Banking stocks are outperforming the rest of the S&P 500, which might be a good sign for market direction in coming months.

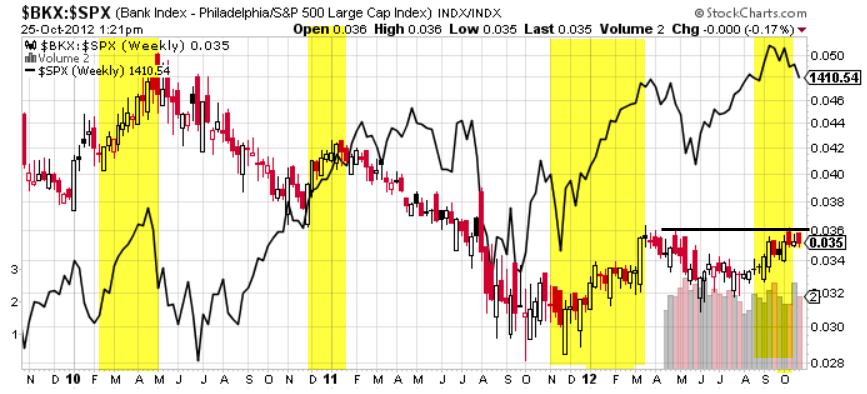

Above is a chart of the S&P 500 in solid black. The red candle chart shows the KBW Banking Index ($BKX) relative to the S&P 500.

Gains for banking stocks often are associated with credit expansion, which is seen as something that is good for the economy as a whole. It also can be associated with a better trading environment, which often reflects a risk-on stock market.

As a result, the S&P 500 trended higher in recent years in the brief periods when banking stocks were outpacing the S&P.

I’ll be watching the relative performance of the banking index in coming weeks. If it were to break to new year highs, marked by the horizontal line in black, that may provide a reason to believe that the selling of the S&P 500 in recent weeks is not necessarily the end of the market uptrend since June.