Omega Healthcare Investors (OHI) released its quarterly earnings on Feb. 13, and Wall Street was noticeably underwhelmed.

The shares slid nearly 4% in after-hours trading.

I won’t be doing a detailed analysis of Omega’s tenant issues or of the broader skilled nursing REIT sector, which has been under pressure for three years now.

This is instead a “quick and dirty” look at some of Omega’s price and valuation trends.

REIT Pain

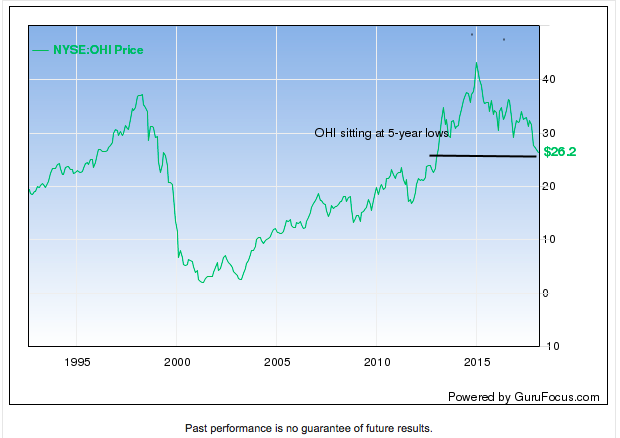

Even before yesterday’s after-hours action, OHI was trading near five-year low at a time when the broader stock market is just a few percent away from all-time highs.

In my opinion, not all of this underperformance is specific to OHI.

The REIT sector as a whole, in my view, has struggled to get any momentum over the past two years still sits below its old 2007 highs.

Yet, in my opinion, the carnage in Omega’s share price has been epic. OHI is down nearly 40% since its early 2015 highs.

Dividend Yield

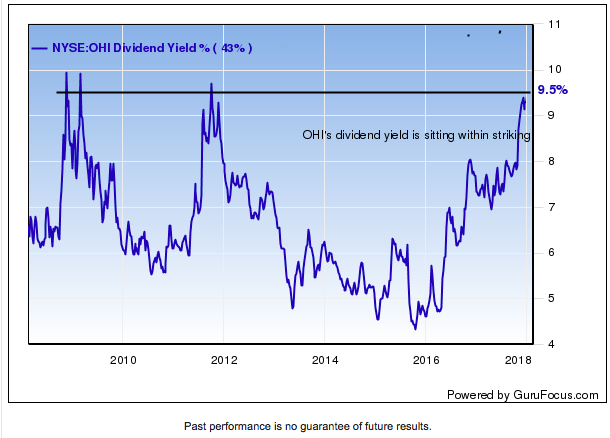

Today, as a result of that slide, OHI’s dividend yield is now approaching the crisis levels of the 2008 meltdown, yet OHI’s dividend payout continues to rise.

Omega has grown its dividend every year since 2003 and at a compound annual growth rate of nearly 10% over the past 10 years.

Omega reported quarterly funds from operations of $0.77, which covers the quarterly dividend of $0.66 by a sufficient margin.

So, unless we see significant and sustained deterioration to funds from operations (FFO), in my opinion, we can assume the dividend is safe, at least for now.

Takeaway

Though, given the issues facing some of Omega’s tenants, it’s something that needs to be watched closely.

Again, this is not a comprehensive report on Omega Healthcare Investors, but more of a gut check.

For now, I’m maintaining my view that OHI should continue to be bought on dips.

Disclosure: Long OHI

Photo Credit: Wonderland via Flickr Creative Commons