From time to time, humankind has had periods of arrogance where society as a whole believes that many (if not all) of life’s mysteries have been solved.

Such was a time in the 1800s when most believed we’d advanced as far as possible…just before the Industrial Revolution.

In Denial

The same kind of faulty thinking occurs in capital markets where the enduring truths of finance and economics are discarded. Someone inevitably states: “It’s different this time.”

Think of the tulip mania, railroad bonds in the early 1900s, Nasdaq during 1999-2000, and the credit bubble of 2004-2007. All are examples of market environments that ran off the rails.

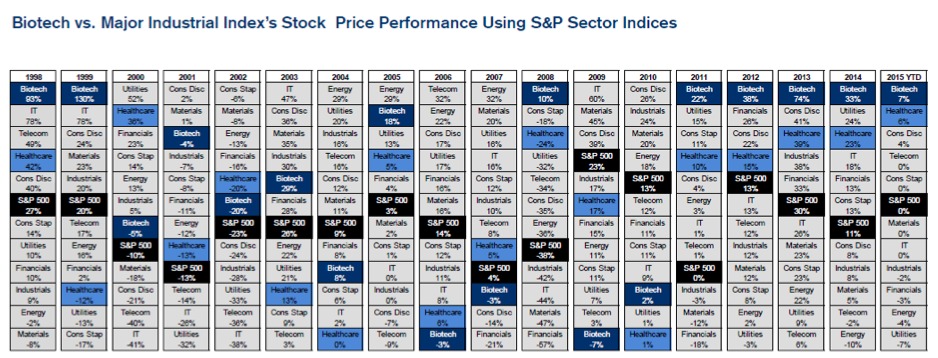

Credit Suisse put out a research piece about the biotech industry with some interesting points and graphics. The investment bank believes that the biotech isn’t in a bubble.

Agnostics

We have nothing against Credit Suisse. However, at Atlas we look agnostically at valuation metrics and don’t pick individual stocks based on a story or intangibles.

We are students of long term investing and markets.

The graphic from Credit Suisse below is telling, not because it shows how impressively the biotech sector has performed, but for the unprecedented nature of continuous relative outperformance.

Bubble Trouble?

Credit Suisse posits that the sector is “not in a bubble” and supports the notion with eloquent points.

We don’t know if the sector is in a bubble, though it certainly looks like it could be. And, of course, it could stay that way for a while.

Markets have a tendency to stay irrational longer than most investors can stay liquid.

What the past has shown us, is when the market psychology changes (perhaps because of some random, unexpected failure), the correction can be swift. You can’t perpetually ignore the laws of finance and economics.

Photo Credit: Nige Brown via Flickr Creative Commons