Following one of the worst first quarters in history, by early May the S&P 500 retraced about half of its losses since the March low. While investors understand that great uncertainty still lies ahead with the pandemic and the gradual restarting of economies, it is worth pausing to consider how asset owners have fared thus far and what lessons they are drawing from the new abnormal.

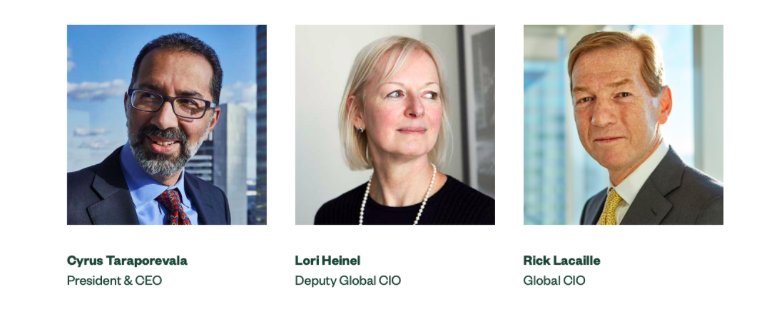

In a recent roundtable, State Street Global Advisors President & CEO Cyrus Taraporevala, Global CIO Rick Lacaille, and Deputy Global CIO Lori Heinel all agreed that these are challenging times for asset owners. But when markets swoon as dramatically as they did in March, they stressed that State Street’s execution and liquidity prowess as well as deep investment management expertise and insights are key to helping institutional investors adapt quickly. Patricia Hudson, State Street’s Head of Executive Communications and Thought Leadership asked what the biggest challenges have been so far.

The Need for Speed

Patricia Hudson: We know that unlike in 2008, the current crisis started as a health emergency that quickly shut down economic activity and in turn transmitted stress to the financial markets. What has that different sequence meant for asset owners, and were they better prepared this time because of lessons from 2008?

Cyrus Taraporevala: Heading into 2020 and knowing that we were still in the longest equity bull market in history, many of our clients thought we might see a garden variety market correction and had positioned their portfolios accordingly. But the severity and speed with which this health and economic crisis hit took everyone by surprise. This was not at all like the 2008 crisis, which was slower-moving and more of a developed markets crisis of built-up financial leverage that indirectly but ultimately affected emerging markets–though China held up well because of its massive reserves. This time everyone – and almost all asset classes – were affected and far more quickly.

What was also completely new this time for asset owners was the need to transition to work-from-home conditions within days. Some clients were able to deal with that better than others, depending on the state of their technology infrastructure and business continuity planning. At State Street, we were fortunate in that we had focused on continuity planning, systems resiliency and decision rights for some time, so we managed quite well. Because of our significant operations in China, we also had a bit of a head start in understanding how to transition work.

Lori Heinel: I agree that the dynamics of this crisis are very different from what we saw in 2008. But the experience of the global financial crisis (GFC) did provide a playbook for reacting to liquidity stresses and other market dislocations. One of the most important lessons from the GFC for regulators and policymakers was the need for speed. Given how abruptly economic activity shut down, policymakers needed to react quickly. And they did! The sheer number of central bank facilities and rescue packages put in place over the last few months has been mind-boggling, and clearly State Street’s experience in 2008 enabled us to partner effectively with the Fed to help launch those market supports in a matter of days.

Liquidity Provision Paramount

Patricia Hudson: What have been the biggest challenges facing clients?

Rick Lacaille: We certainly didn’t see a rush to liquidate the way we did in 2008. There were some clients who had to act because of their specific liquidity issues. But the markets crashed so rapidly and dramatically in March that investors were left unsure about what direction the next trade was going to be: another 10 percent drop or would there be a rebound of the same magnitude?

For those clients who needed to act, our role as an execution and liquidity powerhouse was vital if they wanted to switch into more secure assets, consider some of the opportunities the crisis created or simply raise capital to address other liquidity needs. We have the ability to transact in many areas, so in a crisis, that ability to provide global trading and order execution is so important. State Street is an execution machine, and clients come to rely on that, especially during times of market stress.

Lori Heinel: It is also important to point out that we had been having regular conversations with clients about downside risk-mitigation strategies long before the crisis happened, because we knew the end of the 11-year bull equity run was drawing closer. We discussed a range of possible protection choices, and any of the hedges we recommended did better than doing nothing: allocating to defensive equities versus a market-cap weighted portfolio, implementing an options-based strategy, incorporating tactical triggers or increasing allocations to gold.

Cyrus Taraporevala: With our institutional clients, there were two immediate areas where we helped: some clients needed significant liquidity for hedging purposes or capital calls; but far more of them needed rebalancing help, as they were 5-8 percent underweight equities heading into the end of the first quarter. Rebalancing back to their strategic allocation was a huge step during the volatile quarter end, but many of our clients were happy we were able to help them do so when equities began to recover.

In our cash business, we helped with two distinct goals: one was helping clients convert longer-term assets into cash, either because they needed to deploy it soon or they wanted to have significant dry powder at the ready. Other clients were focused on de-risking their cash holdings and rotated out of prime money market funds into government and treasury money market funds. Given the importance of having the right governance and decision-making models in place when a crisis hits, it is worth pointing out that in our defined contribution business, we have that. It just happens to be called a target date fund and comes with the reassurance that a professional manager is focusing on participants’ long-term goals even in the midst of a crisis. We saw in 2008 that individuals behaved very differently with their defined contribution plans versus their retail accounts. They were prepared to stay the course with the former, which in most cases was very much the more prudent course to take.

