By: Jose Torres, Interactive Brokers’ Senior Economist

Markets are struggling for direction for a second consecutive session against the backdrop of consumer confidence and durable goods data badly missing expectations. Perhaps the next significant move for stocks and bonds will occur Thursday upon the release of the Fed’s preferred inflation gauge. For later today, however, the outcome of a meeting with Congressional leaders and the White House to forge a difficult budget deal that would avoid a government shutdown is likely to be a focus for investors. Meanwhile, persistent inflation in Japan has traders betting that the nation’s central bank will finally end its negative interest rate regime, even as its economy navigates recession and contracting real wages. If Tokyo is going to hike amidst slowing inflation and recessionary conditions, should the Fed push rates higher one more time in the face of firm growth and accelerating inflation? Perhaps traders will begin to price that in after Thursday’s results. Also today, the US Treasury wraps up its auctions for the week as it seeks bidders to fund $80 billion for 42-day bills and $42 billion for 7-year notes.

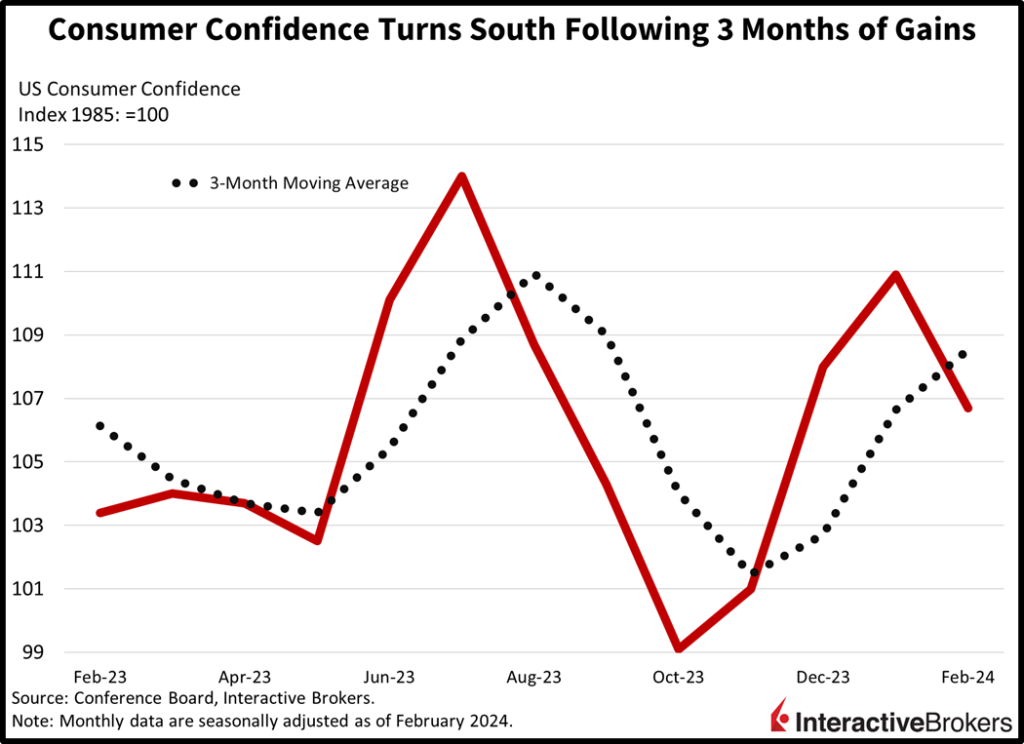

Consumer Confidence Surprises with a Decline

Consumer confidence fell this month as households reflected concern over the US political environment, rising prices and labor market opportunities. The Conference Board’s Consumer Confidence Index dropped to 106.7 in February, following a three-month streak of gains. February’s figure missed expectations of 115 by a mile and deteriorated from January’s 110.9 level. The Present Situation and Expectations indices fell to 147.2 and 79.8 from 154.9 and 81.5 month-over-month (m/m). Other consumer categories that deteriorated during the period included personal finances, business possibilities, plans for buying big-ticket items, the outlook for interest rates and rising recession odds. On the other hand, survey respondents were upbeat about stock prices while they lowered their 12-month inflation expectations.

