors to educate investors on what market volatility is and why it can spike during a crisis. Equally important, they can help them make investment choices in context with their unique life situation:

- What is their investment horizon?

- What stage of life are they in?

- What are their financial goals?

During stressed markets, advisors can play a crucial role in reorienting clients to the long-term outcomes they sought to achieve in the first place — and also review how well-positioned investors are to reach those goals. The best time, however, to start educating investors about potential risks is early in the relationship and before a challenging market strikes.

To help you engage in conversations that reinforce your value as an advisor — ones that help clients put risks in context, identify goals, and reveal biases that may make them vulnerable to poor investment decisions — check out the goals-based planning conversation guide below:

Goals-Based Planning Conversation Guide

| Help clients look at the downside risk of an investment option separately from overall volatility, which can mask performance. | Introduce the idea of a portfolio budget to help incorporate risk where it‘s most likely to be rewarded. Frame performance discussions in terms of expected return per unit of risk |

| Help clients balance risk relative to return expectations to properly align asset allocation decisions with their actual risk tolerance. | Illustrate the opportunity cost and inflationary risk of holding too much cash. Review portfolio performance against priorities and long-term goals to fuel motivation and maintain focus on achieving outcomes |

| Discuss concepts like risk aversion and loss aversion — and how these can bias decisions — to help your clients become better-informed, more successful investors. | Review objectives and quantitative comparisons between investment choices. Frame decisions in a relative context to reinforce a thoughtful buy/sell discipline |

| Balance emotional quotient (EQ) with intelligence quotient (IQ) in investment decision-making to help clients achieve long-term goals at risk levels they’re able to tolerate. | Demonstrate empathy, listen actively, and show patience during the decision-making process. Look for opportunities to tailor investment solutions to clients’ personal situations, aligning plans with what’s most important to them (e.g., family, security, and independence) as a force for action |

Challenging markets may be inevitable, but they shouldn’t undermine an investor’s ability to meet their long-term financial goals.

All the rational financial discussions in the world won’t propel an investor to their goals if they’re not aware of their tendency to make decisions emotionally. That’s where an advisor can add value and, in the process, strengthen relationships with their clients.

More specifically, help investors:

- Become aware of and manage counterproductive biases and behaviors.

Focus on the basics and what clients can control in uncertain markets, things like portfolio diversification, regular rebalancing, and even tax loss harvesting. - Stay invested for the long-term, through periods of volatility or uncertainty.

Keep investors focused on their long-term plan, which was designed to withstand inevitable market slumps. This can help them avoid counterproductive behaviors when volatility strikes.

This post first appeared on August 29th, 2023 on the State Street Global Advisors’ blog

PHOTO CREDIT: https://www.shutterstock.com/g/Roman+Samborskyi

Via SHUTTERSTOCK

Footnotes

1 State Street Global Advisors Gold ETF Impact Survey, March-April 2023. Note: although the survey was designed to focus on gold/gold ETFs, the above data is representative of all types of US investors, not just those interested in and/or holding gold/gold ETFs.

Disclosure

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

The views expressed in this material are the views of the State Street Global Advisors Practice Management Group through the period ended August 2, 2023 and are subject to change based on market and other conditions. The opinions expressed may differ from those with different investment philosophies. The information provided does not constitute investment advice and it should not be relied on as such. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon.

This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.