By Philip Lawlor, managing director, head of global markets research, FTSE Russell

Assessing how damaging the coronavirus epidemic will ultimately be for the global economy remains challenging.

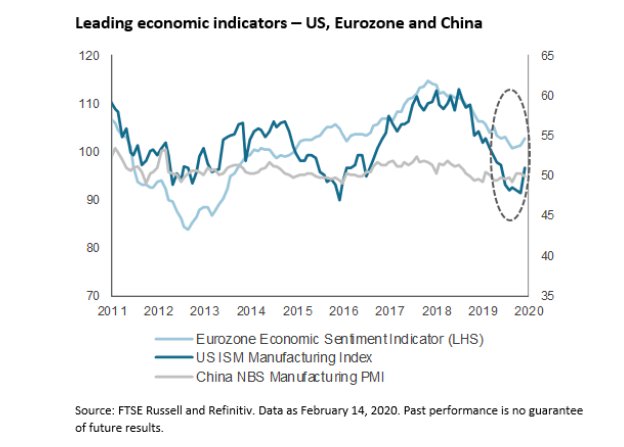

The viral outbreak has cast a shadow over global growth expectations, which had been improving in recent months thanks to coordinated central-bank stimulus efforts and the US-China trade truce. Notably, leading indicators, particularly in manufacturing, had begun showing tentative signs of recovery.

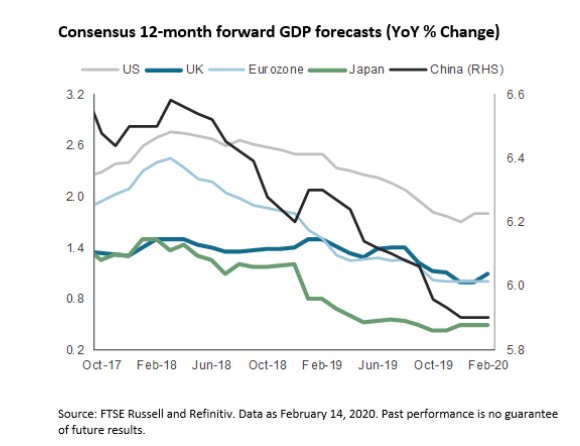

This fledgling rebound has been mirrored in consensus 12-month forward GDP estimates, which had also appeared to be stabilizing after the sharp deterioration from early 2018 peaks.

Yield curves resume flattening

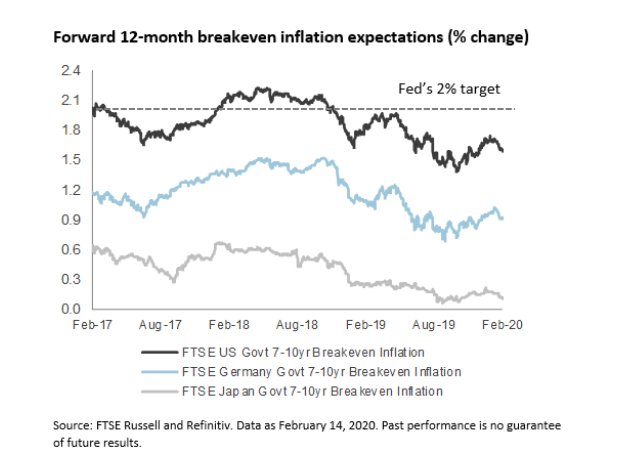

Bond markets have largely interpreted the outbreak as a disinflationary shock: With the sharp decline in China-dependent oil and copper prices, breakeven inflation expectations have given back much of their Q4 gains, resuming the downtrend since early 2018. They remain well below stated policy targets, posing challenges for central banks.

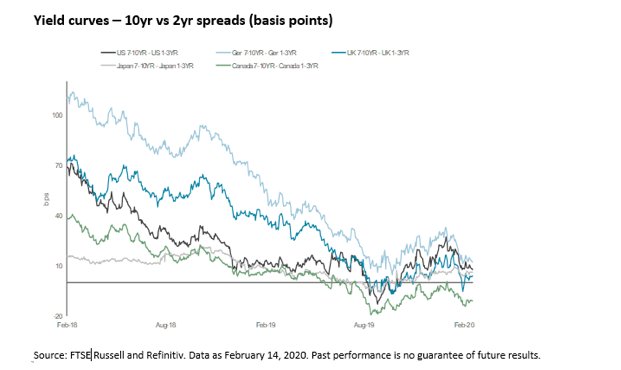

Yield curves have also resumed flattening across most of the G7 countries, erasing much of the steepening seen in the final quarter of 2019. Yield curves are not far from the inversion tipping points that had ignited the recession fears and roiled global markets last summer.

What lies ahead for financial markets hinges on the extent of the disruptions to global supply chains, as well as the magnitude and effectiveness of the policy responses in China and elsewhere.

What is apparent, however, is that the virus outbreak has caught the global economy at a vulnerable point and is disrupting the prevailing mid-cycle recovery narrative and raising the prospect of a double-dip slowdown.

This article first appeared on Feb. 29 on the FTSE Russell blog

Photo Credit: Studio Incendo via Flickr Creative Commons

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “MTS®”, “FTSE4Good®”, “ICB®”, “Mergent®”, “The Yield Book®”, “Beyond Ratings®” and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, MTSNext, FTSE Canada, Mergent, FTSE FI, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products, including but not limited to indexes, data and analytics, or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.