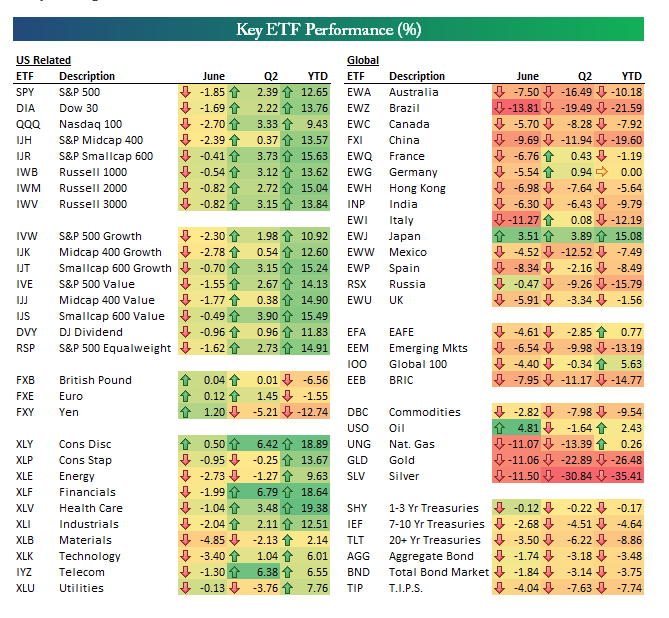

Below is a final look at the performance of various asset classes in the first half of 2013. Performance numbers are for the various US-listed ETFs that cover that asset classes shown.

The US was clearly the place to be in the first half of the year when it came to stocks. Japan (EWJ) was the only country ETF that outperformed US index ETFs in the first half, but Japan had some extreme volatility in the final months of the second quarter.

All of the other country ETFs shown were actually flat or down in the first half. Brazil (EWZ) was down the most in the first half with a decline of 21.59%, followed by China (FXI) and Russia (RSX). Clearly 2013 has not been a good year for the BRICs.

Within the US, the S&P Smallcap 600 (IJR) did the best of the index ETFs with a first-half gain of 15.63%. In terms of sectors, Health Care (XLV) gained the most at 19.38%, followed closely by Consumer Discretionary (XLY) and Financials (XLF). The Materials sector (XLB) did the worst in the first half with a gain of just 2.14%.

While oil (USO) was up slightly in the first half, most commodities got crushed. The broad commodities ETF (DBC) was down 9.54% in the first half, while gold (GLD) was down 26.48% and silver (SLV) was down 35.41%. SLV was down the most of any ETF in the entire matrix.

Finally, along with commodities and international stocks, fixed income saw red in the first half as well, led by the 20+ Year Treasury ETF (TLT) at -8.86%. Outside of US stocks, which had a great six months, the first half was really not so great at all.