If you want to be like Warren Buffett and be greedy when others are fearful, now might be a time to talk to an adviser about your market positioning.

Consider the following facts from an E.S. Browning story in the Wall Street Journal:

- Investors have pulled $138 billion from mutual funds and ETFs that invest in U.S. stocks since March 2009, according to the Investment Company Institute.

- The current exodus of funds from U.S. stock funds is only the second time that’s happened for more than a year at a time since 1981.

- Only a quarter of households with retirement plans were willing to take above-average investment risks in 2011, down from 33% in 1998.

- The portion of stocks held in all 401(k)-type retirement accounts fell to 61% in July, down from 70% in early 2007.

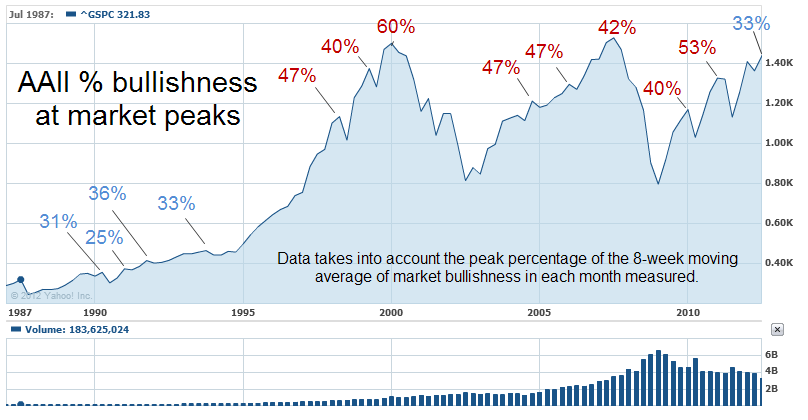

Also of note is that the latest AAII Investor Sentiment Survey as of Oct. 3 reflects that 33.9% of those polled are bullish about the markets, below the long-term average of 39%. The average bullishness of the past eight multi-year market peaks is 47%, based on this chart: