Author: William Smith

Author: William Smith

Covestor Model: Price Volatility Volume

As I’ve mentioned many times, my system thrives on volatile environments. Frequently these are associated with bear markets or corrections, but it’s not the falling prices that feed the machine… it’s the volatility.

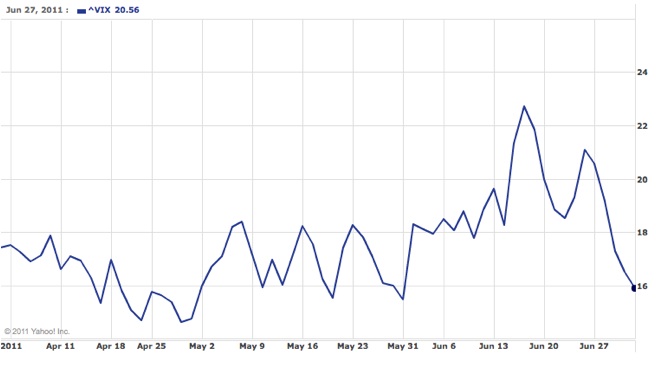

Here’s the VIX chart (4/1/11 to 7/1/11), via Yahoo Finance [yhoo.it/jBy9zC]:

There are many measures of volatility, but the VIX is perhaps the most watched. As you can see, June brought rising volatility that we haven’t see for months. At least that was the case during the first half of the month, and the system performed as expected. I ended with June returns in the Covestor Price Volatility Volume model of about +4.1%.

The second half of the month saw dropping volatility as the market began to rise consistently, and the system flat-lined for a few days as it signaled to exit the market. I have been in cash (save for the the PUDA untradeable position) for about a week now (as of 7/1/11).

The market seems to be at a tipping point. Since the recent peak in early May there has been about a two month down trend in the broad equity indices. The all-important 200-day moving average has been approached twice and the downward trendline is intact. Is this just a short term correction, or will the bear market resume? As a quantitative trader I don’t really care, but it’s interesting to watch. On to July!

Good Trading.