Michael Arone, CFA, Chief Investment Strategist

Hey, big spender.

Shameful. On July 22, White House and Congressional negotiators agreed to increase federal spending and raise the government’s borrowing limit. This deal for more than $2.7 trillion in spending over two years would suspend the debt ceiling until the end of July 2021.

Increasing spending by nearly $50 billion for the next fiscal year, the agreement provides for $320 billion in spending over two years, beyond the limits set in 2011’s sequester that established automatic spending cuts. Go figure, wasteful spending that will burden future generations with mountains of debt and further fuel the deficit is the one thing that Republicans and Democrats can agree on.

This deal, which still must pass both chambers of Congress and be signed by President Trump, avoids a fiscal crisis by splashing more red ink on a deficit that has already surged to more than $1 trillion. DC’s general acceptance for operating under massive deficits can be traced back to 2002, when the Bush administration’s economic team met to discuss a second round of tax reductions to follow Bush’s 2001 cuts.

Deficit Politics

When then-Treasury Secretary Paul O’Neill raised concerns that additional tax cuts could cause the US government — already running a $158 billion deficit — to spiral toward a fiscal crisis, Vice President Dick Cheney famously alleged that “Reagan proved deficits don’t matter.” It was as if Cheney’s words were delivered on two stone tablets, granting all future governments permission to spend well beyond the nation’s means.

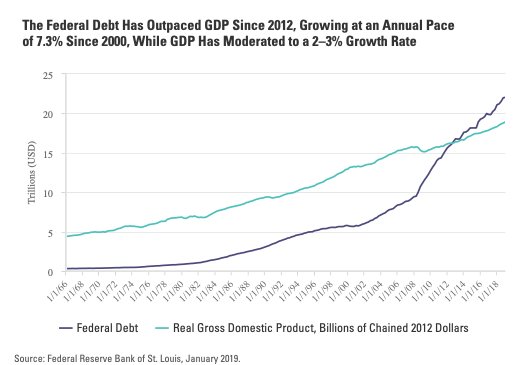

If you believe that debt and deficits don’t matter, I’m sorry, but you are wrong. They may not seem to matter because nothing terrible has happened yet as both debt and deficits have ballooned in recent years. However, just because a person is lucky enough to not blow his brains out in a game of Russian roulette doesn’t mean that the game isn’t dangerous — potentially fatal.

While it might not be possible to determine exactly when this irresponsible behavior will wreak havoc on the world, some fascinating research about generations may provide insight into which generation will most likely solve what might be our nation’s greatest future challenge

Talkin’ ’bout the generations

Thinking about how massive debt and huge deficits will impact future generations reminds me of one of the most thought-provoking books I have ever read — The Fourth Turning: An American Prophecy — What the Cycles of History Tell us About America’s Next Rendezvous with Destiny by William Strauss and Neil Howe. The authors apply their generational theories to the cycles of history to conclude that the United States may be on the brink of a crisis period they define as the “Fourth Turning.”

Strauss and Howe suggest that US history moves in predictable cycles that last roughly 80 years, where different generations (i.e., Baby Boomers, Generation X and Millennials) move through roughly 20-year periods of influence called “turnings.”

Each of the four turnings comes with a mood shift that catches people by surprise. For example, the rapid breakdown of globalization in concert with rising nationalist sentiment and the surge in populist leaders around the world has shocked many people in recent years.

The turnings follow a familiar rhythm of growth, maturity, decay and — ultimately — destruction. It’s easy to connect them to the four seasons — spring, summer, fall and winter. When the book was published in 1997, Strauss and Howe were forecasting that winter was due to arrive early in the 21st century.

Followers of their work have cited such events as 9/11 and the Great Recession as evidence that the Fourth Turning was beginning as predicted. The massive national debt and increasing deficits have become symptoms of this crisis period.

For more, please read the rest of the post originally published on the SPDR Blog on July 31.

Photo Credit: Kevin Dooley via Flickr Creative Commons

This material is from State Street Global Advisors and is being posted with State Street Global Advisors’ permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and are subject to change based on market and other conditions. Interactive Advisors is not endorsing or recommending any investment or trading discussed in the material.

The opinions expressed may differ from those with different investment philosophies. This material is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed or relied on as research or investment advice.

This information does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. This material is for informational purposes only and does not constitute investment or tax advice and should not be relied on as such. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation to buy, sell or hold such security.

This material does not and is not intended to take into account the particular financial conditions, strategies, tax status, investment horizon, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.