By: Olivia Engel, CFA, CIO, Active Quantitative Equity, State Street Global Advisors

As equity prices drop, it’s important to remember that valuation alone doesn’t make a true bargain. Improving investor sentiment is also crucial.

A drop in price doesn’t necessarily make a stock a good bargain. Whether a stock is an attractive buy depends on many aspects of performance. This commentary focuses on valuation and investor sentiment, because they are two of the most prominent and observable dimensions of performance, and they interact with each other in important ways.

Price changes certainly play a role in assessing value, but value is determined by comparing changes in price with changes in stock fundamentals. (Falling prices due to weakening fundamentals do not indicate good value.) It’s also critical to compare a stock’s value with that of other stocks (and not just with its own history)

Even when these comparisons suggest that a stock is genuinely undervalued, that doesn’t mean that it’s ripe for investment. Improving investor sentiment is an important signal that a stock’s price is likely to realize its true value over time.1

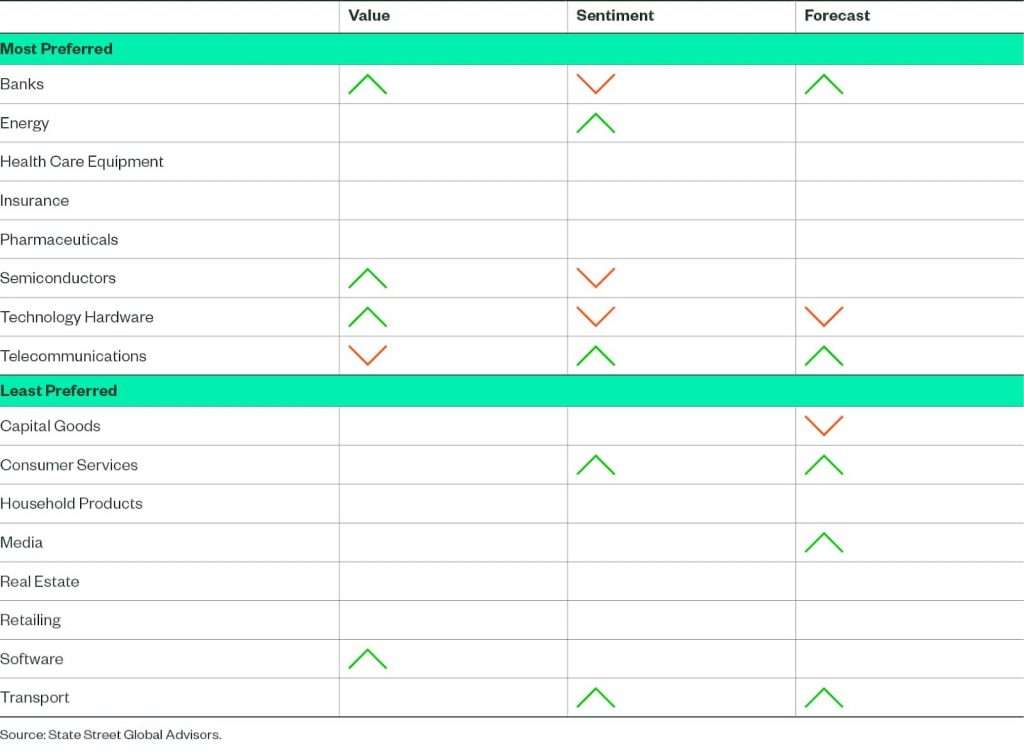

This is why the Active Quantitative Equity (AQE) team’s segment preferences have been quite stable over the last few months, despite equity-market declines. Our headline forecasts and our most preferred and least preferred segments have remained unchanged, although the drivers of those preferences have shifted in a few cases. Here is what has happened in our most preferred segments in the developed-market universe:

- Technology Hardware, Semiconductors, and Banks have experienced both declining sentiment and improving value (particularly Banks in regions where our overall forecasts have improved). In Banks, valuations have improved so much that our overall forecast has improved, despite falling sentiment.

- Telecommunications have seen improving overall forecasts, driven by improving sentiment, even though the segment is looking a bit expensive.

- Energy, Pharmaceuticals, Health Care Equipment, and Insurance are all unchanged in their attractiveness.

For our least preferred segments across the developed-market universe, most of our forecasts are unchanged:

- Capital Goods has declined even further in our eyes, mainly due to our sentiment and catalyst signals weakening further, from an already low base.

- Software is still expensive, despite looking cheaper on our measures than at the start of the year; it remains one of our least preferred segments.

- Other segments that remain least preferred (i.e., with reasonably unchanged signal preferences) include Real Estate, Retailing, and Household Products.

- We have seen a small improvement in the forecast return for Transport and Consumer Services (both with improving sentiment) and Media (a slight improvement in quality), so we are watching these segments.

The biggest changes in our forecasts have occurred in segments that are neither most preferred nor least preferred, i.e. Autos, Consumer Durables, and Diversified Financials. Each of these segments has seen deep losses over the last few months, and much worse investor sentiment — which has led to a deterioration in our overall forecasts for these segments.

The Bottom Line

A large drop in price doesn’t necessarily make a stock look more compelling from AQE’s perspective. Even if a stock is looking more attractive on relative valuation, investor sentiment needs to be positive for us to see it as attractive overall. This powerful combination of valuation and sentiment helps us to recognize when an undervalued stock is likely to realize its true value over time.

AQE Sector Preference Summary

Changes in Value, Sentiment, and Overall Forecast, by Segment, Over the Past Three Months As of May 10, 2022

This post first appeared on May 16th, 2022 on the State Street Global Advisors Blog

PHOTO CREDIT: https://www.shutterstock.com/g/Roman+Samborskyi

Via SHUTTERSTOCK

Disclosure

ssga.com

Marketing Communication

State Street Global Advisors Worldwide Entities

For use in EMEA: The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the Markets in Financial Instruments Directive (2014/65/EU) or applicable Swiss regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This communication is directed at professional clients (this includes eligible counterparties as defined by the appropriate EU regulator) who are deemed both knowledgeable and experienced in matters relating to investments. The products and services to which this communication relates are only available to such persons, and persons of any other description (including retail clients) should not rely on this communication.

Important Risk Information

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investing involves risk including the risk of loss of principal.

The views expressed are the views of Active Quantitative Equity through May 12, 2022, and are subject to change based on market and other conditions.

Quantitative investing assumes that future performance of a security relative to other securities may be predicted based on historical economic and financial factors, however, any errors in a model used might not be detected until the fund has sustained a loss or reduced performance related to such errors.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.