A few years ago, gold bugs argued the precious metal was a can’t-miss investment given the ultra-loose monetary policies around the world and the prospect of higher inflation.

And gold prices did have a good ride through much of 2012 and 2013.

No more it seems.

The price of gold has just tumbled to a five-year low as investors brace for higher interest rates in the US

Precious No More

Gold has lost favor.

Why buy gold, the ultimate protection against purchasing power risk, when inflation is tame in the US, Europe and Asia?

On that top of that, the prospect of rising US interest rates has also hurt demand for bullion.

As an asset class, gold doesn’t earn interest or pay dividends and will struggle to compete with assets which do.

On July 20, the SPDR Gold Trust EFT (GLD) fell to its lowest point since the financial crisis in September of 2008.

China Syndrome

Gold has also come under pressure after recent media reports the Chinese are selling aggressively.

In fact, the economic slowdown in China and recent stock market rout have hurt commodities across the board.

The world’s second biggest economy is growing at its slowest pace since 1990.

That’s bad news given that China is the No. 1 global consumer of energy, metals and grains.

Epic Selloff

No surprise, then, that the Bloomberg Commodities Index, which tracks 22 raw materials including oil, wheat, cotton, coffee and gold, has fallen to a 13-year low.

That’s weaker than after the banking meltdown of 2008 and the euro-zone crisis of 2012.

Lousy Returns

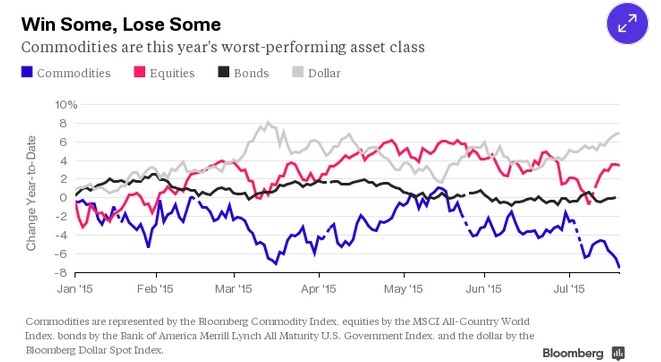

Commodities are also the poorest-performing asset class this year through July 20.

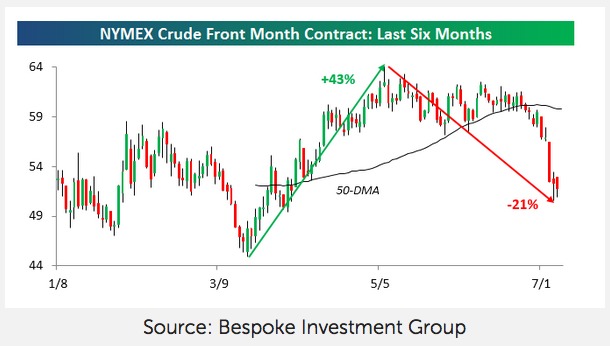

It also looks like the recent rally in crude oil prices is finished for now.

Bear Market

Crude oil entered into a bear market after it fell more than 20% from early May.

Takeaway

These are tough times for gold bugs and investors long on commodities.

The Chinese economic slowdown and the prospect of rising interest rates in the US have delivered a double-whammy to commodity prices.

Gold bulls are beating a fast retreat in the face of relentless selling.

Photo credit: Bullion Vault via Flickr Creative Commons

The investments discussed are held in client accounts as of July 21, 2015. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.