For the bears, 2013 can’t end soon enough. Stocks continue to grind higher despite the long-awaited Federal Reserve tapering announcement, with the S&P 500 climbing to fresh records.

The conventional wisdom was that the Fed scaling back its economic stimulus would be bearish for stocks. However, the conventional wisdom on Wall Street is often wrong, and the latest rally in the wake of the Fed announcement last week also reflects the central bank’s nuanced message.

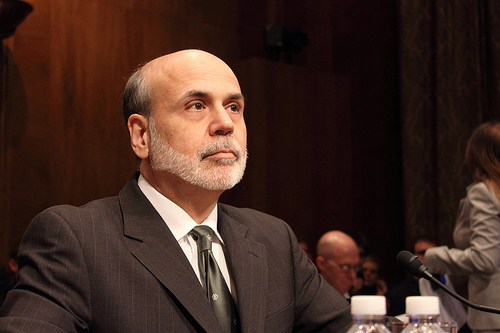

Yes, the Fed did say it would reduce its monthly bond purchases to $75 billion from $85 billion. But outgoing Fed chairman Ben Bernanke added the central bank would keep interest rates low even if unemployment and inflation data hit its targets. In particular, inflation is running well below the Fed’s 2% target despite unprecedented quantitative easing programs after the financial crisis. Janet Yellen, who is expected to replace Bernanke as Fed chief, voted in favor of last week’s decision.

S&P 500

“If things get worse in the economy, the Fed could increase its bond buying,” said Eric Steiman, who manages the Undervalued Opportunities portfolio on Covestor. Indeed, Bernanke last week said the Fed’s next steps will depend on the data. According to a Bloomberg News report:

“If we’re making progress in terms of inflation and continued job gains, then I imagine we’ll continue to do, probably at each meeting, a measured reduction” in purchases. If the economy slows, the Fed could “skip a meeting or two,” and if the economy accelerates it could taper a “bit faster,” Bernanke said.

“The key takeaway is that if the economic data continues to improve, that potentially accelerates Fed tapering. If the data deteriorates, then it will stop tapering or maybe even buy back more bonds,” Steiman said.

“The bottom line is that the Fed is saying it will be there, no matter what,” the portfolio manager added. “That’s a huge cushion for the market. It’s bullish in the sense that the Fed appears to be saying it will unwind the stimulus as strategically as possible. The protection is there for the market, and it’s very bullish for stocks.”

Jim Rickards, senior managing partner at Tangent Capital, had a similar takeaway when he spoke with Yahoo Finance’s Daily Ticker last week:

“We didn’t get a pure tapering, we got two messages: one is they’re going to begin tapering in modest amounts and the other was that they’ve made it very clear that they’re not going to raise interest rates for a very long time,” Rickards said. “What the Fed is saying is ‘Don’t worry we’ve got your back, you can borrow money for as long as you want,’ and that’s what the stock market wanted.”

Michael Arold, who manages the Technical Swing portfolio on the Covestor platform, is also bullish on U.S. stocks heading into 2014 after a roughly 30% rally for the S&P 500 this year.

“This is a great environment for stocks with very low interest rates, and the Fed is signalling that rates will remain low for the foreseeable future,” Arold said. “We also have relatively low growth so inflation shouldn’t be a concern. Stocks usually do well in low-rate and low-growth environments.”

So the U.S. stock market has taken the Fed tapering announcement in stride so far, an encouraging sign for the bulls after a big rally in 2013 without a major correction. Yet investors may be getting too complacent, and volatility could pick up in early 2014 as Washington braces for another fight over the debt ceiling.

Photo Credit: Medill DC

Disclaimer: The information in this material is not intended to be personalized financial advice and should not be solely relied on for making financial decisions. All investments involve risk and various investment strategies will not always be profitable. Past performance does not guarantee future results.