Insiders are selling a lot less stock than they were just a few weeks ago -- a far less negative sign for markets.

Outlook

Volatility helps you time big and meaningful changes in market direction. And as it relates to the markets as they stand right now, it may be better to wait.

Raymond James strategist Jeffrey Saut says a tradable market bottom has likely been reached. He recommends a gradual re-accumulation of investments.

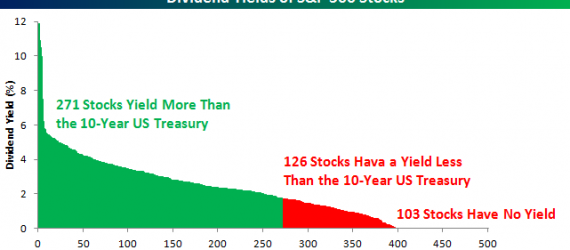

The 10-Year US Treasury is now paying a coupon that is less than the dividend yield of more than half of the stocks in the SP 500.

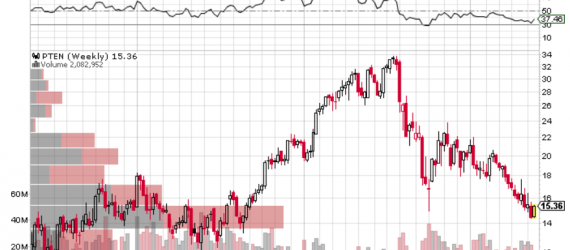

Tyler Kocon, manager of the Bakken Shale model, is invested in stocks that could benefit whether or not there's a face-ripping rally in natural gas.

The average investor is still buying high and selling low. And I think many may be making a very similar mistake when they choose a money manager.

We ran the numbers. Out of our 115 managers, only one has purchased Facebook shares so far today for Covestor models.

Mike Arold, who runs the Technical Swing model, is now backing out of his short positions in preparation of a market bounce. Here is how he plans to play it.