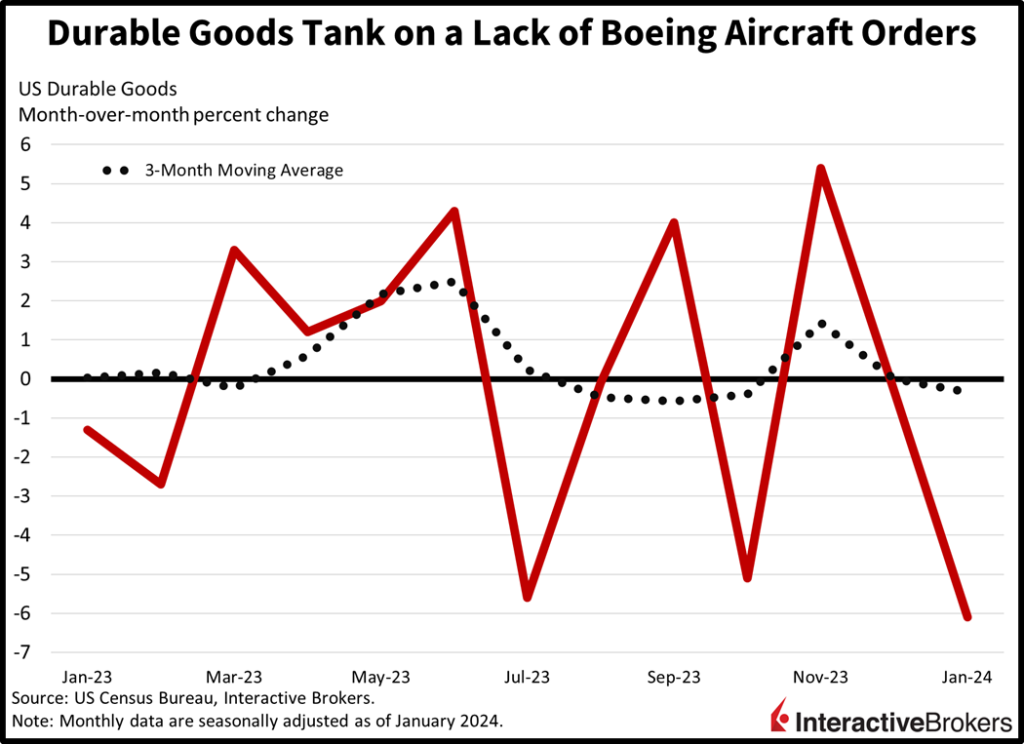

Durable Goods Orders Weaken on Boeing Problems

Durable goods orders slipped for the second consecutive month in January as airlines refrained from buying aircraft from Boeing, which has struggled with quality control. Orders dropped 6.1% m/m, much worse than projections of 4.5% and December’s 0.3% decline. Excluding transportation, however, orders declined only 0.3%. Passenger airline orders led the decline with a 58.9% m/m fall while communication equipment dropped 8.4%. Other notable categories and their respective declines included the following:

- Primary metals, 1.7%

- Fabricated metal products, 0.9%

- Other durable goods, 0.5%

- Motor vehicles and parts, 0.4%

Offsetting some of the pain were computer products, defense aircraft and electrical equipment which saw orders increase 5.8%, 2.6% and 0.9%. Machinery was unchanged. Nondefense capital goods excluding aircraft, a proxy for business investment, rose 0.1% m/m, recovering from December’s 0.6% decline.

Tokyo Likely Abandoning Negative Rates

Across the Pacific in Tokyo, core consumer prices rose 3.5% versus the 3.3% forecast, opening the door for the Bank of Japan to shift interest rates into positive territory in March or April. Japan’s yields and currency are rising in response to the expected hawkish shift by the nation’s central bank. The change comes at a time when Japan is facing a combination of higher prices amidst recession. Investors are carefully assessing the situation for clues on how rising rates amidst negative growth impacts the global economy these days. A stronger yen is likely to cause some additional stress across global markets as it is a key currency for borrowing and pair trading due to its relative stability and low yields.

