by Michael Tarsala, CMT

Here’s a quick update on gold, and why you, the stock investor, should care:

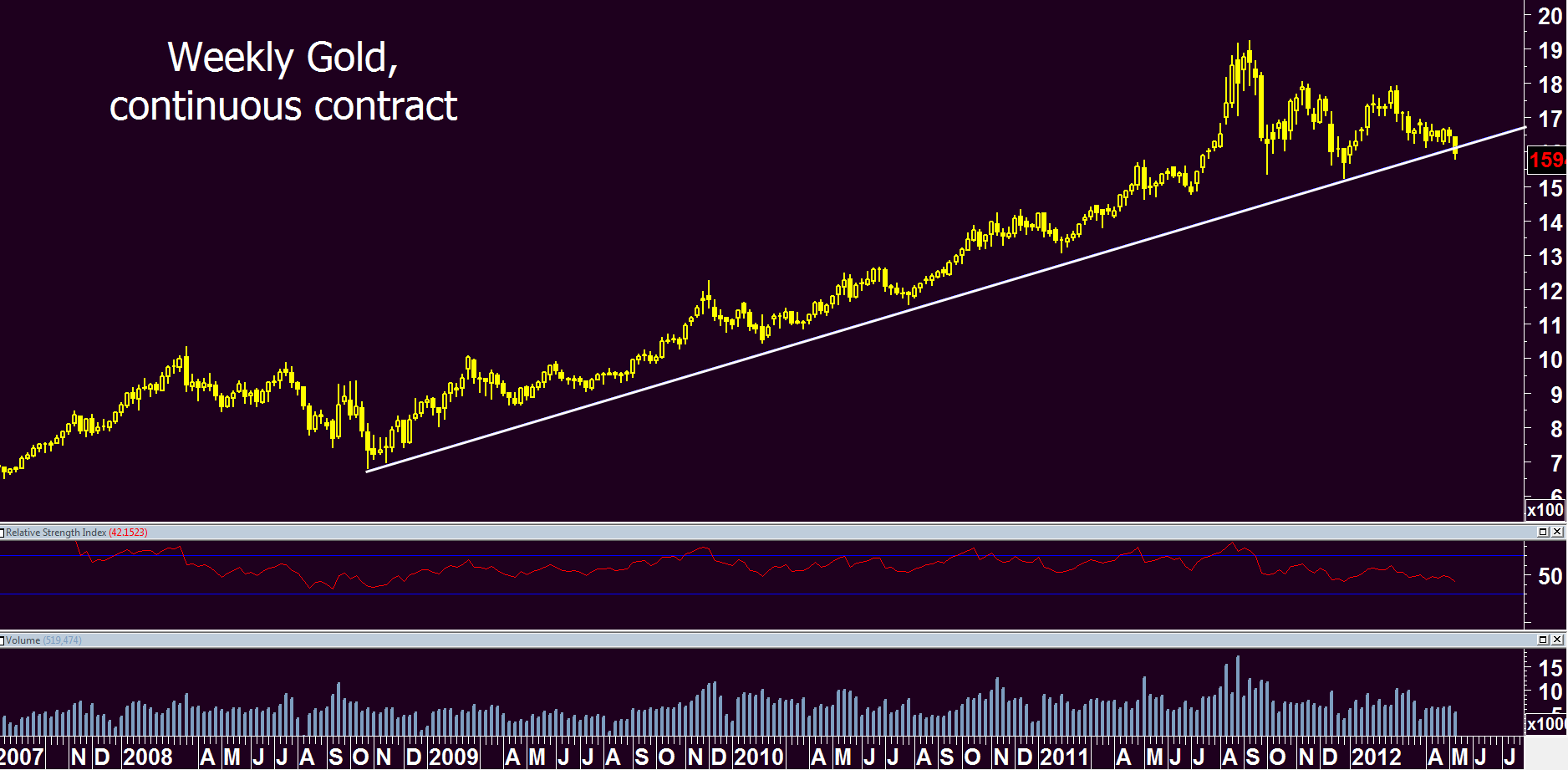

Source: MetaStock

This could be the week that gold breaks down from its long trendline dating back to late 2008. It depends on whether it closes above or below the white line on Friday.

As the WSJ MarketBeat blog points out, gold is losing its luster despite worries about Greece.

That spells out a few important thing for equity investors:

- Expectations for QE3 are still pretty low; if they were a lot higher, gold wouldn’t be breaking down. So no one is really expecting a tailwind for stocks from the Fed. See this post for details.

- For now, the market sees Greece’s problems as being fairly contained to Greece. Otherwise, you would have seen a scramble for gold, and not just U.S. Treasuries this week.

- Stocks were correlated with gold during the runup, especially during the second QE period. But the correlation is not significant at the moment. So a gold breakdown does not necessarily spell bad news for equities.

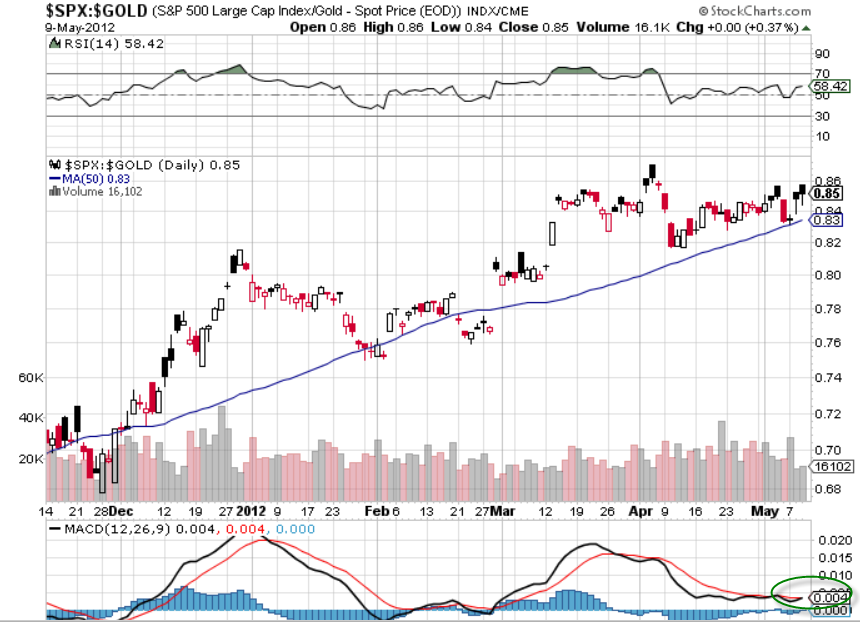

- Finally, watch this chart below: It’s the S&P relative to gold. It’s been a good bet so far this year. The RSI, at the top of the chart, is at a middling level, so a breakdown of that uptrend does not appear imminent. Also, the MACD, at bottom, is getting a buy signal — an indication that the uptrend may persist.

Source: StockCharts.com