The debate over the potential environmental impact of shale energy and gas extraction continues to rage on in 2013. Yet when it comes to the economic aspects of America’s energy boom, the gains are real and verifiable, according to a new report by consulting firm IHS.

IHS is home to Daniel Yergin, one of the country’s top energy analysts and author of a Pulitzer-prize winning book called The Quest. While the study was partially underwritten by the energy industry, much of the firm’s analysis is backed up by government statistics.

What’s new is this: The economic windfall from North America’s shale holdings is greater than previously estimated. Consider the following findings from the IHS study titled America’s New Energy Future: The Unconventional Oil and Gas Revolution and the Economy.

1) The wealth generated directly and indirectly in the form of lower energy costs and goods and services from the shale boom increased disposable income by an average of $1,200 in 2012. That figure is expected to grow to $2,000 in 2015 and more than $3,500 in 2025.

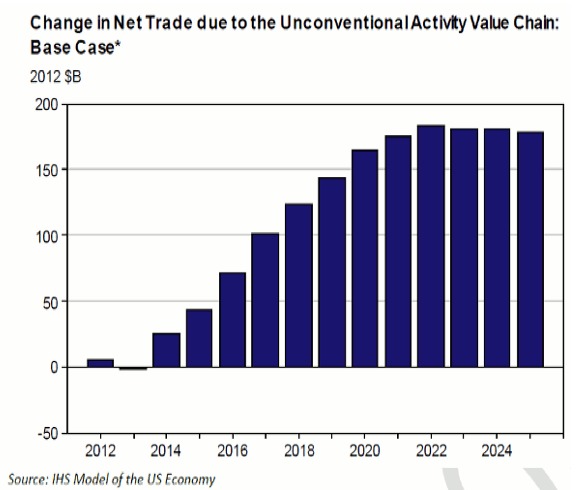

2) The U.S. trade balance will continue to improve as the country imports less oil and multinationals, facing lower energy costs, export more abroad. IHS forecasts the U.S trade deficit will be reduced by about $164 billion by 2020.

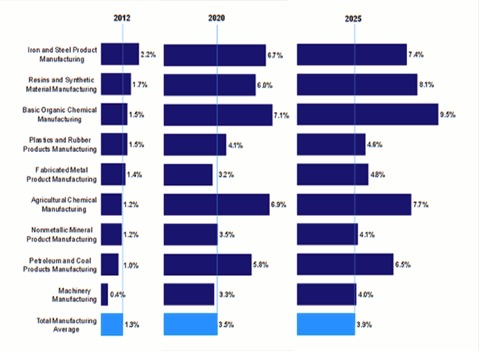

3) The shale energy industry broadly defined (upstream, downstream and energy-related chemical companies) supports more than 2.1 million jobs. By 2020, that figure is expected to hit 3.3 million and 3.9 million five years later.

4) Profits generated by the unconventional oil and gas industry generated $74 billion in government tax revenue in 2012. The tax revenue haul will grow to $125 billion in 2020 and $138 billion by 2025, according to IHS.

5) Cumulative investment from shale energy and associated industries will hit $346 billion between 2012 and 2025.

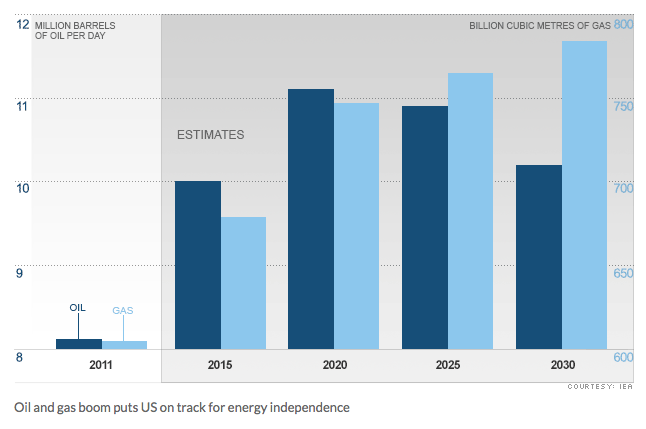

Other sources seem to back up the bullish outlook from IHS. Between now and 2018, North America will provide 40 percent of new supplies through the development of light, tight oil and oil sands, while the contribution from the Organization of Petroleum Exporting Countries (OPEC) will slip to 30 percent, according to the International Energy Agency. The IEA also sees the U.S. emerging as the biggest oil producer by 2020 and a net exporter of oil by about 2030. Meanwhile, the agency trimmed global fuel demand estimates for the next four years.

The U.S. is also on pace to add 2 trillion cubic feet per year of natural gas once three just-approved LNG projects start operating, an 8 percent increase in total U.S. capacity based on 2012 production levels. Yergin predicts natural gas, both conventional and liquefied, will be the No. 1 energy source by the end of 2030. If so, the U.S. will dominate that market given its vast reserves.

For an up close at the shale revolution, check out this indepth post from Split Rock portfolio manager Tyler Kocon and researcher Brian Michaud. Tyler manages the Bakken Shale portfolio on Covestor.