By: Jose Torres , Interactive Brokers’ Senior Economist

A strong retail sales report and a warning about U.S. bank credit ratings are provoking angst among investors who are unloading risk-on assets this morning. The risk-off sentiment is being exacerbated by sticky inflation in Canada, a larger-than-expected rate cut in China to stimulate the nation’s battered economy, and notable beats regarding increases in U.S. import and export prices.

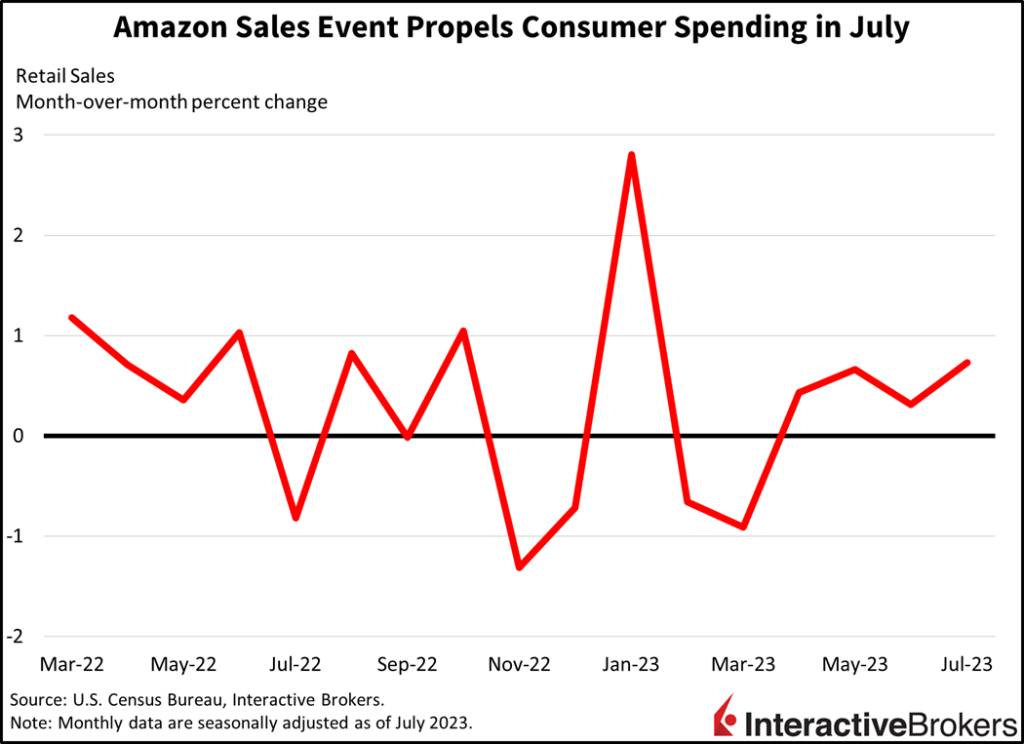

July retail sales were strong across the economy, with strong e-commerce incentives and plentiful job opportunities supporting consumer spending. Retail sales jumped 0.7% month-over-month (m/m), leaping past projections calling for 0.4%. July’s strong performance exceeded June’s 0.3% print. On a year-over-year (y/y) basis, sales grew 3.2%.

Ecommerce Lights Up Retail Sales

Broad strength was led by Amazon’s Prime Day sales event, which propelled ecommerce sales up 1.9%. Other contributors to growing sales including the following categories:

- Sporting goods sales, up 1.5%

- Restaurant sales, up 1.4%

- Apparel sales, up 1%

Food markets, building materials stores, personal care retailers, general merchandise shops and gasoline stations contributed to lesser degrees.

On the other hand, the following categories detracted from results:

- Furniture dealers, with sales declining 1.8%

- Electronics and appliances suppliers, with sales dropping 1.3%

- Automobile dealerships, with sales declining 0.3%

- Miscellaneous, with sales declining 0.3%

Bank Fears Extend Beyond Regional Financial Institutions

Fitch pointed to regulatory gaps, uncertainty about interest rates, commercial real estate valuations, borrower delinquency rates and the U.S.’s sovereign credit rating.

As consumers search for more closet space after splurging in July, Fitch Ratings has announced that it is considering another downgrade of the overall banking industry, a move that could lead to credit rating downgrades of some of the country’s largest banks such as JP Morgan Chase. In June, Fitch cited a challenging operating environment for banks and cut the industry’s score from AA to AA-. In doing so, it pointed to regulatory gaps, uncertainty about interest rates, commercial real estate valuations, borrower delinquency rates and the U.S.’s sovereign credit rating. Downgrading the industry to A+ would require Fitch to downgrade various banks because bank ratings can’t be higher than the industry’s rating. Such a move would then require Fitch to evaluate other banks and potentially lower credit ratings for numerous financial institutions.

