Author: John Gerard Lewis, Gerard Wealth

Author: John Gerard Lewis, Gerard Wealth

Covestor model: Stable High Yield

In my last Marketwatch article, I embarked upon a portfolio design to achieve future returns that might exceed those in Pacific Investment Management’s (Pimco’s) “New Normal” forecast. Pimco chieftains Bill Gross and Mohamed El-Erian anticipate just 4%-6% nominal annual returns for stocks for virtually the rest of our lives, a number that is considerably below the roughly 10% (6.6% inflation-adjusted) average annual return that investors have enjoyed over the past century.

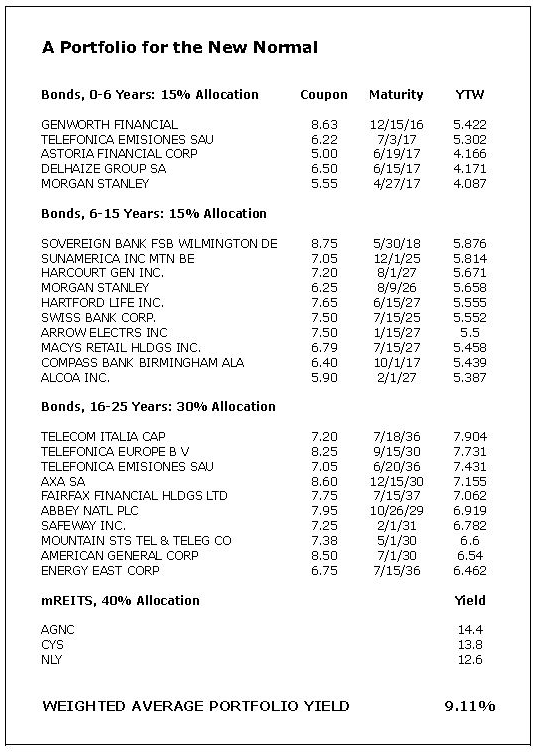

Given Pimco’s dim prospect for stocks, I proffered that an opportunity to best their 6% ceiling might begin with corporate bonds. I therefore identified 25 bonds, rated BBB- or better, that would be held for various maturities up to 25 years. That group, held in equal parts, would produce a real return of only 3.4% (based on Aug. 24 prices), not much better than Pimco’s 3% inflation-adjusted forecast for stocks.

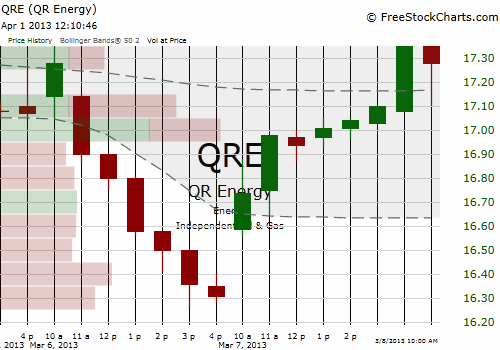

I think considered whether there was anything we might do to boost the prospective return, without scraping the bottom of the bond-quality barrel. I came up with this yield-enhancing idea: Add some mortgage real estate investment trusts (mREITs). I’m obviously a believer in mREITs, which comprise nearly 45% of my model portfolio.

A 40% allocation to mREITs would drive the portfolio’s notional yield to worst up to 9.11%. (Of course, the yields for the mREITs would have to remain constant for that return to consistently happen, and they’re not going to do that. But for the sake of illustration, we’ll pretend that those yields would last indefinitely.) That’s a real return of more than 6%, accounting for Pimco’s 3% inflation assumption.

Here’s how the portfolio would look:

Would this specific formula serve us well for the duration of the New Normal? Don’t count on it. While a relatively passive investing approach isn’t always unreasonable, exceedingly passive investing always is. Adjustments need to be made along the way.

Yes, mREITs have been throwing off double-digit total returns over the past few years, but that doesn’t mean they always will. An investor will have to review and perhaps update any investment portfolio from time to time. This theoretical portfolio is no different.

And mREITs do add uncertainty and volatility to the mix. Although the bonds have known yields to maturity and will, barring an unlikely default, return that promised yield, mREITs operate like leveraged bond funds that, of course, have no such return guarantees. The boost that mREITs provide today to the portfolio’s return is subject to a host of variables that could alter their contribution in the future.

Therefore, it’s not necessarily a static portfolio to be held for the duration of the New Normal, but rather an example of what an investor might consider for at least the first part of it.

The author is long certain bonds of SunAmerica, Jefferies Group, Hartford Life, Alcoa, Genworth Financial and Morgan Stanley. Also, the hypothetical model discussed in this article does not represent actual trading and may not reflect the impact of material economic and market factors might have on the adviser’s decision-making if the adviser were actually managing clients’ money.