By: Kevin Flanagan, Head of Fixed Income Strategy

Where will it all end? That’s the question on investors’ minds these days when it comes to interest rates. While the focus has been on the Fed Funds Target range in the wake of last week’s FOMC meeting, there is also another component to this query: the Treasury (UST) 10-Year yield.

The Fed certainly made headlines at the just completed September FOMC meeting with their internal projections for the Fed Funds Rate. According to their median estimates, the policy makers are looking for the overnight money target to come in at 4.40% for the end of this year and 4.60% for 2023. Ok, now that we got that covered (insert laugh track here), what about that UST 10-Year yield?

Without a doubt, many factors come into play when trying to determine the fate of the UST 10-Year. Filed under the obvious would be the state of the U.S. economy, and of course, inflation. Also, flight-to-quality and supply considerations, technical analysis and don’t forget, quantitative tightening (QT) can all potentially play important roles in the process as well.

Nominal vs. Real Yields

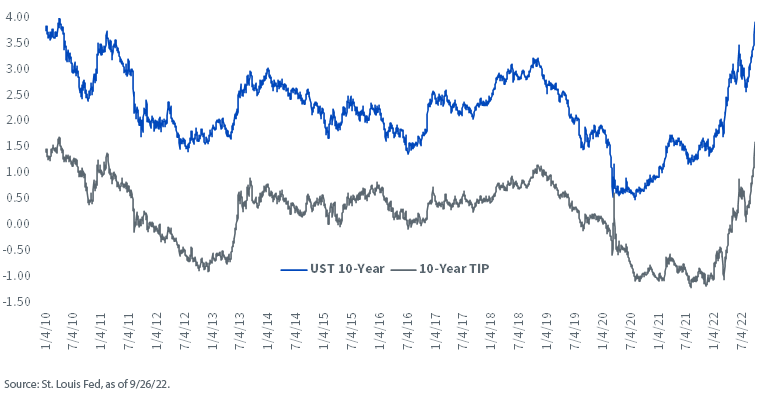

However, there is one aspect to this analysis I have blogged about in the recent past that also warrants attention: developments in real yields, or the TIPS market. In this case, we would be focusing on the Treasury 10-year TIP.

After residing in negative territory for the better part of 2021 and early 2022, real yields have now moved back decisively into the plus column. In addition, this move into positive territory has been swift, and rather noteworthy. To provide perspective, as recently as March 8 of this year, the 10-year TIP yield was as low as -1.07%, but as of this writing, the level has risen to 1.66% on an intra-day basis, an incredible turnaround in a relatively short period. By hitting this new interim peak, the 10-year TIP yield blew through the 2011 high watermark of 1.38%. And guess what other Treasury security has been following in lockstep? The UST 10-Year note.

As the above graph illustrates, this is not just a 2022 phenomenon either, but rather an historical correlation between the two. As the 10-year TIP broke above its high point from both the last rate hike cycle (1.16%) and 2011 (1.38%), the UST 10-Year yield went through the 3.50% threshold to hit 3.99%.

The next interim peak for the 10-year TIP is 1.68%, a reading that was registered in 2010. When the 1.68% real yield was printed in 2010, the UST 10-Year yield came in at 3.99%.

Conclusion

While this blog post focused on a ‘4%’ UST 10-Year yield, don’t forget, the recent selling pressure in the UST market has not been confined to any one maturity, as the spike in yields has been widespread. In fact, the UST 2- & 5-Year yields are trading at levels not seen since 2007.

The natural question to ask is, if the Fed does raise the Fed Funds Target to over 4%, will the UST 10-Year yield follow close behind? Looking at upcoming trends for real yields could offer a useful clue.

Originally Posted September 28th, 2022, WisdomTree Blog

PHOTO CREDIT: https://www.shutterstock.com/g/tawatchai+prakobkit

Via SHUTTERSTOCK

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see the prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.