Jeremy Schwartz, CFA, Executive Vice President, Global Head of Research

A recent episode for the “Behind the Markets” podcast featured JC Parets, founder and chief strategist at All Star Charts, and Timothy Hussar, CIO of WhartonHill Investment Advisors, discussing their outlook for 2020. Here are some of the highlights of the conversation.

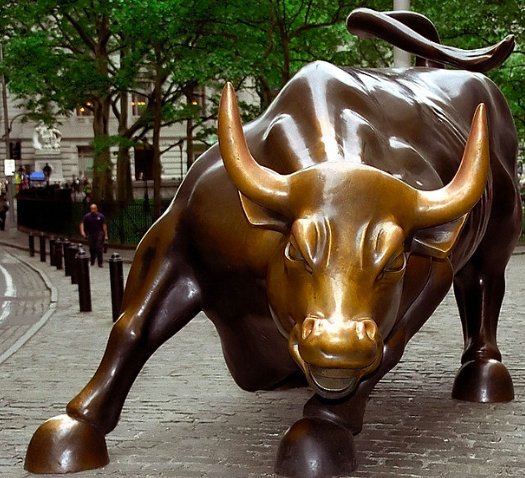

A New Global Bull Market?

- Parets believes there is a large misperception that markets are “long in the tooth” and counters the prevailing narrative that we’ve experienced a global bull market for the last 10 years. He sees this bull market narrative as an overly U.S.-centric worldview.

- Looking around the world, we see the major international, European and emerging market averages are just starting to get back to highs set 20 or even 25 years ago.

- Parets believes we are just starting a new global bull market, not ending one from the last 10 years, and that stocks can go much higher.

- Hussar thinks that bull markets usually end with euphoria, and it is hard to describe the current environment as overly euphoric.

Can Interest Rates Break Out Much Higher?

- Parets explained why the commercial hedging positions in gold and copper, their chart dynamics and their correlation to the U.S. 10-Year Treasury market suggest interest rates are going much higher.

- Prevailing market sentiment suggests the exact opposite, that interest rates are staying low forever, so it is interesting to hear someone with a fairly different worldview.

- This view on rates heading higher has Parets being bullish on asset classes such as regional banks, base metals and emerging markets, and more bearish on gold.

Should We Put New Money to Work?

Hussar’s clients often ask him if they should put new money to work since markets are at all-time highs.

- Over the last 60 years, if you invested money at any point in time, there was an 81% chance of having positive returns 5 years ahead.

- But with markets at all-time highs, you had about an 82% chance of positive returns 5 years ahead with average returns a little higher.

Getting Defensive or Aggressively Long?

- Our two guests have somewhat different worldviews on relative positioning. While Hussar still likes U.S. equities, he sees client allocations from a 60% equity and 40% fixed income combination drifting higher toward equities with an emphasis on derisking. With Treasuries offering less than a 2% yield on the 10-Year, Hussar looks at global infrastructure stocks and preferred stocks as one way to rebalance out of equities and get a bit more defensive.

- Parets contrasted a defensive mindset with getting aggressively long equities, seeing 50% more gains likely from his read of the charts in some of the large-cap technology stocks.

- As for comments that the market is being driven by a few stocks, Parets said that the best players are supposed to score the most points. LeBron James is expected to be the leading scorer on his team, and Parets sees the equity markets in the same way.

Please listen to our full conversation with our two guests below.

This article first appeared on the WisdomTree blog on January 6.

Photo Credit: David Ohmer via Flickr Creative Commons