by MIchael Tarsala, CMT

The BRICs have been such a poorly performing investment the past two years that they are worth watching as an eventual turnaround play.

Jim O’Neill, chairman of Goldman Sachs Asset management, rockstar economist and the guy who popularized the term BRIC, told Bloomberg back in late June that Brazil, Russia, India and China now present a “huge opportunity” for investors.

According to O”Neill, the combined stock market value of the BRICs just a few months back reached 16% of the global equity market, four points lower than what those countries contribute to the world economy. It may be only a matter of time before the equity performance and economic contribution come back in line.

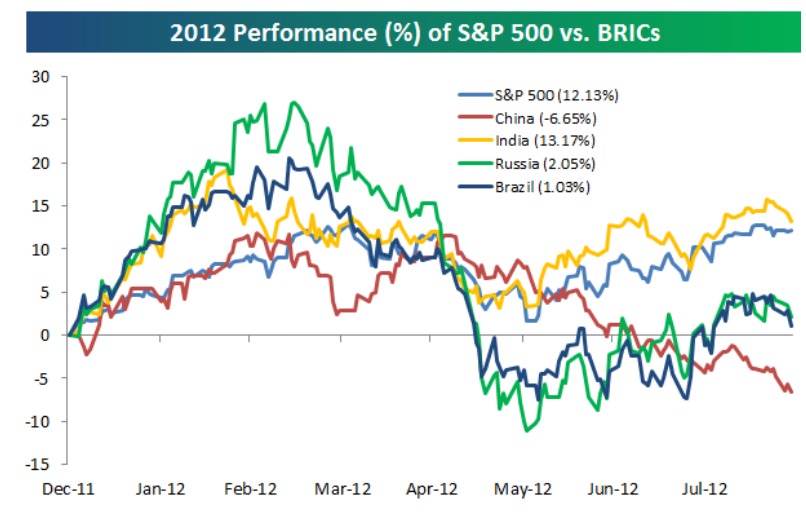

Yet BRICs have lagged for two years . All but India are badly behind the S&P 500 so far in 2012:

Source: Bespoke Investment Group

On top of global economic worries, each country has unique challenges. China may be choking on its own success, as labor costs rise and past growth rates become harder to achieve as its economy gets bigger. Brazil’s materials-centric economy is hurting due to the slowing growth in China and elsewhere. And India and Russia each are dealing with political issues that may be hampering growth.

So when could BRICs start to see the performance that O’Neill is looking for? Will it be months or years from now?

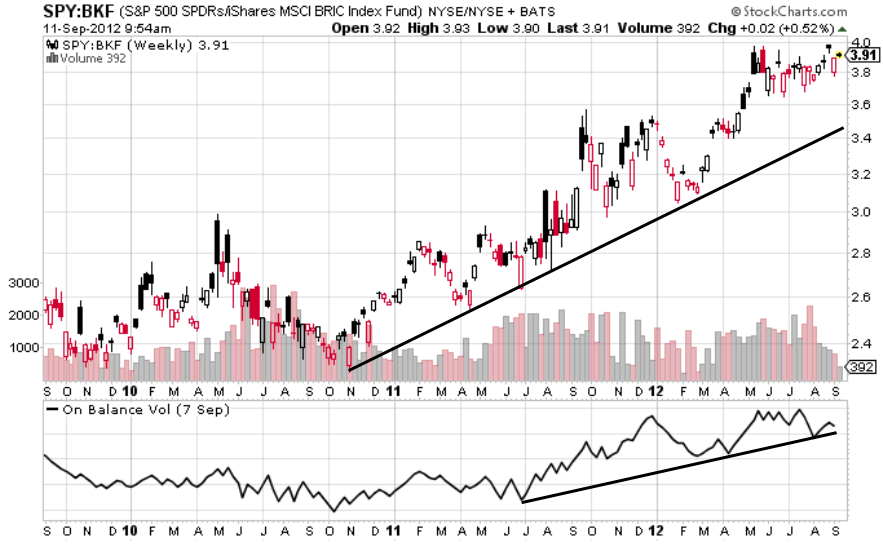

Source: Stockcharts.com

The chart above may provide cues. It shows the price relationship of the S&P 500 SPDR (SPY) relative to the MSCI BRIC Index Fund (BKF). You will notice a strong trendline that is still up and to the right. From a technical perspective, this chart suggests that the BRIC Index will not outperform the S&P ETF any time soon.

At the bottom of the chart is the potential early warning system to watch: It’s the relative on-balance volume for the two instruments. It’s used commonly by charting specialists, and it measures the running total of positive-to-negative volume of the S&P ETF relative to the BRIC fund.

On-balance volume helps to confirm price trends. It rises to confirm a strong price move to the upside, validating the strength of the trend. A price move absent volume may not have much staying power.

Yet when price is up and volume is down, it can provide an early heads-up to a price change. It may suggest that there is not much institutional support and the price uptrend is ready to move either sideways or lower.

So right now, the on-balance volume is confirming the S&P’s continued relative outperformance. Any breakdown of the on-balance volume trendline in coming months, though, may provide and early cue that price could do the same, and that the value Jim O’Neill sees in the BRICs could start to be realized by the markets.