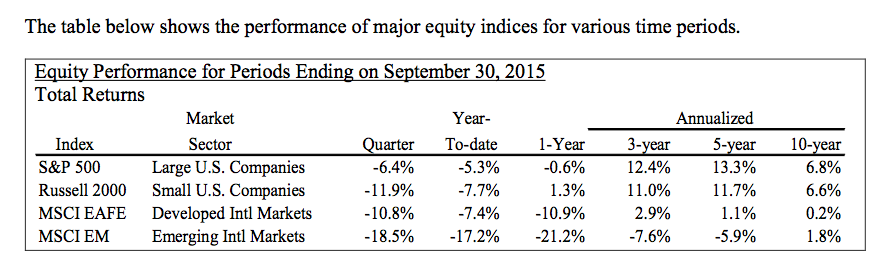

Virtually all major stock markets around the globe experienced a correction in the recently completed third quarter of 2015.

At the lowest level, large U.S. companies (measured by the S&P 500 Index) had fallen 12.4% from an all-time high in May.

The Correction

It was the first decline of more than 10% for the S&P 500 since the summer of 2011. Other market sectors suffered greater losses.

The Russell 2000 Index of small U.S. companies experienced a 16.4% correction.

The MSCI Emerging Markets Index reflected an 18.5% decline during the quarter, as concern over growth in the Chinese economy pulled down the entire sector.

Taking into account declines from the second quarter; it has fallen almost 30% from late April to its low point in August.

China Syndrome

Most market pundits attributed the global market correction to concern about a weakening Chinese economy.

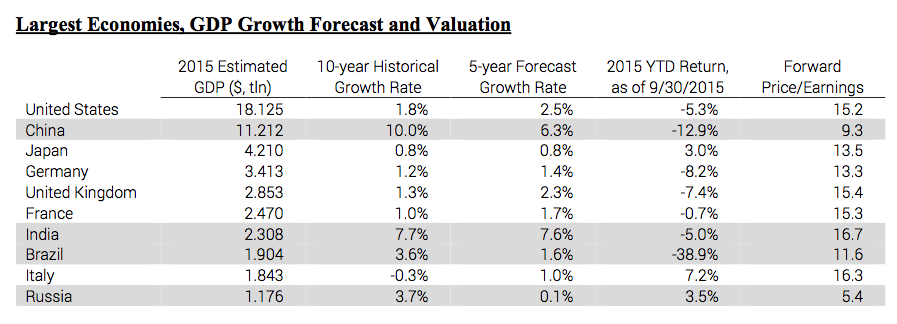

In recent months, estimates for 2015 growth in China, the world’s second largest economy, declined from 7.1% to 6.9%.

Despite the downward revision, China’s economy is still forecasted to grow at more than twice the rate of the world’s advanced economies.

In the following table we show 2015 estimated GDP for the ten largest economies and their historical and forecasted GDP growth rates.

Still Strong

For years the developed world has counted on China to drive global growth.

As China’s economy expands, it becomes a much bigger ship to steer.

Its growth remains strong relative to developed economies, but its rate of growth is likely to decline as its economy matures.

Advantage China

Of the ten largest world economies, the four from the emerging markets (highlighted in the table) have been the fastest growing over the past decade.

For example, ten years ago China’s GDP was smaller than that of Japan, Germany, and the United Kingdom, each.

Now China’s GDP exceeds that of those three economies combined.

And although the commodity-based economies of Brazil and Russia are forecasted to have slower growth over the next five years, China and India are expected to grow at rates substantially higher than the developed world.

Global Impact

Given the size of China’s economy, the downward revision in economic growth raised concerns that lower growth could lead to a global recession.

After all, China has been the greatest contributor to global growth since 2007, contributing $0.9 trillion to the increase in global GDP in 2014, compared to $0.6 trillion from the U.S. and $0.3 trillion from the U.K. Brazil, the only major economy currently in a recession, has already been hurt by lower Chinese demand for its commodity exports.

With Europe and Japan struggling to generate growth, a slowing China raises legitimate concerns.

Resurgent US

The U.S. economy has been one of the few global bright spots. U.S. GDP grew at a 3.9% rate in the second quarter and is forecast to show growth of 2.6% for the second half of 2015.

However, slower growth in China led to weakness in certain sectors of the U.S. stock market in the third quarter.

The Basic Materials and Energy sectors of the S&P 500 declined by 17.0% and 18.0%, respectively, as many companies felt the impact of weaker

Chinese demand and lower prices for most major commodities, including oil, coal, iron ore, aluminum, and copper.

Fed Guessing Game

With the stock market down and the September Federal Reserve meeting approaching, investors were hoping the Fed would provide confirmation that the U.S. economy was in good shape.

Instead, the Fed’s decision to keep interest rates unchanged along with its follow-up comments fueled fears that the global economy might be in trouble. In its press release, the Fed mentioned it considered economic and financial developments abroad in making its decision.

The Fed–whose statutory objectives are to foster maximum employment and price stability in the U.S.—appeared as though it was also supporting international economies with its low interest rate policy.

Market Doldrums

With the U.S. economy looking relatively strong, the concern over foreign economies caught many market observers by surprise.

The market reacted negatively falling 5.4% in the seven trading days following the press release.

With concern over global economic weakness, bonds strengthened in price during the quarter, especially for higher quality securities.

The yield on the benchmark 10-year Treasury bond decreased from 2.34% to 2.06%, and the Barclays Aggregate Bond Index—the broadest benchmark of the U.S. bond market—generated a 1.2% return for the second quarter.

Portfolio Strategy

We continue to believe long-term interest rates are likely to increase over time, which will have a negative impact on longer-term fixed income investments.

Consequently, the fixed income portion of our managed portfolios are primarily invested in short duration securities.

The generally accepted definition of a stock market correction is a decline in market value between 10% and 20%. Declines greater than 20% are referred to as bear markets.

The word correction implies that stocks were not correctly priced previously, but after the decline are more appropriately valued.

Better Valuations

We believe this characterization applies to the current U.S. stock market; stocks appear to be more reasonably valued than they were three months ago.

U.S. stocks at the end of last quarter were trading at valuations about 10% above historical averages; they are now closer to historic norms.

As always, we believe it is virtually impossible to predict the short-term direction of the stock market. That said, we feel that there is a low probability for a U.S. or global recession over the next year, despite recent concerns over slowing growth in China.

In the absence of such a recession, we think stocks are likely to recover from the current correction.

We believe U.S. stocks are more attractively valued than several months ago, but we do not consider them to be significantly undervalued.

Emerging Opportunities

Additionally, we regard most emerging markets as undervalued with excellent long-term return potential.

As a sector, emerging markets have lower P/E valuations and higher forecasted growth rates than developed markets.

Speculative Froth

While market corrections are uncomfortable for most people, they do offer some benefits for long-term investors.

They provide buying opportunities at attractive prices for securities that have declined in value.

In addition, corrections usually cause a reduction in speculative behavior which makes for a more rational market.

While some corrections become bear markets, most begin to recover before falling to the 20% bear market threshold, and most are short in duration.

Photo Credit: Dave Center via Flickr Creative Commons