Whatever happened to the dire predictions by Ben Bernanke critics that the Fed’s quantitative easing programs would debase the dollar, unleash powerful inflationary forces, trigger a bond market crash, send interest rates soaring and usher in the end of days?

To whom do I refer?

CNBC analyst and Tea Party spiritual father Rick Santelli has specialized in on-air rants predicting financial Armageddon if the Fed continues to expand the monetary base.

Republican presidential candidate and Texas Governor Rick Perry in 2011 called Federal Reserve Chairman Ben Bernanke’s ultra-loose monetary policies “treasonous.”

And as Floyd Norris at the New York Times reminds us in an excellent recent column, back in 2010 a group of 43 economists, most of them Republican-leaning, urged Bernanke to abandon the Fed’s quantitative easing program. The planned bond purchases, the economists said, “risk currency debasement and inflation, and we do not think they will achieve the Fed’s objective of promoting employment.”

So how have things turned out?

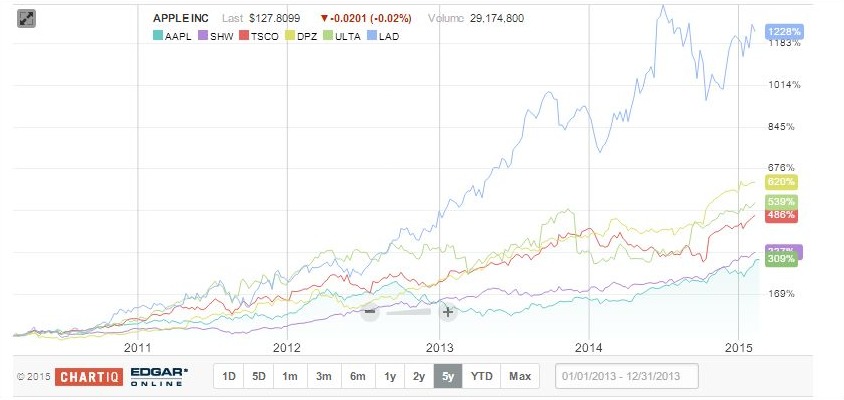

Well, the stock market has been on fire since its early 2009 lows.

The bond market went on a tear and lately has come back down to earth, but has hardly “crashed.” Interest rates are still at ridiculously low levels.

10 Year Treasury Rate data by YCharts

Hyper-inflation? You’ve got to be kidding.

US Consumer Price Index data by YCharts

Nor has the dollar crashed:

US Dollar to Euro Exchange Rate data by YCharts

Of course, the Fed’s ultra-loose monetary policy hasn’t delivered on every front. The U.S. jobless rate is still elevated. And Robert Auerback, professor of public affairs at the University of Texas at Austin, has an intriguing post on the Huffington Post today about why a big chunk of the money the Fed has generated is sitting idle at private banks. Here’s his take:

There is a massive misconception about where the Bernanke Fed’s stimulus landed. Although the Bernanke Fed has disbursed $2.284 trillion in new money (the monetary base) since August 1, 2008, one month before the 2008 financial crisis, 81.5 percent now sits idle as excess reserves in private banks. The banks are not required to hold excess reserves. The excess reserves exploded from $831 billion in August 2008 to $1.863 trillion on June 14, 2013. The excess reserves of the nation’s private banks had previously stayed at nearly zero since 1959 as seen on the St. Louis Fed’s chart. The banks did not leave money idle in excess reserves at zero interest because they were investing in income earning assets, including loans to consumers and businesses.

Photo Credit: f_mafra