Author: Michael Arold

Author: Michael Arold

Covestor model: Technical Swing

Disclosures: None

Traders usually like trending markets with smooth pullbacks for buying opportunities. A ” perfect” textbook-like market (which probably doesn’t exist) would offer declines in the area of 30 – 50% of the original up move. So if stocks would rally 10%, they would decline maybe 3%.

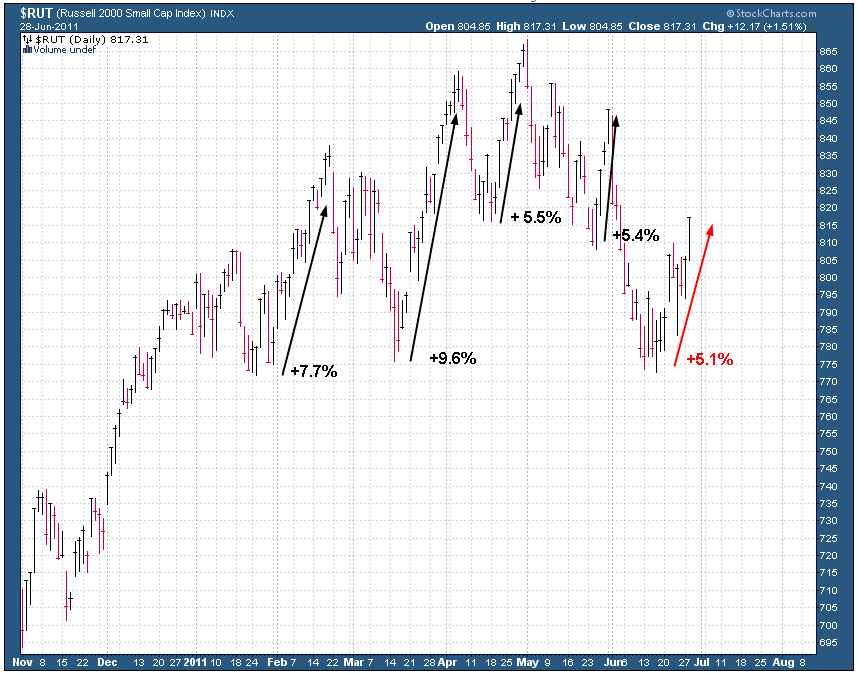

Unfortunately, the current market environment is different and investors need to adjust their short-term trading styles to this “hit-and-run environment”. Basically, there are no shallow pullbacks. You are either in or not. Take a look at the recent runs of the Russell 2000:

The Russell rallied between five and 10 percent in 2011. No base building, no textbook-like reversal candle. Note that the latest run is getting into the “danger zone” where we would expect a leg down if the pattern we have seen this year holds.

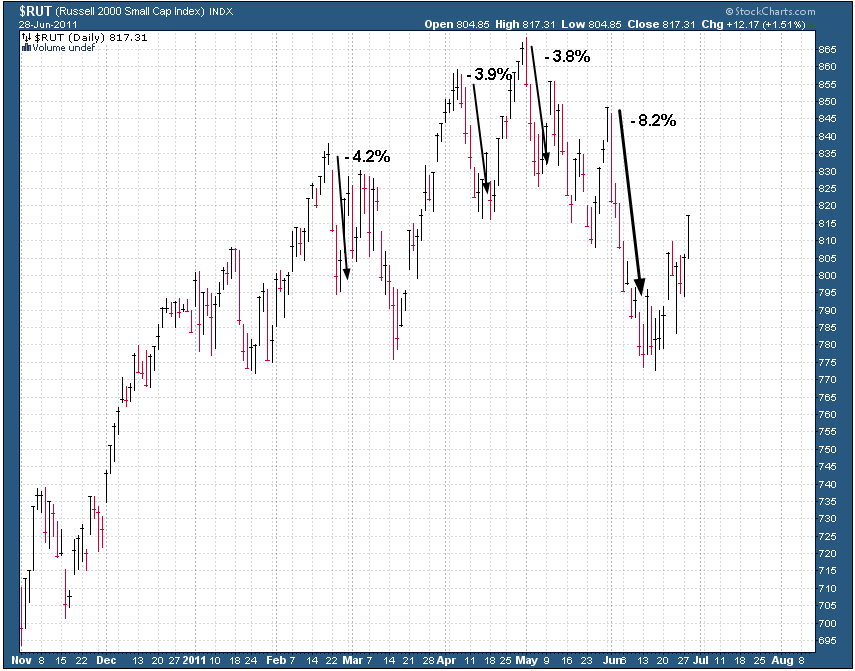

The down-legs have been of the magnitude of four to eight percent:

Trading this environment profitably is extremely difficult and requires you

- Go more or less “all in” after strong down moves and quickly close positions (or even go short) after (or better during) the up-leg

- Not chase stocks if they get away from you

- Look at 30-min charts because it is easier to spot reversals intraday

- Maybe even don’t trade. The choppiness can wipe you out. There will be an easier environment in the future. I promise.

Sources:

Charts from StockCharts.com, as of 6/28.