The tech sector is living large.

It remains by far the most highly valued sector in the S&P 500 Index. Whether that’s a good thing or not is another matter.

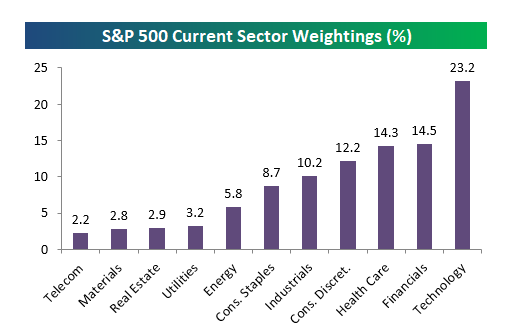

As of August 14, bellwether tech stocks represented about 23.15% of the S&P’s overall weighting.

The next closest are financials (14.52%) and healthcare (14.25%), according to an analysis by the Bespoke Investment Group.

At the other end of the spectrum are telecom (2.2%), materials (2.8%) and utilities (3.2%).

Half Trillion

That’s not a huge surprise given that Facebook (FB), Apple (APPL), Amazon (AMZN), Netflix (NFLX), Microsoft (MSFT) and Google (GOOGL) all have monster market valuations.

Together, these six stocks are valued at more than $2.5 trillion.

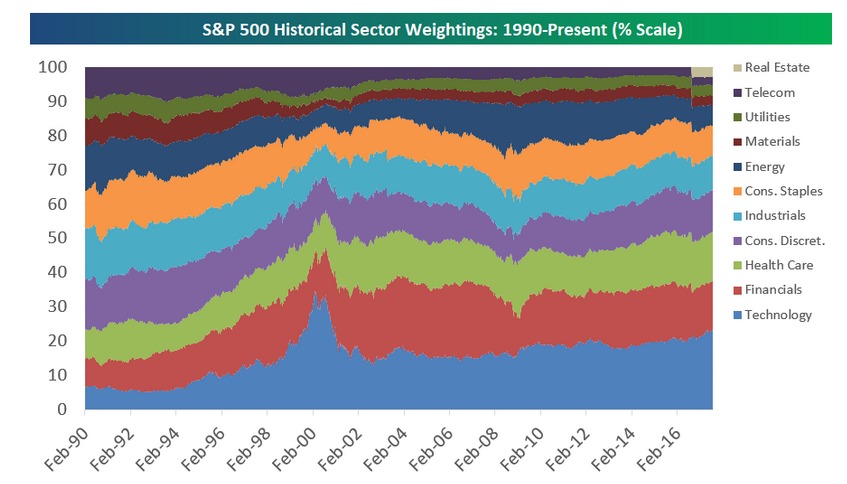

Trouble is, as Bespoke points out, the tech sector hasn’t been this big relative to the rest of the market since 1999 and 2000.

At the height of the dot.com bubble, tech stocks were about 30% of the S&P 500’s weighting.

Bespoke points out that in the early 1990s, the market was more evenly distributed.

In 1990, industrials was the largest sector of the market at 14.72%.

Takeaway

Tech investors have been on a joy ride in recent years.

That’s great, but having so much of the S&P 500 Index wrapped up in tech stock valuations could be risky, in my opinion.

It’s worth remember that financial stocks were princes of the realm from 2004 to 2006 during the last housing bubble.

The housing bubble went bust and we all know what happened next: a stock market meltdown and the Great Recession.