The S&P 500 reached an all-time high on June 20, pushing the benchmark index up to nearly 18% on the year.

That’s reason to cheer, in my opinion, and most analysts believe the US Federal Reserve’s shift to a more dovish monetary policy, including possible rate cuts later this year, is a big reason why.

Yet it’s worth remembering why the Fed has suddenly shifted gears in the first place: There’s growing evidence that the record-long US expansion is losing energy.

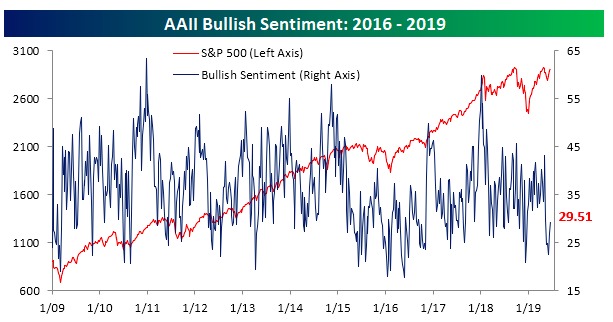

Bearish Sentiment

While the US stock market is hitting the high notes, investors are scarcely in a buoyant mood.

As Bespoke Investment Group analysts pointed out in a recent post, the AAII weekly sentiment survey is “around 10 percentage points off of where it stood the last time the S&P 500 was at these levels.”

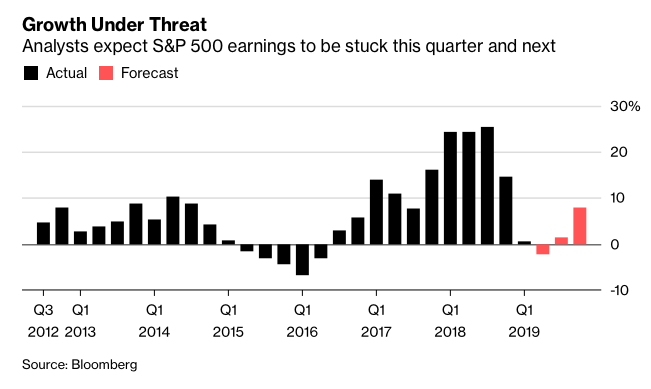

Earnings Slowdown

And there’s no denying the big falloff in US corporate earnings since last year, thanks to rising global trade tensions and slower growth at home.

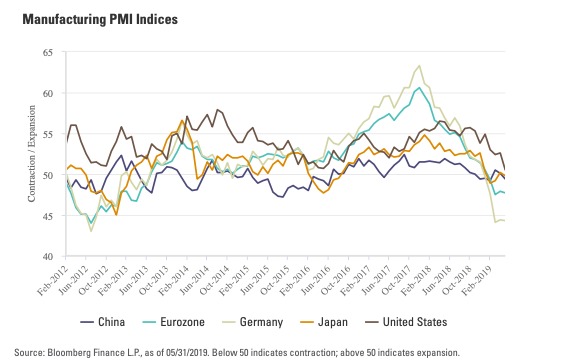

Synchronized Slowdown

In fact, global growth around the world is also taking a hit as the tariff war between the giant US and Chinese economies is having a ripple effect on manufacturing worldwide.

Takeaway

In April, the IMF slashed its global forecast to the lowest point since the 2008 financial crisis.

Economists at the IMF see the U.S. economy decelerating to 2.3% this year, versus 2.9% in 2018, and to 1.9% in 2020.

A booming stock market is a wonderful thing. Yet, in my opinion, at some point these negative trends may be reflected in stock prices.

Photo Credit: Zooey via Flickr Creative Commons