“Never think that lack of variability is stability. Don’t confuse lack of volatility with stability, ever.” — Nassim Nicholas Taleb

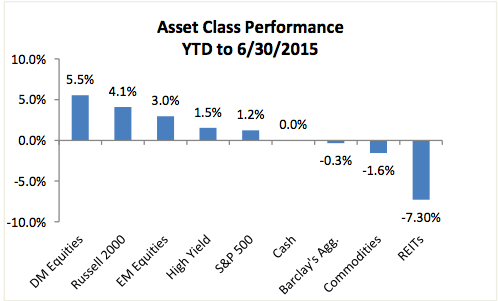

Equity markets zigged and zagged during the second quarter, with non-US developed markets up nearly 12% at one point in mid-May, but falling back to earth in the last half of the second quarter, finishing the first half of the year up 5.5% (MSCI EAFE).

US markets, as measured by the S&P 500, ranged more narrowly, between -3.0% and 4.1%, and ending the six months up 1.2% and 0.3% for the quarter.

Bonds lost value, dropping 1.9% for the quarter, and down 0.3% for the year. Volatility returned to the markets at the very end of June as the VIX index increased to its highest levels (18.5) since the first week of February.

US Lags

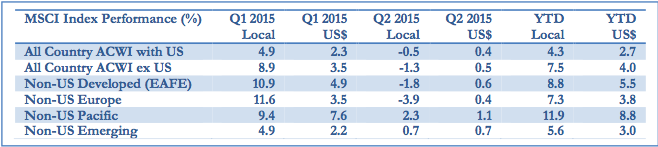

For the first six-month period since 2012, non-US developed markets outperformed US equity markets.

The S&P 500 companies were impacted by a strong dollar and lower commodities prices which offset the strengthening US economy.

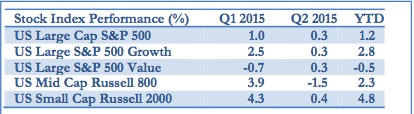

Small cap stocks outperformed, returning 4.8% during the first half, after significantly underperforming large caps in 2014, according to my research.

Europe and Japan

Non-US markets, as measured by MSCI All Country ex-US Index, returned 4.0% for the half year and 0.5% for the quarter ended June 30.

During the first half of the year, developed markets (5.5%) outperformed emerging markets (3.0%) with Europe and Japan benefitting from quantitative easing and emerging markets seeing signs of stabilization, according to my research.

Interest rate sensitive assets such as fixed income, REITs and MLPs suffered at the hands of higher and more volatile interest rates as the US economy showed signs of finally picking up from anemic growth.

US Jobs Growth

The latest economic data shows a big second-quarter rebound in the US economy with strong retail sales and employment growth, consistent with annualized GDP growth of around 3.0%.

Auto sales, housing starts, manufacturing growth, consumer sentiment and job creation all increased recently.

The drop in the unemployment rate to 5.3% in June combined with May’s inflation increase of 0.4% (the highest in two years) and the positive impact of the last year’s low oil price helps make the case that the growth in the economy can withstand a modest adjustment in interest rates.

US Equities

US stocks were flat (0.1%) for the quarter and up modestly (2.0%) for the year, as measured by the All- Cap Russell 3000 index.

Smaller cap stocks outperformed large caps for the half year despite a 4% drop in the last two days of June.

Large growth (high price to book) stocks continued to outperform large value-oriented stocks (low price to book) by 3.3% for the half year.

Mid-cap stocks lost ground in the second quarter but are still ahead of large cap for the year by 1.1%.

Sector Returns

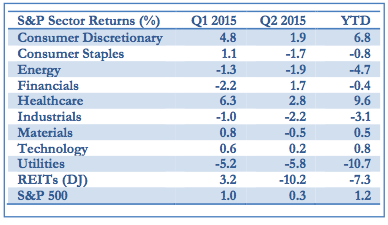

The major sectors of the US economy had disparate returns year to date, with the healthcare and consumer discretionary sectors recording impressive results while utilities fell nearly 11% through June 30.

We can look at the impact of consolidation and M&A activity in the healthcare marketplace and improving consumer sentiment as the main drivers of positive performance, while rising interest rates and fluctuating oil prices hurt utilities and energy.

The price of oil (West Texas) went from $53.45 per barrel at year end to $47.72 on March 31, and $58.34 on June 30, an increase of 9% for the year to date and of 22% for the quarter.

The materials and technology sectors were also modestly positive.

REITs Tumble

REITs (Commercial Real Estate) lost all their first quarter gains and more, dropping 10.2% in the second quarter and off 7.2% for the year, according to my research.

REITs over the long term tend to do well as the economy and job outlooks improve and demand for commercial office space increases, leading to stronger cash flow from increased occupancy and higher rental income.

Over the short term, REITs are highly sensitive to interest rate changes. In addition, with interest rates low, investors seeking higher yield look to REITs to provide more income than a traditional bond.

Foreign Stocks

Despite a sharp sell-off in Chinese A shares in June and July (off 33% from the peak on June 8), foreign equities were modestly positive in dollar terms in the second quarter.