China Malaise Prompts Rate Cuts

In China, consumer demand has been anemic, compelling the nation’s central bank to cut interest rates by 10-15 basis points (bps) across lending durations. Additionally, the People’s Bank of China also injected 204 billion yuan into the economy to support lending and liquidity conditions. The nation has been struggling with a manufacturing recession driven by weak orders from other countries, high oil prices, a real estate slump and elevated youth unemployment. Furthermore, a credit crunch and trade tensions with the West continue to hurt confidence.

Inflation’s Far Reach

Price increases continue to threaten economies around the globe with July’s Canadian headline inflation of 0.6% m/m and 3.3% y/y significantly exceeding projections for just 0.3% and 3%, respectively. In similar fashion, core inflation rose 0.5% m/m and 3.2%, loftier than estimates of 0.4% and 2.8%. Price pressures remained strong in the U.S. as well, with July import and export prices up 0.4% and 0.7%, hotter than the consensus’s expectations of 0.2% for both categories. Most of the upside pressure was driven by energy prices in Canada and the U.S.

Corporate Results Depict Weak Retail Spending

While this morning’s retail sales data is encouraging, executives at Home Depot and Foxconn just provided downbeat views of consumer spending. Home Depot Chief Financial Officer Richard McPhail this morning said second-quarter sales declined 2% y/y because many consumers already made big ticket purchases and completed large home improvement projects during the Covid-19 pandemic. Consumers who have yet to do so are holding off on large purchases and making home improvements due to higher financing costs. The trend of consumers splurging on services rather than goods is also continuing and the company expects same-store sales to drop between 2% and 5% this year relative to 2022. Home Depot’s earnings per share (EPS) of $4.65 declined from $5.05 in the year-ago quarter but exceeded the expected EPS of $4.45. Foxconn, which is a contract electronics maker and supplier to Apple, yesterday said it expects overall third-quarter sales to decline with slumping sales of consumer smartphones while global monetary policy tightening, inflation and geopolitical risks create headwinds for consumers and businesses. Foxconn’s strong results in manufacturing artificial intelligence GPU modules contributed to the company beating earnings expectations.

Investors Embrace Caution

Markets are reacting cautiously to today’s strong retail sales, with investors concerned that the results will pressure the Federal Reserve to maintain its restrictive policy. All major U.S. equity indices are down around 1%, all sectors in the red. Meanwhile, regional banks are leading the way lower on the back of the Fitch warning, with the sector’s ETF (KRE) down 2.2%. Fitch’s warnings didn’t spare the big banks either, pushing the financial sector ETF (XLF) down 1.5%. Investors are scooping up Treasuries marginally, however, with short-medium term bond yields generally lower by a few basis points across the curve. Prospects for further tightening in the U.K. and the Euro Area are weighing on the dollar, with odds slightly favoring no more rate hikes from the Fed. Probable rate hikes from the Bank of England and the European Central Bank, however, are pushing up borrowing costs and the two respective currencies, while the Dollar Index has declined 24 bps to 102.92. Energy markets are weaker this morning in response to weak data from China, the world’s largest oil importer, which has sparked concerns about demand for the commodity even as supply conditions remain buoyant. WTI crude oil is down 2.1% to $80.76 per barrel.

The U.S. Consumer Just Won’t Quit

U.S. shoppers continue to defy expectations with strong spending supported by a tight labor market that has resulted in consumer sentiment gains while wages increase faster than inflation. Consumer optimism is also being supported by a strong equity market, with the S&P 500 Index generating an 18.11% year-to-date return. Meanwhile, economic headwinds are persisting, such as inflation increasing the cost of living and higher interest rates making financing more expensive. In the coming months, consumer optimism and the ability of consumers to support economic growth will be tested as the long and variable lags of monetary policy appear. Many consumers will also face the burden of having to resume tuition debt payments. For investors, the coming months will help illustrate if consumer spending is sustainable and likely to help the country avoid a recession as the Fed continues to battle inflation.

Visit Traders’ Academy to Learn More about Retail Sales and Other Economic Indicators.

This post first appeared on August 16th 2023, IBKR Traders’ Insight Blog

PHOTO CREDIT: https://www.shutterstock.com/g/Bobex-73

Via SHUTTERSTOCK

DISCLOSURE: INTERACTIVE BROKERS

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.