Matthew J. Bartolini, CFA, Head of SPDR Americas Research

In this June edition of Charting the Market, we’ll look at what’s going on from a global economy perspective, including how trade tensions have impacted growth projections and sector performance.

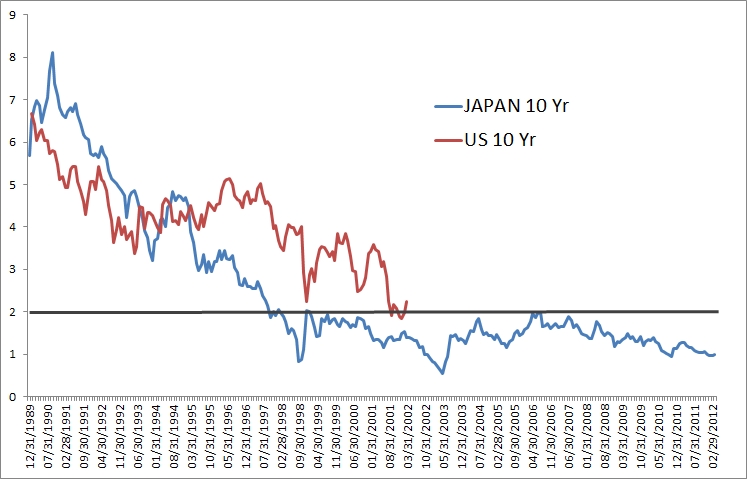

We’ll also tackle the question of whether the current slowdown and movement in the yield curve means a recession is right around the corner—or not.

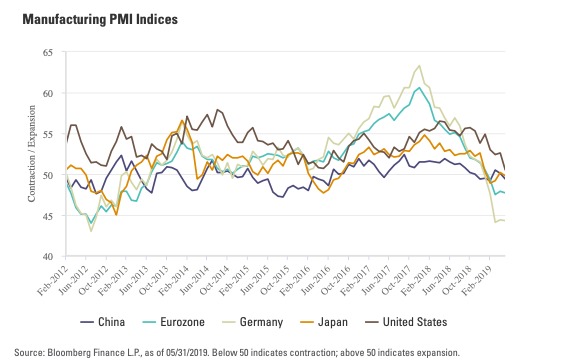

Chart #1: Global economic sentiment negative as manufacturing down

Global economic sentiment rolled over in 2018 and remains negative in 2019. Eurozone economic sentiment has been recovering since April on the heels of some improvement in manufacturing activities and better-than-expected Q1 GDP.

Most countries/regions, except the US, are now in contraction territory, as trade tensions escalated. US sentiment bottomed out in May but could face more stress in the coming months, as trade flare-ups may dent business sentiment further.

While the US has been at the forefront of trade tariff discussions, Germany has notably had a sizable downturn in its manufacturing indices due to its reliance on emerging market demand for the goods it produces.

What does it mean? We’ve been in a global economic slowdown for some time. And because leading economic indicators in the US have been moving lower year over year since November 2018, the US is experiencing a slowdown too.

My Take: The economic growth music is slowing, but it hasn’t stopped. And a slowdown doesn’t mean negative market returns. Quality has historically led amid slowdowns and it’s leading again this year, outperforming the broader market by 3.2%.

Still, investors will want to be judicious about where they allocate capital. Targeting quality stocks, as opposed to value or size, may be beneficial when there’s a stronger preference for sustainable cash flows.

For more, please read the rest of the post originally published on the SPDR Blog on June 14.

Photo Credit: Beth Scupham via Flickr Creative Commons

This material is from State Street Global Advisors and is being posted with State Street Global Advisors’ permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Advisors is not endorsing or recommending any investment or trading discussed in the material. The opinions expressed may differ from those with different investment philosophies. This material is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed or relied on as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation to buy, sell or hold such security. This material does not and is not intended to take into account the particular financial conditions, strategies, tax status, investment horizon, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.