by Michael Tarsala, CMT

Market sentiment is the one set of technical factors that even many of the strictest fundamental investors track. Sentiment indicators are watched by dozens of Covestor model managers.

Sentiment is often very important from a contrarian point of view. The masses are not always wrong, but they often extend to extremes. The reason is simple: By the time everyone finally agrees about the direction of a trend — up or down — that trend is just about over!

Using that logic, historically high levels of bearishness can be a great time to buy. Conversely, historically high bullishness can be an ideal time to sell.

One of the most popular measures of market sentiment that you can track on your own is the put/call ratio.

In options trading, puts are used to bet on a market decline or to hedge against weakness. And call options are used to bet on a market advance or to hedge against market strength.

The ratio of overall puts to calls purchased, therefore, gives you an idea of the total market bearishness or bullishness.

Yet a historically high put-call ratio may reflect excessive market bearishness, which contrarians can take as a time to buy. And stay with me here: A historically low put-call ratio may reflect excessive market bullishness, which may indicate time to sell.

Most professionals tend to look at put/call ratios using a moving average. It helps to identify the underlying longer-term trend. Also, charts can be very jagged and hard to read without being smoothed out a bit.

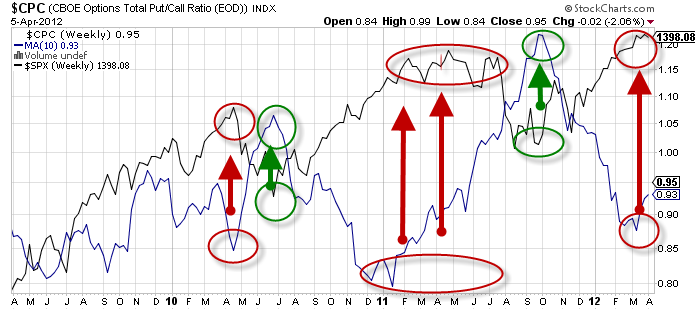

Here’s an example:

Source: Stockcharts.com

This is a weekly view of $CPC, which is the CBOE Total Options Put/Call ratio. The blue line is a 10-week moving average of the $CPC, superimposed on the S&P 500, which is in black. A reading of 1.00 on the right scale suggests that the ratios of puts to calls are in balance.

By the way, you will see all the underlying data if you attempt this chart on your own. To get rid of it, change the Type to invisible under Chart Attributes.

What you’ll notice is that this simple indicator provided some timely cues in the past. The ratio in blue got very low in April 2010, reflecting overly bullish sentiment. It provided a warning sign of weakness ahead.

Yet bearishness was extremely high again by late June of that year, as the crowd became overly bearish. That provided a bullish signal ahead of a multi-month rally.

By now you get the idea… and you’ll have a hint about what the signal might be saying right now. It’ s fairly low, with the put/call ratio around 0.90. And it’s come down an awfully long way, suggesting that this rally, at minimum, is becoming mature.

The $CPC ticker in Stockcharts.com, by the way, reflects both index and individual stock options. You can look at the put/call of just equity indices by using the ticker $CPCI. And the $CPCE will give you just stocks, without the indices.

And with that, you know how to track one of the sentiment gauge sets that many of the pros are using.