By: Gerald Sparrow President & Founder, Sparrow Capital Management, Inc.

That’s a question I’ve been asked a number of times in recent weeks. And my answer is the same, “Let’s give it a little time.”

But people are quick to remind me that stocks are off to a good start in 2023, inflation appears to be trending lower, and the economy was strong in Q4. All true. But it takes more than a few good weeks and a couple of solid economic reports to inspire a new market cycle.

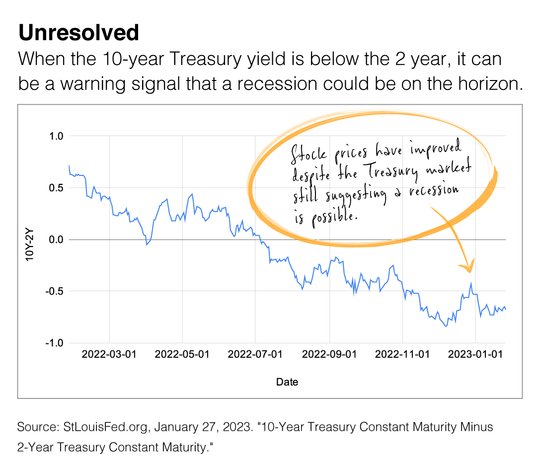

Right now, there are several questions that the financial markets need to address in the coming months. For example, will the economy enter a prolonged slowdown? The accompanying chart shows the US Treasury market is still signaling a recession.

What I can tell you is that between 1942 and 2021, the average Bull market lasted 52.8 months, while the average Bear market lasted 11.3 months. The Bear market of 2020 ended in a little over one month, but the back-to-back bear markets of the early 2000s spanned a painful 2½ years.1

The current Standard & Poor’s 500 bear market was called on June 13, 2022, when stock prices dropped 20% from their high. Some people point out that stock prices started trending lower in January 2022, but that wasn’t the beginning of the bear market.2,3

As we get deeper into 2023, the team of professionals that I work with will continue to review economic data and company reports to get a better understanding of what trends are emerging. I’ll gather their information and relay to you any updates that may affect your specific situation.

1. CaptiveInternational.com, September 9, 2021. “Playing the odds: Bull vs Bear markets.”

2. Forbes.com, November 23, 2022. “When Will the Bear Market End?”

3. The S&P 500 Composite Index is an unmanaged index that is considered representative of the overall U.S. stock market. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

PHOTO CREDIT: https://www.shutterstock.com/g/Poring2017

Via SHUTTERSTOCK

DISCLOSURE

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.