Corporations Embrace Tech as Consumers Splurge on Travel

Recent earnings reports illustrate that companies are continuing to turn to tech firms for business productivity tools while consumers are holding off on do-it-yourself home improvements. In a related matter, strong travel demand is continuing. Consider the following earnings call highlights:

- Shortly after announcing it will lay off approximately 100 workers, teleconference tech shop Zoom posted fourth-quarter results that exceeded analyst expectations and sent its share price up more than 14% in extended trading. Zoom, which generated stellar growth during the pandemic as businesses turned to remote working, has sought to continue its growth by expanding into call centers, telephone services and artificial intelligence. Those initiatives resulted in the company’s sales growing 2.6% year over year (y/y) to $1.15 billion for the quarter ended January 31. The average analyst forecast was $1.13 billion. Its profit of $1.42 a share after adjusting for certain items substantially beat the analyst expectation of $1.15 and climbed from $1.22 in the year-ago quarter. For the fiscal first quarter, Zoom anticipates generating $1.18 to $1.20 in adjusted earnings per share (EPS) and $1.125 billion in revenue. The analyst consensus anticipated guidance for an adjusted EPS of $1.13 and $1.13 billion in revenue.

- Lowe’s quarterly results beat the analyst consensus expectation even with sales declining y/y. The sales weakness is likely to continue with the company anticipating a 2% to 3% decline this year due to an uncertain economy. For the quarter ended February 2, its revenue of $18.60 billion surpassed the analyst expectation of $18.45 billion but declined substantially from $22.60 billion y/y. Its EPS of $1.77 also exceeded expectations with the analyst consensus forecasting an EPS of $1.68. In the year-ago quarter, the company’s EPS of $1.58 was hurt by pre-tax transaction costs associated with Lowe’s divestiture of its Canadian retail business. In the recent quarter, the company’s comparable sales declined 6.2%, largely due to do-it-yourself customers cutting back on spending and bad weather in January. Sales among contractors were virtually flat.

- While do-it-yourselfers may be sailing past Lowe’s, they are continuing to splurge on travel with Norwegian Cruise Line posting revenue growth and providing stronger-than-expected guidance. For the recent quarter, the company generated $1.99 billion in revenue, surpassing the analyst expectation of $1.97 billion and climbing from $1.59 in the year-ago quarter. It posted a loss per share of $0.18 after adjusting for one-time expenses, which was worse than the analyst forecast for a loss of $0.14 a share. On a non-adjusted basis, the loss per share of $0.25 declined from the loss of $1.14 in the year-ago period. CEO Harry Sommer said the company is experiencing record-high bookings and for the full year, it expects to generate an EPS of $1.23, which is higher than the analyst expectation of $1.21.

Crypto Continues to Surge

Stocks are bonds are relatively tame this session with some exceptions stemming from cryptocurrencies and small-caps as market participants await more clues on the path of monetary policy and inflation. Major US stock indices are mixed with the small-cap Russell 2000’s 1.1% gain leading. Indeed, other indices appear maxed out, as the Dow Jones Industrial and S&P 500 indices are down 0.1% each while the Nasdaq Composite is near the flatline. Sector breadth is tilted positive with 7 out of 11 sectors higher led by utilities, consumer discretionary and communication services; they’re up 1.3%, 0.6% and 0.2%. Energy, financials and consumer staples are lagging with declines of 0.5%, 0.3% and 0.2%. Bond yields and the dollar are near the flatline. The greenback is gaining relative to the euro, pound sterling and Canadian dollar while it sheds value versus the yen, franc, yuan and Aussie dollar. Energy markets are bullish as Red Sea disruptions persist and doubts over a potential Gaza ceasefire emerge. WTI crude oil is up 1.1%, or $0.88, to $78.42 a barrel. Players are definitely navigating cryptocurrency lands these days in search of further upside, with Bitcoin now at its highest level since 2021’s mania. Bitcoin is up roughly 10% in the past seven days and 37% in the past 30 days. It is trading at $57,000 as investors appear exuberant.

