by Michael Tarsala

The Mark Faber blog is out today with a comment suggesting that stock investors might want to own some gold, citing the tenuous link between stocks and the economy:

“I think that people should own some gold and I think that people should own some equities, because before the collapse will happen, with Mr. Bernanke at the Fed, they’re going to print money and print and print and print. So what you can get is a bad economy with rising equity prices.” — Mark Faber, Forbes.

Regardless of whether you believe in the famed market timer’s doom and gloom, he’s right about one thing: There is a weak link — at least directly — between stocks and economic figures. That flies in the face of conventional wisdom that the market is a leading indicator of what will happen to the economy, and that you need a strong economy for stocks to rise.

I am not sure that most investors who follow the markets and the economic news realize that fact. You certainly can have stocks rise in a bad economy and fall in a good one. More importantly, the degree of economic bullishness or bearishness is not necessarily reflected in the S&P 500.

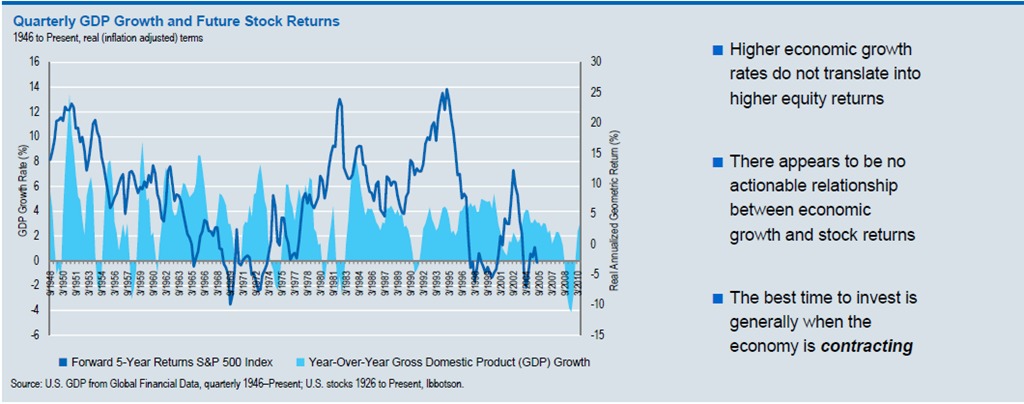

As noted by O’Shaughnessy Asset Management, higher economic growth rates do not translate into higher equity returns. The financial site HistorySquared calls the correlation between GDP and stocks “non existent”. And even the idea that the market is a a leading indicator for the economy does not appear to be true.

Source: HistorySquared.com

As with most anything, there are exceptions.

I watch the Citigroup Economic Surprise Index. It incorporates a weighted group of many economic indicators, relative to economists’ expectations. Intuitively, I think it has a closer link to the markets, which also are gauged relative to expectations.

And the one economic figure that is a must-watch is initial jobless claims. It tends to move along with the S&P 500 over time. So it’s worth watching, especially at turning points. As you see in the chart below, initial claims provided an early warning of last year’s market swoon.

Source: Forbes.com