ETFs Prove Critics Wrong

Patricia Hudson: ETF trading showed extraordinary volumes in the first quarter: average daily equity ETF trading volume in the US more than tripled to over $200 billion per day in the five weeks to the end of March, from an average of about $60 billion. Fixed income ETF daily trading also tripled to an average of $35 billion.1 State Street’s ETFs alone represented 42% of US ETF trading from late February through the end of March.2 In fact, SPY — the first ETF created in the US – saw 15 consecutive days of secondary market trading of more than $50 billion, including a record high of $113 billion.3 What was driving those volumes?

Cyrus Taraporevala: Clients were looking to our ETFs first and foremost for price discovery, particularly in fixed income where you couldn’t get a real price other than in the ETF market. We saw clients increasingly use ETFs as a way to transact quickly and deeply with enough size, regardless if they were risk on or risk off.

The experience dramatically underscored that ETFs are now the preferred liquidity vehicle for an overwhelming number of investors. We all know that liquidity is the lifeblood of investors’ ability to transact, and so our clients’ ability to access that liquidity juggernaut with us at State Street is a defining feature of our partnership, especially when times are tough.

Patricia Hudson: We heard a lot of concerns before the crisis that the build-up in allocations to index strategies and vehicles like ETFs would amplify and exacerbate a severe market sell-off—what did we actually observe during the worst volatility in March?

Rick Lacaille: As Cyrus mentioned, ETFs did perform well in providing liquidity to investors to make choices on both the upside and downside. It was also an effective way for investors to behave opportunistically to get exposure to an asset class quickly that they couldn’t access any other way. As to concerns that ETFs would exacerbate a sell-off by making it easier for investors to herd or panic, there was actually healthy two-way traffic in ETFs, especially in high yield and other asset classes that experienced some of the most dramatic pricing and trading action. My view is that ETFs facilitated activity that investors wanted to undertake and would have undertaken less efficiently if the vehicle didn’t exist.

The other long-standing critique about the so-called “wall of passive money” is that when asset correlations go to one during a market shock it is supposedly proof that all price behavior is driven by indexes desperately selling or buying. But similar to what happened during the GFC, this time around you had one factor dominating asset pricing. In this case it was an existential public health crisis and economic shutdown. If you are shutting down the economy, the individual nuances of Company A versus Company B frankly don’t matter. So whether indexing is a large part of the market ecosystem or not, you will always find asset correlations rising when a single dominant factor is driving fundamentals, which is usually the case when you have a severe market event.

Lori Heinel: I agree that what the market has digested is that ETFs give you better price discovery, especially when you have dramatic price dislocations. In past episodes, ETFs were criticized, mistakenly in our view, for not keeping pace with cash markets. This time around, investors actually recognized that ETFs were better vehicles than the cash markets for price discovery and position-taking.

Cyrus Taraporevala: It has always seemed curious to me that so many active equity managers assume that index-based strategies, whether they are ETFs or not, are all going to drive in the same direction. At the same time, it is often overlooked that many active portfolios are in fact loaded up with mainly beta and dominated by the same stocks, which is the case when 20 percent of the market is driven by 5 tech stocks. So it’s strange to think that if I sell essentially the same set of stocks from my active manager, it is going to have a markedly different impact on the market compared with selling my index exposures.

Investment Lessons So Far

Patricia Hudson: We all remember Warren Buffet’s remark during the GFC that “when the tide goes out, you learn who has been swimming naked.” What have we learned or re-learned this time about areas of vulnerability that might change investor behavior or preferences?

Rick Lacaille: I think we’re still too early in the story to say, but we know that there are potential vulnerabilities among those companies and investors that are highly levered. Many companies have loaded up on debt because interest rates have been so low; similarly, I am sure we will see challenges with some investors who have been overly confident about the volume of illiquid assets in their portfolios.

Another area of vulnerability we will see in time involves aggressive accounting to obscure some real underlying cash flow problems. Think about the oil hedges that have gone wrong as prices have crashed: a lot of market participants have hedged their future consumption of oil and have lost a great deal of cash flow meeting margin payments. Those problems might not be readily apparent now, but they will eventually emerge, whether with an insurance company or an asset owner or a company like Metallgesellschaft in Germany, which ran into huge difficulties with its energy hedges in the 1980s.

In emerging markets, there will likely be some big problems where the dollar mismatch is material and some emerging market debt will be mispriced, leading to losses. But we believe a large number of emerging market issuers will be able to navigate the current crisis without defaulting. The question is the extent to which those individual defaults might cascade to developed market and emerging market investors.

I also think investors will see a number of opportunistic buying opportunities as distressed funds are launched. We are engaged in discussions with clients about those possibilities, but there has been little money in motion so far.

To read the rest of this round table interview that first appeared on the SPDR blog on May 15, please click here.

Photo Credit: Yuri Samoilov via Flickr Creative Commons

Disclosure:

Investing involves risk including the risk of loss of principal. The views expressed in this material are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. All statements, other than historical facts, contained within this document that address activities, events or developments that SSGA expects, believes or anticipates will or may occur in the future are forward-looking statements. These statements are based on certain assumptions and analyses made by SSGA in light of its experience and perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances, many of which are detailed herein. Such statements are subject to a number of assumptions, risks, uncertainties, many of which are beyond SSGA’s control. Please note that any such statements are not guarantees of any future performance and that actual results or developments may differ materially from those projected in the forward-looking statements.