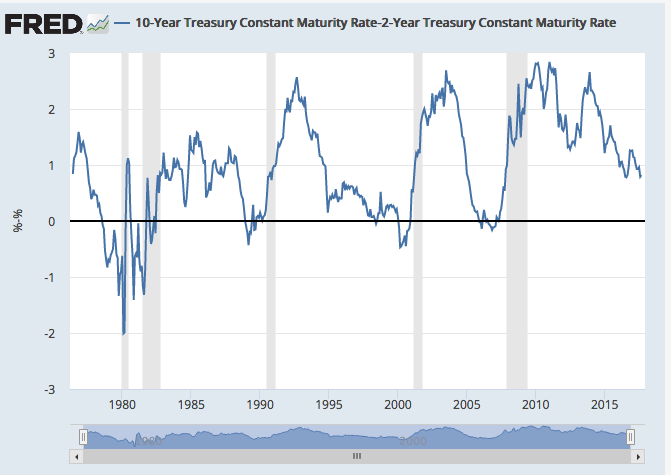

The yield curve is flattening, so they say.

That’s worth watching because an inverted yield curve, in which short-term rates yield more than long-term rates, can be a warning sign that a recession is looming.

That was the case in 2000 and 2006. But in my opinion, it isn’t as flat as you would think.

Long View

Going back to 1976, the spread between the 10-year and 2-year Treasury bond yields has averaged 0.9696%, with a standard deviation of 0.93%.

Or more easily put, the 10-2 year spread, has a one standard deviation move with the range of 0.03% and 1.89%. The spread is currently 0.83%.

Certainly, that’s much closer to the average than the low end of the range.

In my view, the yield curve is a long way from signaling recession.

Economic Outlook

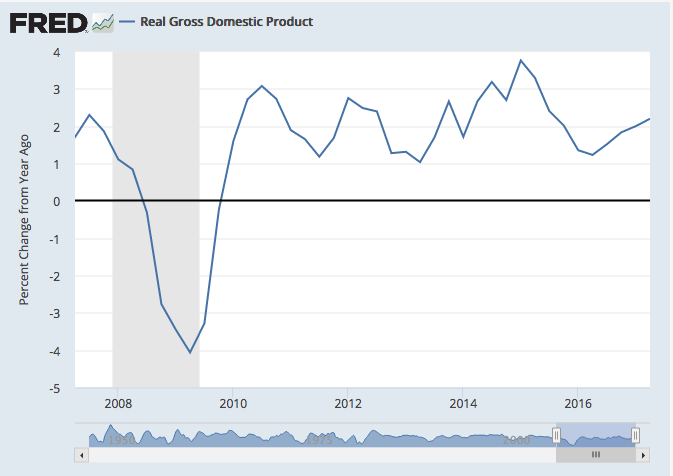

The US economy has been trending nicely higher since bottoming in the second quarter of 2016.

GDPNow, an economic forecast calculated by the Atlanta Fed, shows the US economy tracking at 2.2 percent growth for the third quarter.

Given all the economic upheaval in hurricane-hit Texas and Florida, that doesn’t seem all that bad in my view.

Fed Lifting Rates

Inflation remains low and that’s the primary reason for the flattening curve in my opinion.

The Federal Reserve, meanwhile, seems intent on raising rates in 2017.

Because the Fed is lifting the front-end of the curve, and low inflation rates are keeping the long-end down, it is causing the flattening.

Relax

In my opinion, the flattening happening now is not because the long-end is coming down to the short end of the curve.

I think this is happening because the short-end is rising to the long-end.

In my view, investors can continue to expect inflation to remain low, and rates to remain low by historical averages.

I think this is a trend that is likely not changing anytime soon. The economy is doing just fine in my opinion.

Photo Credit: Pictures of Money via Flickr Creative Commons