By Kevin Flanagan, Head of Fixed Income Strategy

One of the key pillars for the Fed to begin a more active exit strategy was “substantial progress” in the labor market. With the July jobs report, it looks like the Fed will need to make some decisions, perhaps sooner rather than later. Here’s a look at the latest numbers:

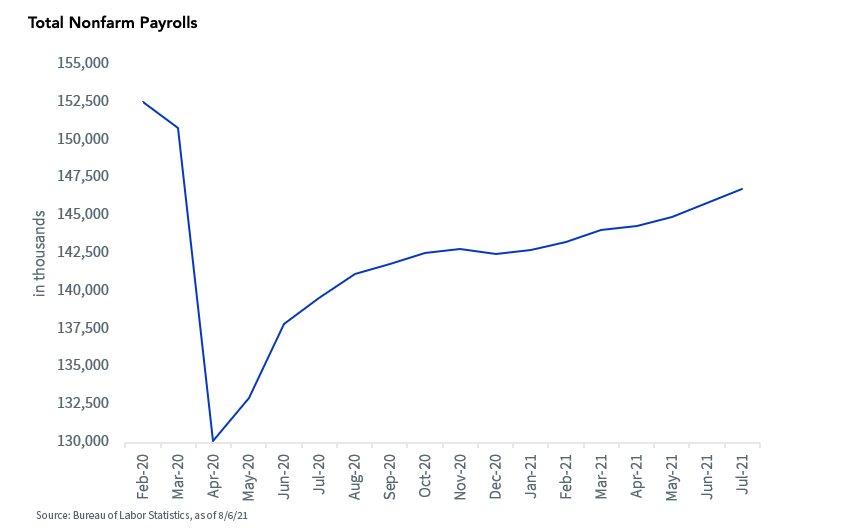

- Total nonfarm payrolls rose by 943,000, beating the consensus estimate of 870,000 handily. In addition, the prior two months’ tallies were revised upward in a noticeable fashion. Thus, the U.S. jobs market has now produced back-to-back gains in excess of 900,000.

- The breadth of job gains was rather wide as well. The usual suspects (leisure & hospitality) continued their comeback from pandemic lows, but both private service-providing and government payrolls (local government) contributed to the better-than-expected performance in July.

- Overall payrolls are still not back to their pre-pandemic levels, but they have now recouped 75% of the March/April 2020 plunge.

- The unemployment rate dropped 0.5 percentage points to 5.4%, once again beating expectations (5.7%) in a noticeable fashion. In fact, within the household survey of the jobs report, civilian employment topped the million mark at 1,043,000.

- Another key development was the solid gain in average hourly earnings, with the year-over-year increase placed at 4.0%. It definitely appears as if the demand for labor coming from the pandemic recovery is putting upward pressure on wages, a development the BLS also noted in the report.

- Chairman Powell’s “inflation is transitory” argument will fall apart if wages join the party.

- There is no Fed meeting until September 22, but it appears as if some FOMC members are getting a little restless. We still have one more jobs report to go before then, but the July jobs report plays into the narrative that the Fed will make a taper announcement at this meeting, with Powell’s expected Jackson Hole appearance later this month potentially being used as a ‘signal’ to the markets as to what’s coming.

Conclusion

The UST 10-Year yield could be poised for round two of higher yields. After testing the Fibonacci 50% retracement level twice in recent weeks, and essentially failing both times, the fundamental and technical setting for the 10-Year suddenly look less friendly. Against this backdrop, I continue to suggest investors deploy rate-hedge strategies for their fixed income portfolios.

This post first appeared on August 9 on the WisdomTree blog.

Photo Credit: Kurtis Garbutt via Flickr Creative Commons

DISCLOSURE

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see the prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.