The uncertainty over when the US Federal Reserve will raise interest rates continues to linger in the markets.

Though the Fed took a pass at its most recent policy board meeting, speculation is still running high the central bank will act later in the year.

What does this mean for your portfolio?

Investing Implications

If you are a long-term investor with a well-diversified portfolio and clear objectives, probably not much at all.

If you are thinking more short-term, here are some things to consider.

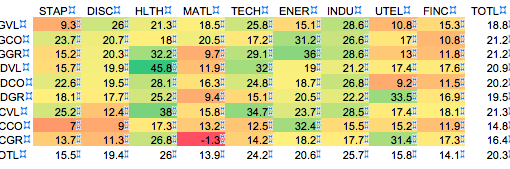

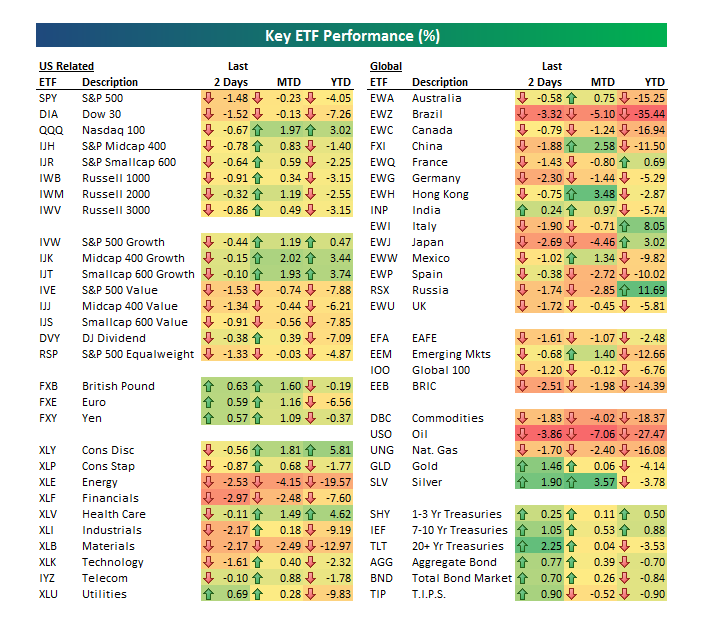

Bespoke Investment Groups has put together a handy chart looking at the performance of ETFs by asset class for the two days following the Fed decision — as well as offering month and year-to-date readings through September 18.

Bullish on Bonds

Treasury ETFs all trended up after the Fed decision to hold steady.

As Bespoke analysts noted:

“Treasury ETFs have been the main winners since the Fed held rates unchanged, with the 20+ Year Treasury ETF (TLT) up 2.25% since Wednesday’s close. Gold (GLD) and silver (SLV) are up nicely as well.”

Bank Stocks

That’s a reflection of the market consensus that, though US interest rates are heading up, the Fed will probably move very slowly.

Therefore, the odds of the bond market getting creamed are viewed as low, or so the thinking goes.

On the flip side, none of this changes the fact that rates are heading up.

That’s why some portfolio managers are accumulating bank stocks, which tend to see their profit margins increase when interest rates trend up.

Buffett’s Bullish

As long as interest rates don’t go up too high, too fast, banks may benefit simultaneously from a stronger economy and higher interest rates.

After strong gains early in 2015, the KBW Bank Index of large commercial-bank stocks took a beating in August amid the broader market downturn.

So there may be bargains if you think the profit recovery at major global banks will continue.

One such bank bull is none other than Warren Buffett.

Berkshire Hathaway (BRK-A) announced in a recent regulatory filing that it has added significantly to its holdings of Wells Fargo (WFC) and US Bancorp (USB).

Emerging Markets

The Fed’s inaction may be a short-term plus for emerging market ETFs.

Had the Fed nudged up rates, the US dollar would have appreciated against emerging market currencies, a negative for stocks generally in those parts of the world.

However, unless China comes storming back, it’s hard to see a robust outlook for most emerging markets any time soon.

Takeaway

For most long-term investors, the Fed’s latest rate decision isn’t a huge factor in their thinking.

Short-term, the decision is probably good for Treasury ETFs, for the Fed is clearly moving cautiously.

Bank stocks are likely to benefit when the Fed does finally move.

Emerging markets, meanwhile, will be more influenced by China than Janet Yellen & Company.

Photo Credit: Day Donaldson via Flickr Creative Commons

The investments discussed are held in client accounts as of September 21, 2015. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.