European economic optimism, fueled by monetary expansion, a weaker Euro and lower oil prices, shook off the possibility of a Greek exit from the Eurozone.

Pacific markets also rode monetary growth in Japan to deliver positive quarter returns.

Foreign Bonds

Higher bond yields in Europe and the UK, improvement in the European economy, and weaker-than-expected first quarter growth in the US (due to the harsh winter and LA dock strike) caused the dollar to ease back from early March highs.

Even so, foreign markets in local terms outperformed foreign markets in dollar terms for the year.

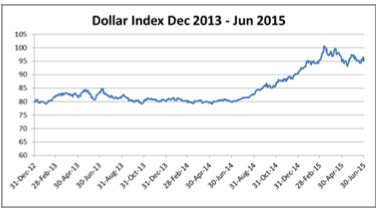

FX Trends

The rush towards a stronger dollar that began in June 2014, despite a short term setback, appears poised to continue over the next few quarters.

The factors leading to the strong dollar remain policy related; the Fed has discontinued its quantitative easing program while Europe and Japan have maintained their expansion programs, leading to an increased demand for dollar denominated assets.

Interest Rates

Regional interest rate differentials also play a major role and US interest rates are higher than in most developed markets.

These interest rate differentials should move towards parity, but until they do, expect the carry trade (investors sell low interest rate currencies and buy high interest rate currencies) to increase the demand for dollars from overseas currencies.

Regionally, as the US economy gains strength, the European economy is moving sluggishly forward, albeit with high structural unemployment, particularly in the peripheral economies.

Europe

Europeans have some reason for hope. Low oil prices, weaker currencies and excess capacity should lead to an increase in exports and more competitively priced goods and services.

And as we noted above, the ECB is flooding the markets with free money. All of this stimulus should provide leverage for European companies to increase production.

Japan, too has benefited from monetary stimulus, falling oil and commodity prices and aggressive fiscal policy, leading Pacific equity markets higher for the year.

Japan annualized GDP growth was 3.9% (March), much stronger than in the previous three quarters and Japanese equities were up 13.6% year- to-date, according to my research.

Emerging Markets

While overall emerging markets equities returned 3.0% during the first half, there were major regional differences.

For example, Asian emerging countries (China, India, Philippines, etc.) grew more than 5% (China alone was up about 13% for the year through June 30, despite the 33% drop in value since June 8).

Latin American countries, meanwhile, were more dependent upon commodities and those linked to the dollar, such as Brazil, were sharply negative (off 6.4%) during the first half.

Eastern Europe (Russia, Hungary, etc.) returned 17% as the Ukraine and oil crisis in Russia dissipated during the first half.

Domestic Fixed Income

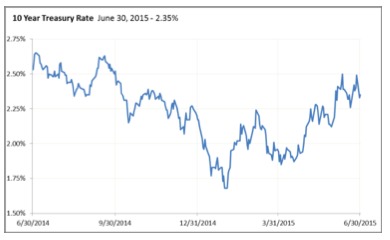

With the US economy finally beginning to show signs of stronger growth, interest rates rose in anticipation, depressing bond markets in the second quarter.

The very low interest rate environment magnified market reaction to changing economic news and differing monetary policies.

We have also seen a resurgence in interest rate volatility, leading to a rocky start in 2015 for interest-rate sensitive investments such as longer duration fixed income instruments.

The longest duration US Treasury securities, which were up nearly 10% at the end of January, ended the six months down 8% for the year, an 18% drop in five months.

The core US Aggregate Bond Index is essentially unchanged for the year at -0.1%, but was down 1.7% for the quarter.

Almost Zero

Short-term interest rates are near zero while the 10 year Treasury rate dropped from 2.2% to 1.7%, recovered to 2.2%, dropped back to 1.8% and finally rebounded to 2.4% at the end of the June.

This volatility in interest rates has translated to disparate performance.

Fixed income instruments with longer duration were badly hurt in the last five months while shorter maturity bonds held up better with less volatility.

Fed Policy

Market sentiment is solidly in the camp of a Federal Reserve policy decision to raise the Federal Funds target rate from 0.25% to 0.50%.

The consensus view is that the Federal Reserve will raise its baseline lending rate, to 0.50% beginning in September with a likely second increase in December to 1.0%.

If so, this will mark the first rise in the Fed Funds rates since May 2006 and the first time the Fed Funds rate has been higher than 0.25% since October 2008.

Rate Hikes

The Fed has been pretty transparent about its goals to raise rates over the next few years until the real rate of interest is equal to the target inflation rate of 2.0% (probably by the end of 2016).

We expect that the Fed will raise rates in increments of 25 basis point (0.25%) at every other meeting beginning in 2015, pause briefly in order to gauge the effect of the new policy, and then move to increase to the real zero rate slowly thereafter.

The direction of longer term interest rates, which are controlled by market forces, is uncertain. Many experts foresee longer-term interest rates increasing due to the US economic growth described above.

Growth Trends

Capital Economics, a highly regarded trade newsletter, foresees ten year rates increasing to 3.0% by the end of 2015 and 3.5% by the end of 2016.

