Alas, not every company is a winner. Some investments are going to bomb on you, and knowing when to take a loss on stocks is important.

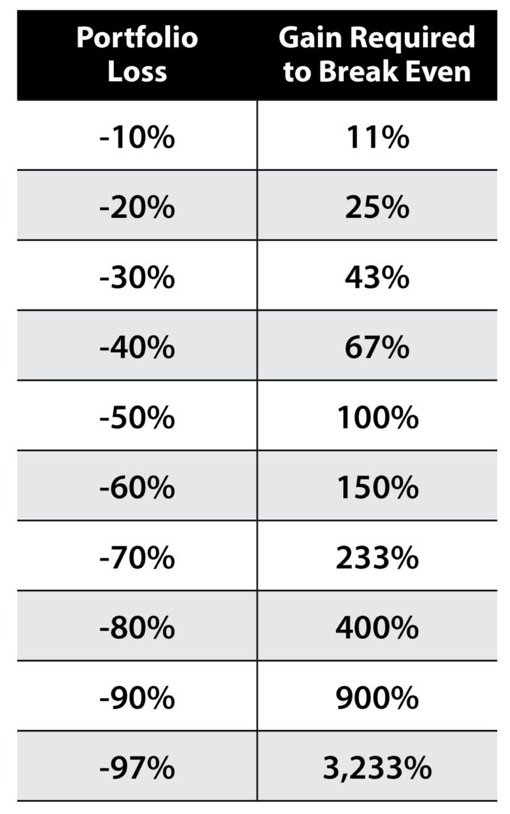

Take a look at the chart below. As you can see, gains and losses are not equal.

After taking a loss on stocks, you have to gain back more in percentage terms in order to break even.

The Math

If you lose 10% to 20% in a trade, it’s not that hard to recover. It only takes 11% to 25% to get back to where you started.

But if you lose 50%, you need 100% returns to get back to break even. Or if you lose 97% — as you easily could in a risky trade gone wrong — you’d need a ridiculous 3,233% on your next trade just to get back to zero.

Deep Hole

You don’t want to dig yourself into a hole you can’t trade your way out of.

But how, exactly, do you do it? Let’s go over two ways.

Probably the single most important tool to keep your losses under control is position sizing. But I can summarize it here in a few words:

- The riskier the position in your portfolio, the smaller it should be.

- The safer the position, the larger it should be.

In my opinion, it pays to be be smart about position sizing, and never overweight your position on a risky bet.

Stop Loss Orders

A stop loss is a rule to automatically sell a stock you own if its price drops below a certain point. For example, you could have a stop loss in Apple Inc. (Nasdaq: AAPL) at $90. If the stock price falls below that price, you sell and walk away. You don’t hold out and hope for a recovery.

Brokerages and apps like Robinhood let you put a stop loss sell order on all of your stocks. That way you don’t have to watch them closely if you don’t want to. Or maybe you are going on vacation or something.

Stop losses are controversial. As a general rule, I’m a fan because they prevent small losses from snowballing into larger ones.

Of course, the downside is that you won’t get to participate in any recovery. Let’s say Apple drops to $350 before immediately turning around and soaring to $400. Well, you just missed all that upside.

Limiting Damage

The decision to use a stop loss goes hand in hand with position sizing and knowing when to take a loss on stocks. If you keep your position sizes small, a stop loss is far less important. A small position isn’t going to blow up your portfolio if it goes south.

But in a larger position, a stop loss is a great idea. If a stock or fund makes up a large portion of your portfolio, you need to make sure you don’t take losses that you will never recover from.

Takeaway

As a general rule, you should set your stops at points that are just below a “normal” trading range for that particular stock. As a simple example, let’s say a stock trades between $10 and $25. You could set a stop loss for $9 since that’s below the “normal” range.

That’s the essence of knowing when and how best to take a loss on stocks. You should look to sell when something has fundamentally changed and get out before it’s too late.

This post first appeared on December 20 on the Money & Markets blog.

Photo Credit: Pictures of Money via Flickr Creative Commons

DisclosureThis article is not intended as tax advice and is provided for educational and information purposes. Interactive Advisors does not provide tax advice. All references to tax matters or information provided here are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.

Any investments discussed in this presentation are for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments are presented for discussion purposes only and are not a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable.”