Since mid-September, U.S. stock markets have turned volatile. And when markets get choppy, it’s easy to let your emotions get in the way of rational decision-making and hit the panic button.

Staying focused on the long game of investing takes perspective, analytical detachment and a little self-awareness of how humans react to risk and uncertainty.

Here are four key things to keep in mind.

1) Pullbacks are normal

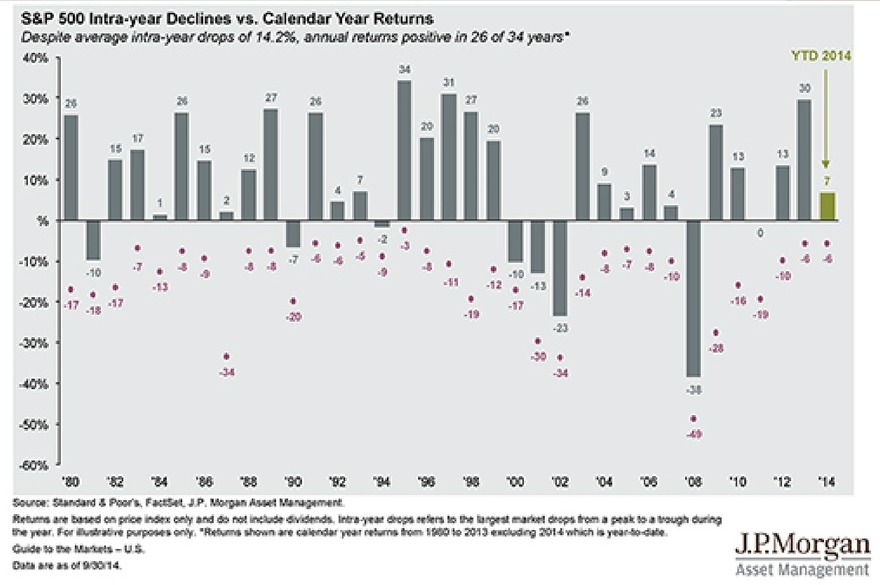

Selling waves that take benchmark indices down 5% to 10% are a natural part of financial market rhythms. The following chart from shows how downturns rarely do permanent damage to stock prices and returns.

If you go back to 1980, the U.S. stock market has experienced average declines of 14.2% but delivered positive returns in 26 of those 34 years.

2) Market timing trap

When markets ricochet back and forth, it’s tempting to try to trade in and out of the market. Don’t. It rarely works.

In most cases, it is far better to stay in the market and ride out the storm. In turbulent times, market rallies can be just as sharp as selloffs.

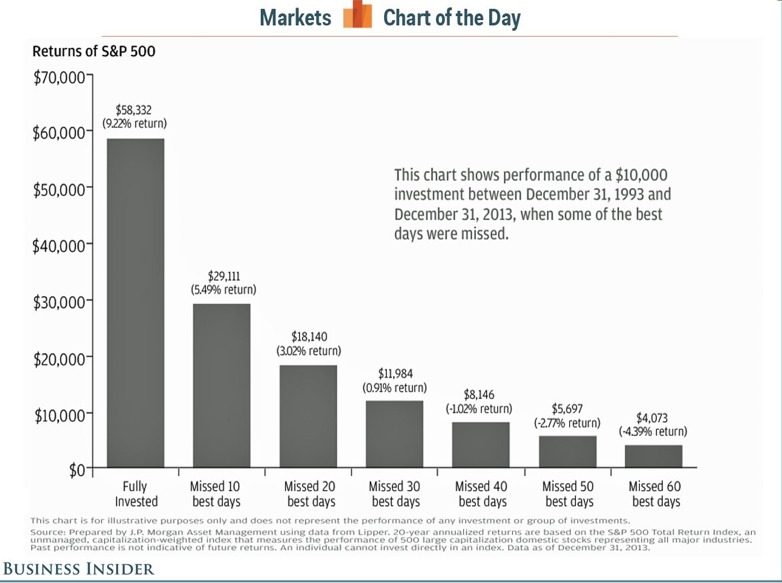

One study reveals that investors who stayed fully invested in the S&P 500 Index from 1993 to 2013, would’ve enjoyed an annualized return of 9.2%.

However, if trading resulted in missing just the ten best days during that same period, those annualized returns would shrink to 5.4%.

3) Buy and hold

In a recent commentary, Covestor manager Henry Ma, who oversees the Dynamic Factor portfolio on the Covestor platform, points to data showing that the average equity mutual fund investor lagged S&P 500 Index by a large margin over various investment horizons.

If an investor had bought an S&P 500 index fund over the last 20 years, he or she would have earned 4.2% more annually than the typical equity mutual fund over the same time frame.

The reason? In Ma’s opinion, investors too often exhibit a tendency to buy stocks after markets had risen, then sell stocks when markets had fallen.

To be sure, in some cases selling is a rational move if the market really experiences a major downturn, especially if an investor faces short-term cash needs like college tuition or is nearing retirement.

“Once in a while, the markets may experience major downturns. The inherent difficulty of following buy-and-bold is the uncertainties on how deep the losses will be and how long it will take to recover during those downturns. The downturns in the US history were normally steep and it took a long time to recover.”

4) Fight or Flight

Humans are evolutionarily wired with a fight or flight response. In investing terms, the (flight) response can manifest itself in selling declining stocks too prematurely when times get tough.

History shows that in most cases that may not be warranted.

The trick is recognizing human instincts for what they are and developing a cool detachment when it comes to contemplating shifting your strategy when markets get rocky.

Photo credit: Catherine MacBride via Flickr Creative Commons

Disclaimer: All investments involve risk and various investment strategies will not always be profitable. Neither the information nor any opinions expressed constitutes investment advice and is not intended as an endorsement of any specific portfolio manager. Past performance does not guarantee future results.