Presidential candidates often cast elections as historic choices that will forever alter America’s economic path. Yet when it comes to the huge and complex $15 trillion U.S. economy, business cycle swings often have little to do with which party holds the White House. Sometimes sheer luck and good timing matter more than economic policy.

Obama inherited a colossal mess in 2008. Even Republicans concede as much, though they argue that the president botched the recovery. The odds are pretty good the next White House will have the wind at his back. Here’s why…

GDP Growth: The US is forecast to outperform most other rich world economies during the next four years, according to the International Monetary Fund’s latest World Economic Outlook.

As the Washington Post’s Fareed Zakaria notes:

U.S. growth is forecast to average 3 percent, much stronger than that of Germany or France (1.2 percent) or even Canada (2.3 percent). Increasingly, the evidence suggests that the United States has come out of the financial crisis of 2008 in better shape than its peers.

Debt Deal: A group of prominent CEOs have just called for Congress and the next president to forge a credible debt deal to rein in spending—even if that includes tax hikes. The group includes Lloyd Blankfein of Goldman Sachs (GS), Jamie Dimon of JPMorgan Chase (JPM), Steve Balmer of Microsoft (MSFT), Jeff Immelt of General Electric (GE), and Samuel Allen of Deere & Company (DE).

The group generally backs the Bowles Simpson approach that reduces debt by $4 trillion through tax code reform, spending and entitlement cuts and modest tax hikes. A President Romney or a second-term Obama will be under enormous pressure to work with Congress on some sort of compromise.

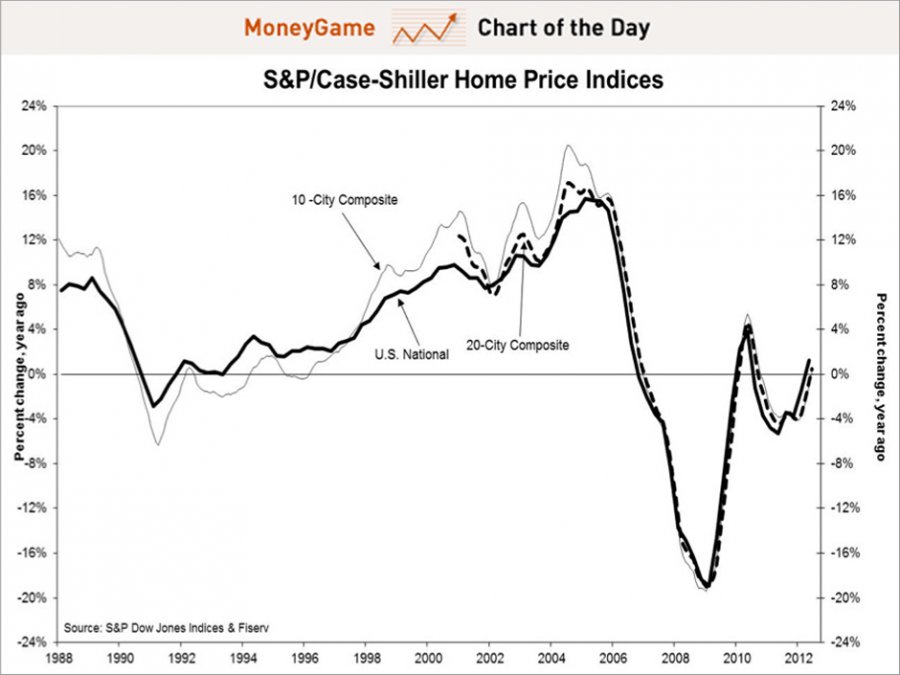

Housing Market: An array of statistics show that this is big sector of the economy has finally turned a corner. Housing is contributing again to GDP growth and in August home prices experienced the biggest increase in six years.

Chart: Money Game, Business Insider

Energy: The shale gas and oil phenomenon has left the US with the best energy security outlook in two decades. The US now produces about 83% of the oil it consumes. The US now may have enough natural gas reserves to last decades, though experts differ on precisely how much.

Certain of the information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. The author believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.