The Covestor Rockledge L2 Portfolio closed out the first quarter of 2015 under-performing the S&P 500 Index.

The portfolio’s return fell -0.74% (after fees and expenses) versus the S&P 500, which gained +0.44%.

This portfolio has been long in four SPDR select sector exchange traded funds (ETFs) thus far in 2015.

4 Sectors

Those positions are equally weighted in utilities (XLU), technology (XLK), energy (XLE) and consumer staples (XLP).

The portfolio’s exposure to the utilities sector has been a major drag on returns for the quarter.

With the 25% weighting in our strategy, versus a 4% weighting in the S&P 500, the underperformance of XLU has been the culprit in the underperformance.

Healthcare had an unexpectedly strong return, driven by a surge in biotech companies. Energy stocks got hammered by decline in oil prices, which subsequently helped utilities.

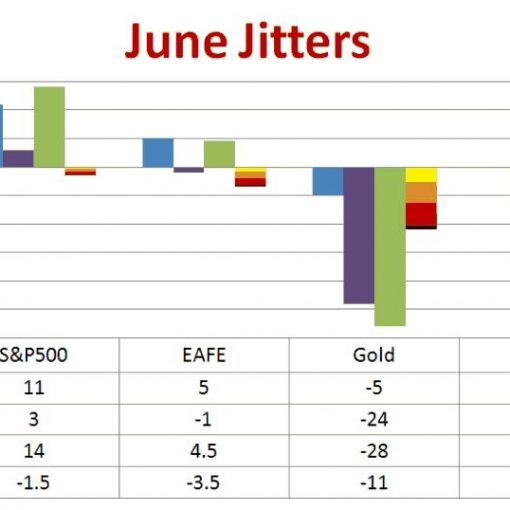

Trend Spotting

The Rockledge program is looking at historical relationships between company fundamentals like earnings growth, valuations like price-earnings, and macro factors like interest rates.

Our strategy doesn’t anticipate any Middle East oil policy changes.

The first quarter has shown some increased volatility in the markets.

Statistically, the standard deviation of monthly returns on the S&P 500 remain below 10% this year, a figure that is quite low relative to the historical average of around 15%, according to my research.

This figure in my opinion suggests that investors seem poised to absorb a 10% correction in the market.

Cloudy Outlook

That was confirmed in October when there was a decline of nearly that amount without any major panic.

This has been a period where a clouded landscape keeps getting cloudier.

The markets and economy seem to add concerns, and not resolve issues.

During the quarter, concerns about the falling euro currency were added to the list.

Political Tensions

Geopolitical issues in Yemen stirred up more Middle East unrest.

All eyes are sure to be focused upon the upcoming earnings season in the US.

With the close of the quarter, it won’t be long before we begin to see how companies have performed.

While lower oil is usually a good catalyst, the fall was massive.

I expect the oil price decline to show up in the numbers in America’s energy growth engines such Texas, North Dakota, and Pennsylvania, as these regions slow production and idle workers.

Earnings Test

Furthermore, it has been an unusually cold year for much of the North and Northeast United States.

Only now are the concrete trucks finally moving, a sure sign that winter is over.

But, the toll that the cold had on businesses will become evident as announcements are made.

Earnings will also get tested by firms with exposure to Europe.

European Troubles

The euro has been sliding, and that 20%-plus decline since late last year will do doubt show up in portfolio’s with exposure to an already slowing Europe.

European GDP growth was 1.4% in 2014, versus 2.4% in the US and 3.2% globally. This will weigh on equities for sure.

Finally, with price-to-earnings ratios at highs across most industries,

Rockledge feels the impact of poorer earnings and slower forecasts at a volatile time will take their toll over the next few weeks.

Getting Defensive

The following chart shows each sectors PE versus its return.

With earnings under pressure, and PE’s stretched by a historical evaluation, this helps explain our conservative posturing.

The overall S&P 500 is currently trading at a PE of 19.1 which is high relative to historical PE levels of around 15.

A quick, back of the envelope look at price and earnings, (based on the current valuation of SPDR S&P 500 ETF (SPY) versus historical averages) suggests that the S&P 500 may be overvalued as much as 21%, according to my calculations.

Aging Bull Market

Going forward, the Rockledge positions tend to depict our conservative view at this point in time.

Our holdings take into account a 6 year bull market run and a mature economic cycle, then factor in shorter term earnings levels.

Our models do not use forward projections, only current valuations, momentum and interest rate levels.

However, in our opinion, we can see a scenario unfolding where rising rates and lower earnings drive the different sectors to more normal valuations.

We believe this negative momentum will propel markets down further, and more technical selling will ensue.

Correction Looms?

We believe that the current risk levels are mispriced and wouldn’t be surprised by a market correction in the 20% magnitude.

What is unclear, is how investors will behave with a 15% fall.

In October 2014, a 10% fall was met with a ho-hum attitude. Investors stayed in the markets.

Should the market fall 15% and investors get unnerved, another 5% decline or more wouldn’t shock us.

Photo Credit: Kevin McGrew via Flickr Creative Commons

The investments discussed are held in client accounts as of April 8, 2015. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.