Covestor model: Technical Swing

Disclosure: Long WFC

Wells Fargo (WFC) is a stock that I plan to swing trade from the long side. Let me run you through my analysis for this trade, which should give a good blueprint of how I approach a trade.

I’m using a “Triple Screen” system, which was proposed by Alexander Elder, which I modified to exploit the momentum and mean reversion anomaly (check out my overview here about the topic).

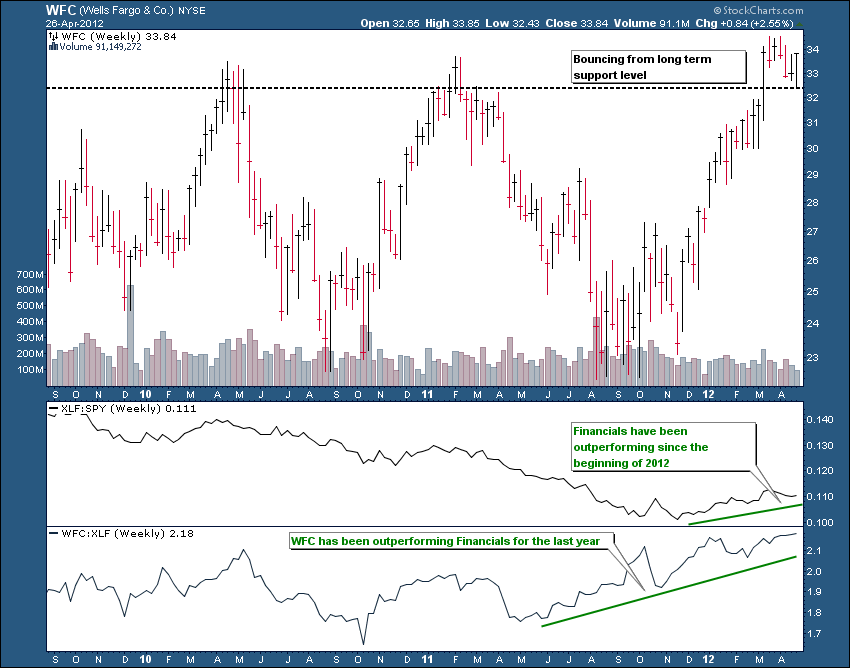

The first step is to look at the weekly chart: the stock is in an intermediate term uptrend and about to break out of a long term trading range. Momentum characteristics have been positive. WFC not only outperformed the financial sector, the Select Sector SPDR-Financial ETF (XLF) also has been outperforming the broader market during the last months.

According to the momentum anomaly, this trend should continue, so WFC is the right stock to trade from the long side:

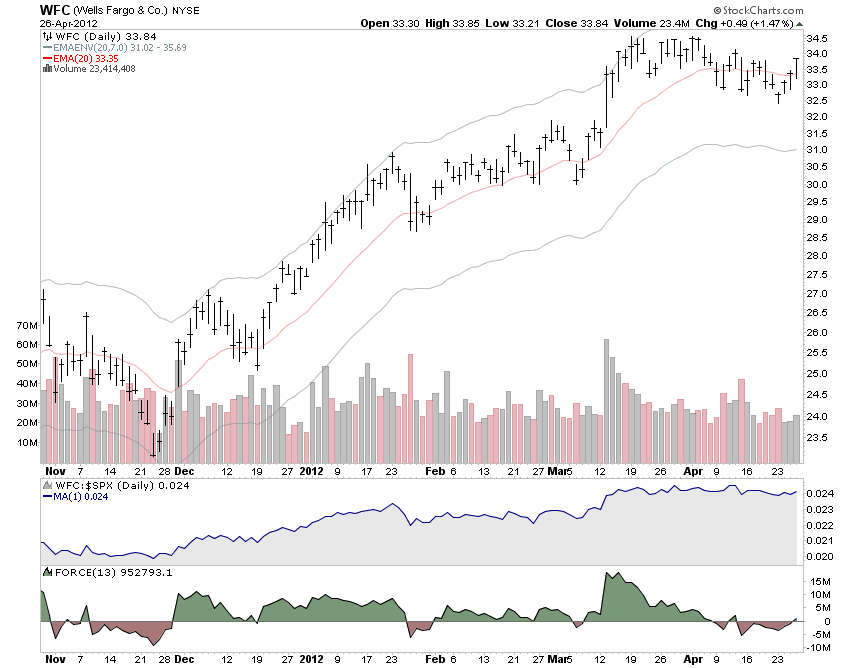

Next, I took a look at the daily chart to get an idea of the mean reversion characteristics: WFC just went through a consolidation phase (“reverted to the mean”) and is about to exit this phase. I want to buy close to the 20 day moving average, so that’s where the stock is trading right now.

