Kevin Flanagan, Head of Fixed Income Strategy

One question I get asked from time to time is, what are your thoughts on the U.S. budget deficit and its potential impact on Treasuries (UST)? Typically, the UST market takes its primary cues from the macro outlook, specifically the economic and inflation setting. Of course, an integral part of the puzzle is the prospect for Fed monetary policy as well. However, there are times when the U.S. government’s finances make headlines, and not just from a debt ceiling perspective. Last week was one of those times, so I thought it would be useful to offer some insights.

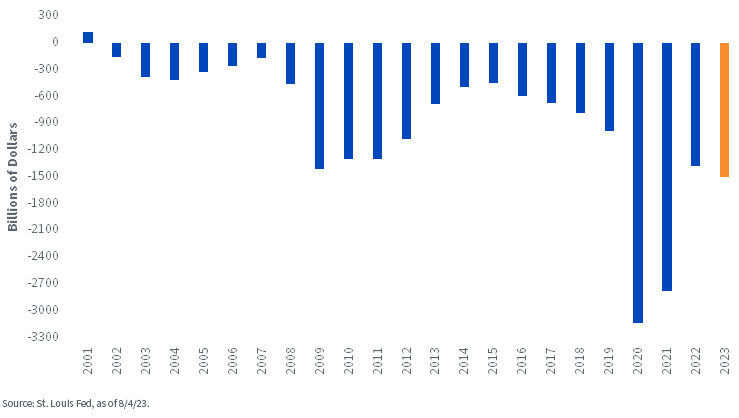

U.S. Budget Deficit/Surplus

Without a doubt, one of the more notable deficit-related headlines was that Fitch Ratings agency downgraded the U.S. government’s long-term rating a notch to AA+ from AAA. The rationale behind this move was summarized in three points: “the expected fiscal deterioration over the next three years, a high and growing general government debt burden and the erosion of governance.” The final point has to do with the dysfunction in Washington, D.C., highlighted by repeated episodes of debt ceiling debate.

For the record, I do not believe this downgrade will change the global investment community’s view of Treasuries as being the “store of value” and safe-haven asset of choice in periods of uncertainty and risk-off trade. Interestingly, this was the situation following Standard & Poor’s ratings downgrade for Treasuries in 2011. For the record, Moody’s and S&P currently have a stable outlook.

Back to the deficit. As the enclosed chart reveals, the budget shortfall following COVID-related issues did get cut by more than half in fiscal year (FY) 2022, but the deficit still remained at historical levels, coming in at just under $1.4 trillion. For FY 2023, the Congressional Budget Office (CBO) is estimating the red-ink total to increase by about $100 billion to $1.5 trillion. In fact, trillion-dollar deficits appear to be the baseline scenario going forward, unless the federal government implements some significant fiscal restraint measures.

That brings us to the next part of the equation, funding the trillion-dollar deficits. We had already seen increases in t-bill auction sizes following the debt ceiling deal, but the nation’s debt managers took the next step last week and increased nominal coupon auction sizes. According to the announcement, the Treasury will be increasing issuance size anywhere from $1 billion to $3 billion per month for each issue through October. Treasury floating rate note auction sizes will be raised by $2 billion per month as well. In addition, the debt managers stated that “further gradual increases will likely be necessary in future quarters.”

Conclusion

While the recent run-up in UST yields had its genesis in the macro side of the equation, it appears that the secondary push higher may very well have been due to the aforementioned increase in auction sizes. One thing does seem for sure—UST yields will not be getting relief from supply issues any time soon.

This post first appeared on August 9th, 2023 on the WisdomTree blog

PHOTO CREDIT:https://www.shutterstock.com/g/HTWE

Via SHUTTERSTOCK

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see the prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.