If President Trump is to be believed, the tax reform package being crafted in Washington will not impact 401 (k) plans.

There had been speculation that Congress would place a cap on annual tax-free retirement contributions to bankroll big tax cuts.

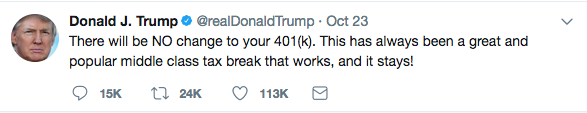

This week Trump suggested otherwise in a tweet:

Powerful Backers

There’s no denying that there’s a powerful constituency wanting to keep 401 (k) plans as they are.

Some 55 million Americans have $5 trillion-plus invested in the plans, according to the Investment Company Institute, a trade group representing mutual funds.

Some have called these retirement savings plans as the single best tax shelter out there for working Americans. As IB Asset Management portfolio manager Charles Sizemore has pointed out:

“The 401(k) plan is the only investment vehicle I’ve ever seen that offers instant, tax-free “returns” of 100%, via employer matching. And depending on what federal tax bracket you find yourself in, you can get instant “returns” of 10% to 39.6% due to the tax deferral.”

Takeaway

In my view, messing around with 401(k) is a political third rail for Congress, which passed legislation launching these plans back in 1978.

They’re a crucial part of the retirement savings equation. Especially since traditional pensions are a thing of the past and the future viability of the Social Security system is iffy.

Given the potential retirement savings gap facing the country, in my opinion, the Trump administration needs to move cautiously.

Photo Credit: Ken Teegardin via Flickr Creative Commons