by Michael Tarsala

Whatever it takes.

That’s what President Mario Draghi said the ECB is prepared to do to preserve the euro.

“And believe me, it will be enough,” Draghi said.

His comments are buoying world markets this morning, carrying more weight than those of Andrea Merkel or other European politicians.

It’s an exercise in reading tea leaves, but the force of his comments may suggest that the ECB is prepared to step in and buy Spanish and Italian bonds, and that it does care about keeping even the weakest members of the monetary union locked in – read Greece.

Many doubts remain. Citi’s chief economist Willem Buiter pegs the chance of Greece leaving the euro in the next 12 to 18 months at 90%, and still thinks Spain and Italy are likely to see some sort of sovereign bailout by year’s end.

Yet for the moment, Draghi’s comments are sending Italian and Spanish 10-year bonds sharply lower – although they remain near 6 and 7% yields, respectively. Oil also is rallying above $90 a barrel. Gold is up, as well. The euro is up relative to the dollar.

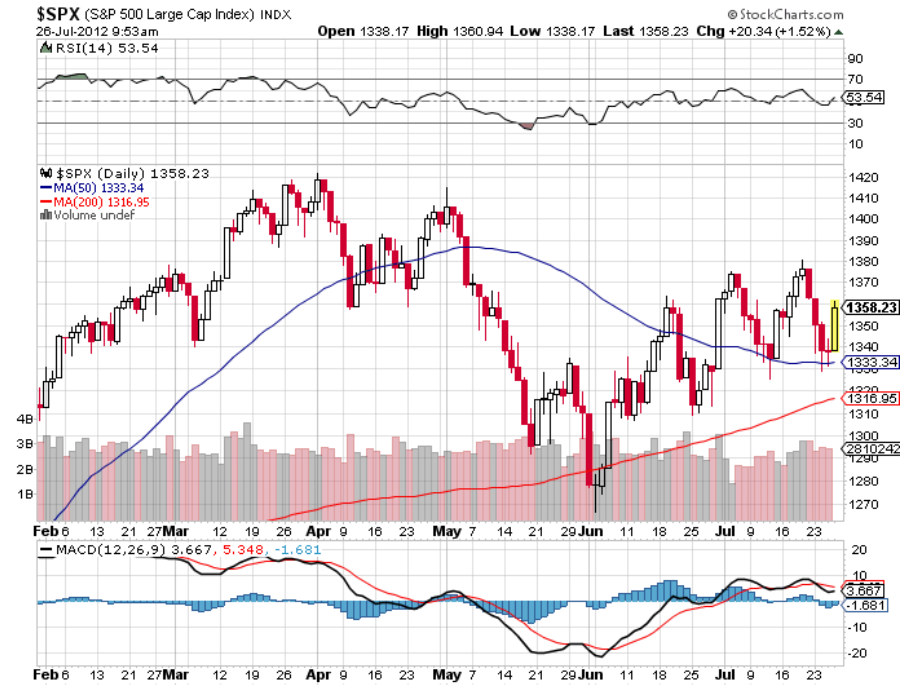

The risk-on pop also is benefiting U.S. stocks, with the S&P 500 up more than 1.5% in the early going, with advancing issues leading decliners across U.S. markets by a 6-to-1 margin.

The risk of the death cross – the 50-day moving average dropping below the 200 – was lessened by the advance. And while it’s not a clean trendline, the benchmark index still has not broken its series of higher highs and higher lows from the June trough. That’s not a clear-cut market buy signal by any means, but it’s constructive.

Source: Stockcharts.com