D5 Advisors shorted oil shipper Frontline Ltd. (NYSE: FRO) on Friday, April 1, for their Covestor Oil and Gas Producers model. Here’s how Bloomberg described FRO’s latest earnings report, on February 22: Frontline Ltd., the world’s largest operator of supertankers, posted a bigger-than-expected fourth- quarter loss and declared a dividend […]

Robert Freedland has over 40 years of investment experience and is a full-time optical surgeon. He uses his expertise in the medical field to help select healthcare stocks. In investing, Robert utilizes two divergent strategies for identifying new names for inclusion. In strong market environments, he searches for companies with […]

Philip Pecoraro is a psychiatrist and internist with 26 years of clinical practice experience in general internal medicine, emergency medicine and general and consultation (hospital-based) psychiatry. He has been an associate professor of Medicine and Psychiatry at a university medical center. He has ten years of private investment experience and […]

Covestor manager Scott Daly is a fifteen year veteran of the investment management business. He describes his investment style as active management utilizing a proprietary method for strategic risk reduction. Here’s how Scott got his start in investing: After a period of personally investing in mutual funds, I came to […]

New Covestor manager Diddi Capital Advisors Inc. is a New Jersey based boutique investment advisory firm specializing in Global and Emerging Markets Investment strategies. The experience of the firm since its inception in 2004 has been in investing in the emerging BRIC nations and frontier markets. Rahul Didi, the firm’s […]

Covestor model manager Raymond Urci brings more than 20 years of investing experience to New York based QSP Group LLC. He manages Covestor’s QuantStockPicks model. Here’s the strategy: QuantStockPicks provides a systematic, quantitative swing trading strategy to actively trade equities in both volatile and static markets. QuantStockPicks is a very concentrated portfolio with […]

Update: Kansas, class act veteran journalist, writes in to acknowledge the mistaken description of the ProShares ETF. Dave Kansas makes some good points in his WSJ article today on the latest batch of “specific, complex, risky” ETFs, but this is not among them: Conversely, the ProShares UltraShort S&P 500 (SDS), […]

Here’s a really interesting tidbit from a man who knows both Apple (Nasdaq: AAPL) and Google (Nasdaq: GOOG) platforms intimately from a business perspective. Bob Bowman is the head of MLB.com, major league baseball’s very successful digital business. In a Q&A with Peter Kafka of AllThingsD, Bowman had this to […]

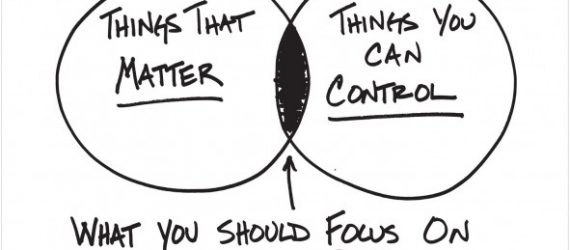

Another great sketch from Carl Richards: From Richards’ newsletter accompanying the sketch: We love control. You name it, we’d probably prefer to control it. But from the weather to our kids, there are limits to what we can control, and in no place is this more clear than our finances… […]

Jose Betancourt is one of Covestor’s model managers. He works as a Portfolio Manager for Betan Group, a holding company, where his role is to make decisions on where to invest the company’s capital through a fundamental analysis of the market. He also works in the capacity of Director for an […]