Senior bank loans have been one of 2013’s hottest asset classes with income-starved investors seeking extra yield along with some protection from the impact of rising interest rates.

“Investors are hungry for yield. For example, baby boomers who wanted growth and capital appreciation ten years ago are now buying income as they approach retirement,” says Charles Sizemore, founder and chief investment officer of Sizemore Capital Management LLC.

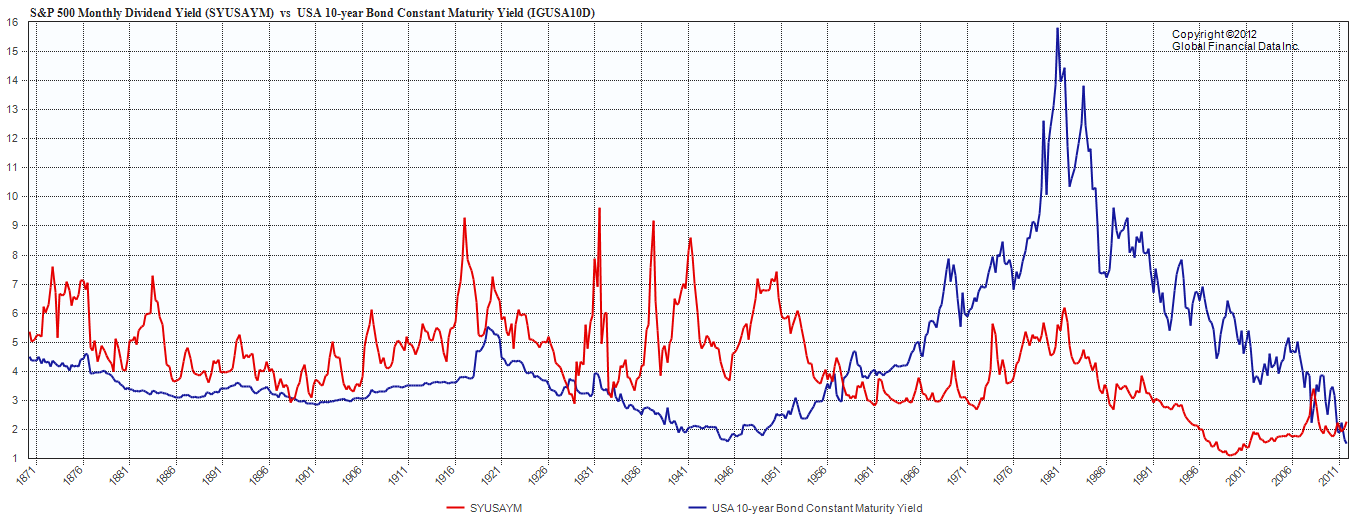

“Interest rates are still very low and investors need yields of more than 2%. This creates demand for funds that invest in bank loans. A decade ago there wouldn’t have been demand because bond yields were so much higher, but now investors are looking further afield for yield,” said Sizemore, who manages the Dividend Growth portfolio on Covestor.

Banks typically issue senior loans to companies that are leveraged or rated below investment grade. The higher yields are designed to compensate investors for the risks, including potential defaults. The companies can be distressed, or financing a leveraged buyout, acquisition or merger.

Aside from higher yields, some investors like bank loans because they provide some shelter from rising interest rates since they are floating-rate securities. Bank loans have a duration near zero, and are secured by collateral such as the assets owned by the borrowing companies. Bonds with longer durations are hurt more when rates rise.

PowerShares Senior Loan Portfolio (BKLN) has delivered a total return of 3.1% this year with dividends, and weathered the move higher in interest rates that has punished many bond funds.

The main risk for bank loans would be a major slowdown in the U.S. economy, which could trigger defaults.

BKLN tracks the S&P/LSTA U.S. Leveraged Loan 100 Index, which fell sharply with most other financial assets during the credit crisis. The index dropped 28.2% in 2008 then rallied 52.2% the following year.

Other ETFs for the asset class include SPDR Blackstone/GSO Senior Loan (SRLN), Highland/iBoxx Senior Loan ETF (SNLN) and First Trust Senior Loan (FTSL).

BKLN is paying a 30-day SEC yield of 4.14%. The fund is the largest ETF for the sector and has grown rapidly this year to nearly $6 billion of assets.

In fact, there are signs that some investors are rotating out of high-yield corporate bonds and into bank loans on expectations interest rates will rise further. As of mid-September, bank loan funds had gathered $49 billion for 2013, which is more than flowed into them in the past eight years combined, according to Lipper. Meanwhile, U.S. high-yield bonds have seen outflows of $11.8 billion this year.

Photo Credit: kenteegardin

DISCLAIMER: The investments discussed are held in client accounts as of September 30, 2013. These investments may or may not be currently held in client accounts. The opinions and views expressed herein are of the portfolio manager and may differ from other managers, or the firm as a whole. The information in this material is not intended to be personalized financial advice and should not be solely relied on for making financial decisions. Past performance does not guarantee future results.