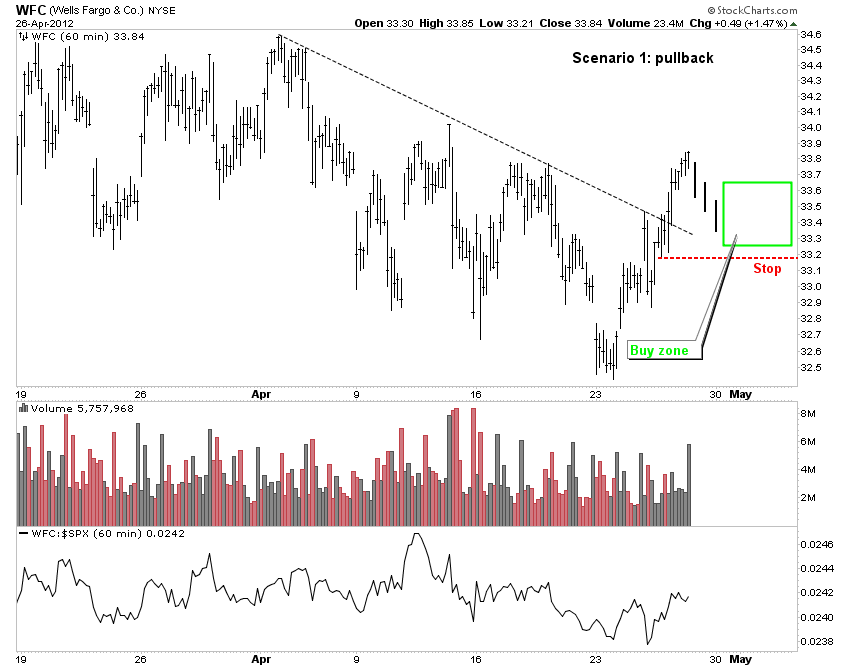

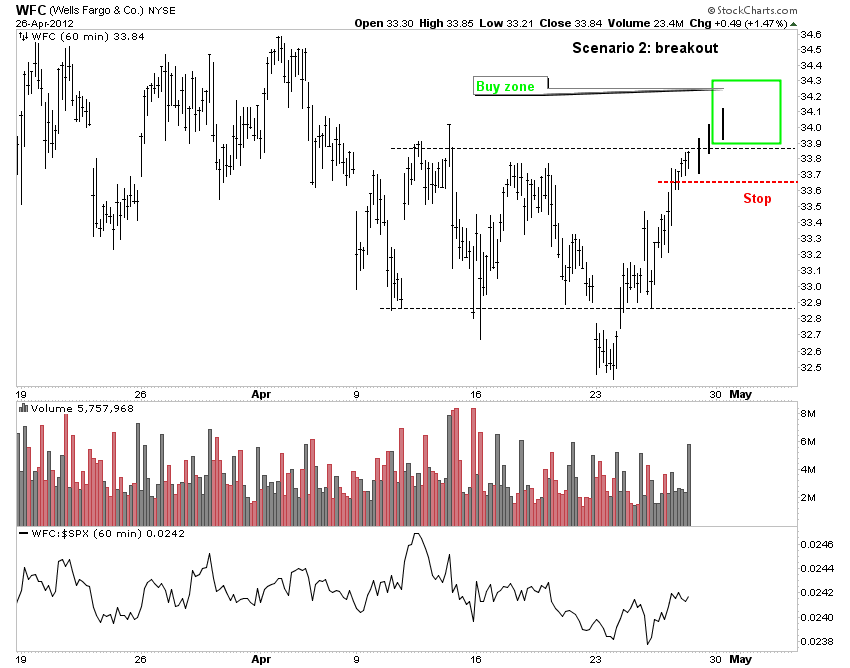

The third step is to analyze the intraday action. There are two possible scenarios: WFC will either pull back (scenario 1), which then created the buying opportunity or the stock will break out of the recent trading range (scenario 2). Depending on these scenarios, I will determine the appropriate stop level in case the trade would go against me.

Scenario 1:

Scenario 2:

Finally, I do a sanity check by visiting Briefing.com: any upcoming event/news that could randomize price action? Most important is the earnings report date, since I do not buy a stock right before the event. WFC just reported on April 16, so no issues from that side.