The leadup and immediate aftermath of the Fed’s September 13th QE3 announcement made for some tidy market gains in short order, up more than 4% since August 31.

Michael Arold, manager of the Technical Swing investment model believes it won’t remain that easy to catch gains. Arold remains bullish for the next few months, but says he plans to stay disciplined and will be looking mainly for three types of stock setups for the shares he selects as part of his model:

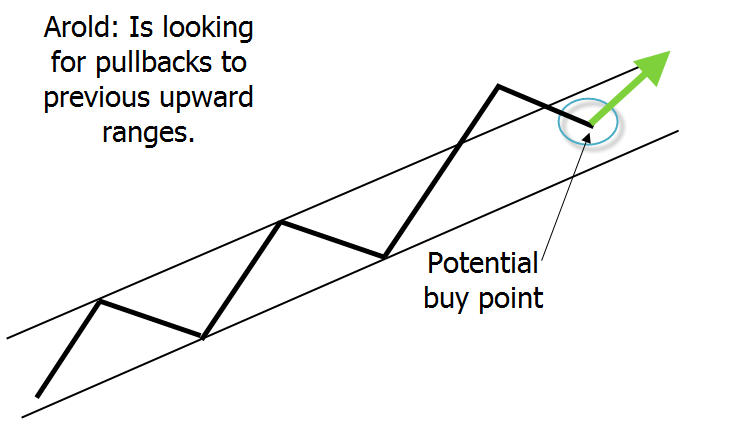

1) Simple pullbacks:

Source: Michael Tarsala, CMT, Covestor

Some stocks with outsized runups in recent weeks may continue to move higher, but will first retreat back to previous upside channels. Buying stocks on that retreat, he says, may provide for better entries.

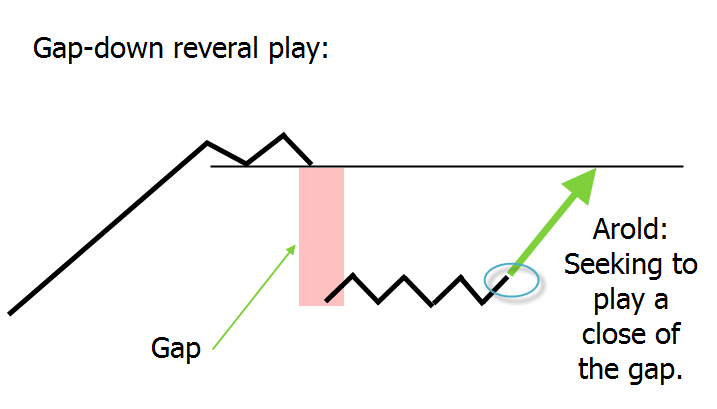

2) Gap-down reversals

Source: Michael Tarsala, CMT, Covestor

Stocks that open far lower following negative news leave a “gap”, or space in the price action. Stocks sometimes begin to consolidate, or move sideways following the gap lower. A rise out of that consolidation to “close” the gap can create trading opportunities, provided the potential reward significantly outweighs the price objective.

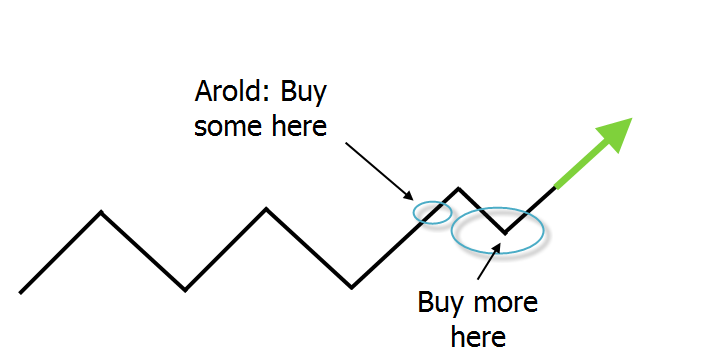

3) Breakout plays

Source: Michael Tarsala, CMT, Covestor

These are easy to recognize. They are sometimes tricky, nonetheless. Arold’s goal is to buy small positions on the breakout itself, then to buy more on future pullbacks.