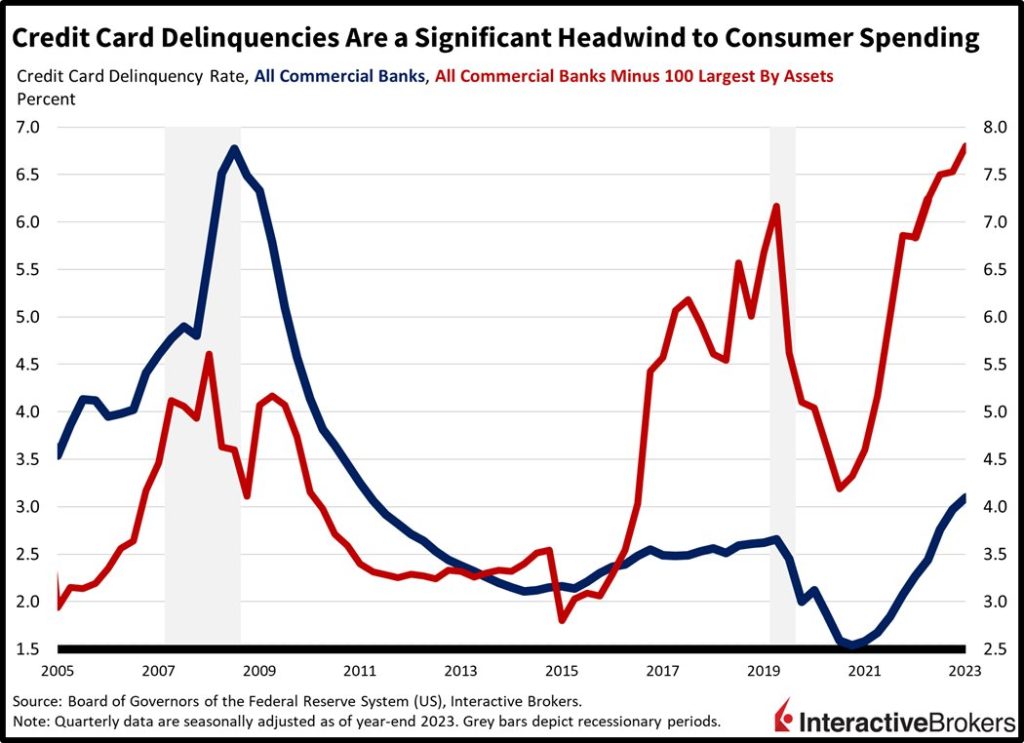

A Weakening Consumer Likely Leads to Stagflation

The Bureau of Economic Analysis releases its Personal Income & Outlays report on Thursday. In addition to providing important details regarding the Fed’s favorite inflation measure, it’ll also tell us about consumer spending. This morning’s consumer confidence weakness paired with a retail sales flop just two weeks ago points to waning consumer momentum. The consumer has been resilient, but credit card delinquencies are now at their highest levels since the great financial crisis of 2008. The credit card situation at small banks is much worse, with charge-offs rising to the loftiest level in history. Thursday and Friday may provide risks and opportunities for investors, with a potential government shutdown serving a severe blow to what’s left of consumer resilience. The last prolonged government shutdown of 2018-2019 was responsible for shaving 2% from economic growth. A similar event next month may push the nation into recession at a time of loftier prices and elevated rates, similar to our Tokyo counterparts, or in other words, stagflation.

Visit Traders’ Academy to Learn More About New Home Sales and Other Economic Indicators.

Originally Posted February 27th 2024, IBKR Traders’ Insight

PHOTO CREDIT: https://www.shutterstock.com/g/Bobex-73

Via SHUTTERSTOCK

DISCLOSURE: INTERACTIVE BROKERS

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.