Other experts are less sanguine and expect that rates will remain level for the year as weaker overseas growth, the strong dollar and other headwinds limit US growth potential.

Option pricing of credit spreads tightened against the backdrop of a rise in interest rates and high yield has returned nearly 2% for the year.

The tightening of credit spreads helps lower-rated fixed income instruments and boosts return.

Some experts forecast a rapid move out of high-yield fixed income as fears of a bond increase drive speculative yield-hungry investors into less risky assets.

Global Bonds

Overseas fixed income performance was also generally negative, with low but rising interest rates in the second quarter.

The Eurozone 10 year yield rose 80 basis points (0.80%) to 1.6% for the quarter while the Japanese Government Bond 10 year yield rose from 0.4% to 0.5%.

Both the European Central Bank and the Bank of Japan continued their quantitative easing programs as real growth in the regions remains muted but with positive signs towards growth.

The Chinese Government, trying to stem a fall in equity markets and amidst slowing growth, dropped the Chinese official lending rate to 4.85%, a record low.

Greece

Finally, a word about Greece. At this writing, voters in Greece have rejected the austerity terms of its European lenders.

Unless the European politicians give Greece a break, we now expect that a Greek exit from the European Union and a restructuring of Greek debt, including the potential of default.

While the market has priced in a Greek exit, the crisis that will result in Europe will likely lower growth expectations, which I believe will potentially lead to a run to safety, perhaps into US Treasuries.

Longer term, the political decisions made with regard to Greece are important indicators of how the European Union will work with other debtor members including Spain and Portugal.

Rate Spreads

Finally, interest rates do not move in a vacuum. The disparity between foreign and US interest rate direction and policy is mirrored by the direction of the US dollar.

We believe that the policy differences between the US, which is increasing rates with a growing economy, and Europe and Japan, who are stimulating monetary policy, will result in a multi-year strengthening dollar and will act as a ceiling to US interest rate increases.

Macro View

Our views on equity markets and the global economy have not changed dramatically in the last quarter.

We expect that the strong dollar will continue, but at a much decelerated rate than we have observed in the last nine months.

We have seen some pullback, as expected, but there is little

reason to believe that the dollar trend will change without some exogenous shock to markets.

Energy

Oil production has very recently picked up from very low production levels earlier in the second quarter.

So while we think that most of the oil price drop has occurred, we expect that oil prices will stay in the current trading range, with price increases later in the year as the world moves to a new equilibrium price closer to the $100 range of the last three years than the $50 range of the last six months.

Energy dependent countries will see marginal growth and energy suppliers will suffer.

Valuations

While US equity valuations are higher than at the end of 2014 and higher than their 20 year averages, they don’t appear to be irrationally high, particularly for small cap, technology and growth oriented equities.

On the positive side, corporate earnings remain at record levels and while earnings growth has slowed somewhat, we expect profit margins to stay high.

The strong dollar and weak oil price are a mixed bag; consumer sentiment has improved markedly, labor gains have remained consistent with unemployment falling to 5.3%.

On the other side, valuations are high and therefore going forward, the potential rewards for equity ownership are likely to be muted in my opinion.

Global economic weakness and the strong dollar will be harmful to US corporations increasingly dependent upon foreign sources of revenue.

Strong Dollar

The current valuations of non-US developed equity markets are lower than both their 10 year averages and the current US market and thus attractive to the value investor.

Exposure to these foreign equities may well benefit from these attractive relative valuations, but a stronger dollar will create headwinds for the US investor.

On the other hand, non-US emerging markets valuations, while attractive relative to the US, are near their 10 year averages. We expect to continue to increase our non-US markets exposure over the next few trading cycles.

Credit bonds

We continue to like credit bonds over treasuries, not convinced that widening credit spreads will be the case for the rest of 2015.

Our overseas fixed income holdings are currency hedged and of longer duration, so they were doubly hit in June, although we expect that trend to change in the latter half of the year.

Nevertheless, we expect to reduce our non-US fixed income exposures into US-centric investments at some point in the next quarter.

Last quarter, we felt that rates would increase from low levels for the remainder of the year.

We were somewhat surprised by the rapidity of the increase in rates during the quarter, but we expect rates to remain in a fairly stable trading range of between 2.2% and 2.7% for the remainder of the year.

I believe low foreign fixed income rates will act as a ceiling on US rates, but US economic growth and wage increases will lead the Fed to raise short term rates in the third quarter.

Summary

The large differences in return among assets so far this year should not only remind investors of the importance of time horizon but also of the need for balance and diversification.

Thus far this year, exposure to foreign assets has benefited the global investor, despite the strong dollar.

Developed market equities outperformed emerging market and US large cap stocks. Small, mid-cap and US growth stocks have also performed well.

China

Low oil prices and high corporate earnings have helped the economy grow with little inflation, declining unemployment and low interest rates.

Europe and Japan appear to be enjoying stronger economic growth, while China is somewhat stagnant.

The benefits of diversification of global assets remain in place, seeking to help to reduce investment risk with more certainty of outcome, and better risk-adjusted returns.

Photo Credit: NASA Goddard Space Flight Center via Flickr Creative Commons