Michael Wagner knows risk. An airline pilot by profession, he has a deep respect for the riskiness of a situation, which he brings to his investment philosophy.

Michael Wagner knows risk. An airline pilot by profession, he has a deep respect for the riskiness of a situation, which he brings to his investment philosophy.

He manages the Covestor Small-Cap Swing Trader model, which focuses on small and micro-cap stocks, which tend to be riskier due to their low liquidity and often high betas. He recently shorted Glimcher Realty Trust (NYSE: GRT). We asked Wagner for his thoughts on the short sale. His response follows:

…..

I shorted this as a purely technical play, with an ok setup. Not a perfect setup, so I am thinking it probably has a 55% chance of working, but the risk / reward is there. Basically it’s just a bet on a counter trend (betting on a downward move in an upward channel).

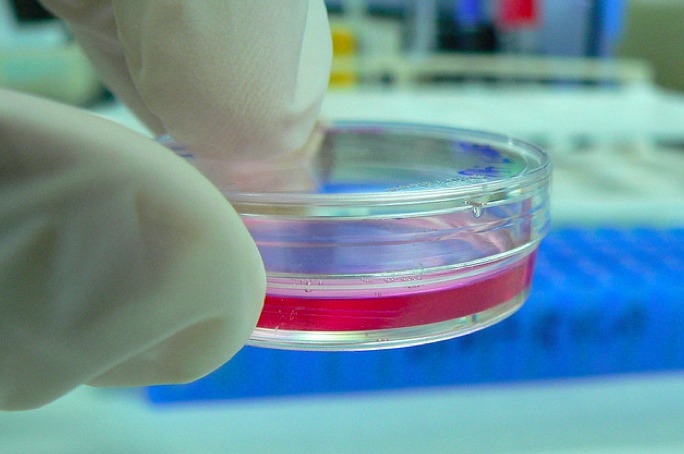

I have attached a chart, and as you can see GRT is channeling upward nicely, and is near the top of the channel. Simply put, I only have a few cents of risk if I am wrong, and a little more than a dollar of reward if I am right.

I set my stops just past the height that defines the channel, and watch and wait. Target price for the short sale is in the $8.15 – $8.30 range, stops are in the $9.66 – $9.70 range. This could even become a buy if it breaks out with enough volume.

Take care,

Michael Wagner