By: Kevin Flanagan, Head of Fixed Income Strategy, WisdomTree

Following the knee-jerk reaction in the U.S. financial markets to the FOMC meeting last week, investors could be forgiven for thinking Powell & Co. had actually achieved their goal of not creating any issues to contend with. As we all know now, that “afterglow” didn’t even last 24 hours. For the purpose of this blog post, I’m going to stick to the bond market. The jump in the U.S. Treasury (UST) 10-Year yield was a not-so-subtle reminder that even though rates, in general, had already risen thus far in 2022, there could be more to come.

As I outlined in some prior blog posts, “real yields” or yields in the TIPS market will be an important factor to watch when trying to determine where the UST 10-Year yield could be headed. As this graph clearly illustrates, the correlation between these two instruments is quite high, especially over the last five years. In fact, this latest move to the upside is occurring in lock-step fashion.

U.S. Treasury Yields

Since early March, the 10-Year TIPS yield has exploded by +132 basis points (bps), and the absolute level is no longer negative, having crossed into positive territory to the tune of almost 25 bps as of this writing. For the “nominal” UST 10-Year note, the yield has skyrocketed an almost identical amount (+136 bps), piercing the 3% threshold as a result.

I believe this relationship will continue as the Fed is now embarking in a more noticeable fashion on tightening monetary policy. While the UST 10-Year note yield is coming increasingly closer to its November 2018 high watermark of roughly 3.25%, the 10-Year TIPS yield still has a long way to go to match the peak it achieved at that same point in time. To provide some perspective, the 10-Year TIPS yield printed a reading just over 1.15% three and a half years ago, or 90 bps above its current level. In other words, the UST 10-Year yield could have more “room to run” to the upside.

A Solution

For the most recent standardized performance click here.

As investors are finding out, TIPS are not necessarily an effective rate-hedge vehicle. Instead, a strategy centered on Treasury floating rate notes (FRNs) can offer fixed income portfolios a better solution for rising rates. The WisdomTree Floating Rate Treasury Fund (USFR) offers investors a means to tap into this strategy.

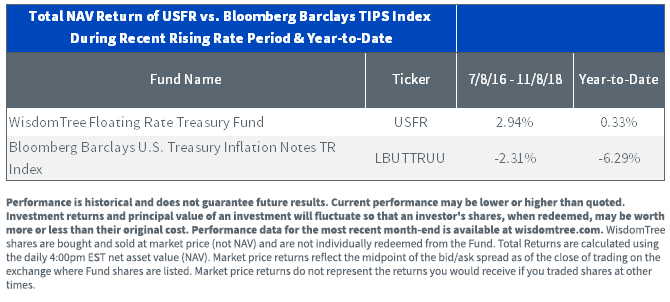

The table illustrates how 10-Year TIPS fared during the last rising rate period from July 2016 to November 2018, as well as the year-to-date experience, as compared to USFR. As one can clearly see, USFR has provided investors with a positive outcome while TIPS have produced visible negative returns. Both instances provide a glaring example of the differences between these two rate-hedging approaches.

It is important to keep in mind that TIPS are indexed to inflation while USFR is indexed (resets) to an interest rate instrument, the weekly UST three-month t-bill auction, which in turn is tied closely to the Federal Funds Rate. With the Fed in just the early stages of its rate hike policy, investors may wish to consider USFR as their preferred rate-hedge tool of choice.

This post first appeared on May 11th, 2022 on the WisdomTree Blog

PHOTO CREDIT: https://www.shutterstock.com/g/KRIACHKO+OLEKSII

Via SHUTTERSTOCK

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new, and the amount of supply will be limited. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.